USD/CHF Price Analysis: Rejection at 0.8225 keeps the 0.8200 support on focus

- US Dollar’s recovery remains capped below 0.8225.

- Concerns about US debt are keeping the USD on the defensive.

- USD/CHF maintains the broader bearish tone intact, with 0.8200 support eyed.

The US Dollar has failed to break the 0,8225 resistance area, where the near-term descending channel meets a previous support, now turned resistance. This keeps bears in control, with the key 0.82 support area at a short distance.

The risk sentiment is Dollar supportive after Trump announced a pause on the Tariffs to Europe, but the USD is failing to bounce up against safe-haven assets like the CHF. Investors’ concerns about the US fiscal stability, as the Senate discusses the sweeping tax bill, keep investors wary of US assets.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.12% | -0.23% | 0.27% | -0.09% | -0.28% | -0.44% | 0.09% | |

| EUR | 0.12% | -0.10% | 0.47% | 0.03% | -0.15% | -0.30% | 0.22% | |

| GBP | 0.23% | 0.10% | 0.23% | 0.13% | -0.06% | -0.21% | 0.34% | |

| JPY | -0.27% | -0.47% | -0.23% | -0.37% | -0.58% | -0.79% | -0.21% | |

| CAD | 0.09% | -0.03% | -0.13% | 0.37% | -0.17% | -0.34% | 0.21% | |

| AUD | 0.28% | 0.15% | 0.06% | 0.58% | 0.17% | -0.19% | 0.39% | |

| NZD | 0.44% | 0.30% | 0.21% | 0.79% | 0.34% | 0.19% | 0.55% | |

| CHF | -0.09% | -0.22% | -0.34% | 0.21% | -0.21% | -0.39% | -0.55% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

USD/CHF Technical Outlook

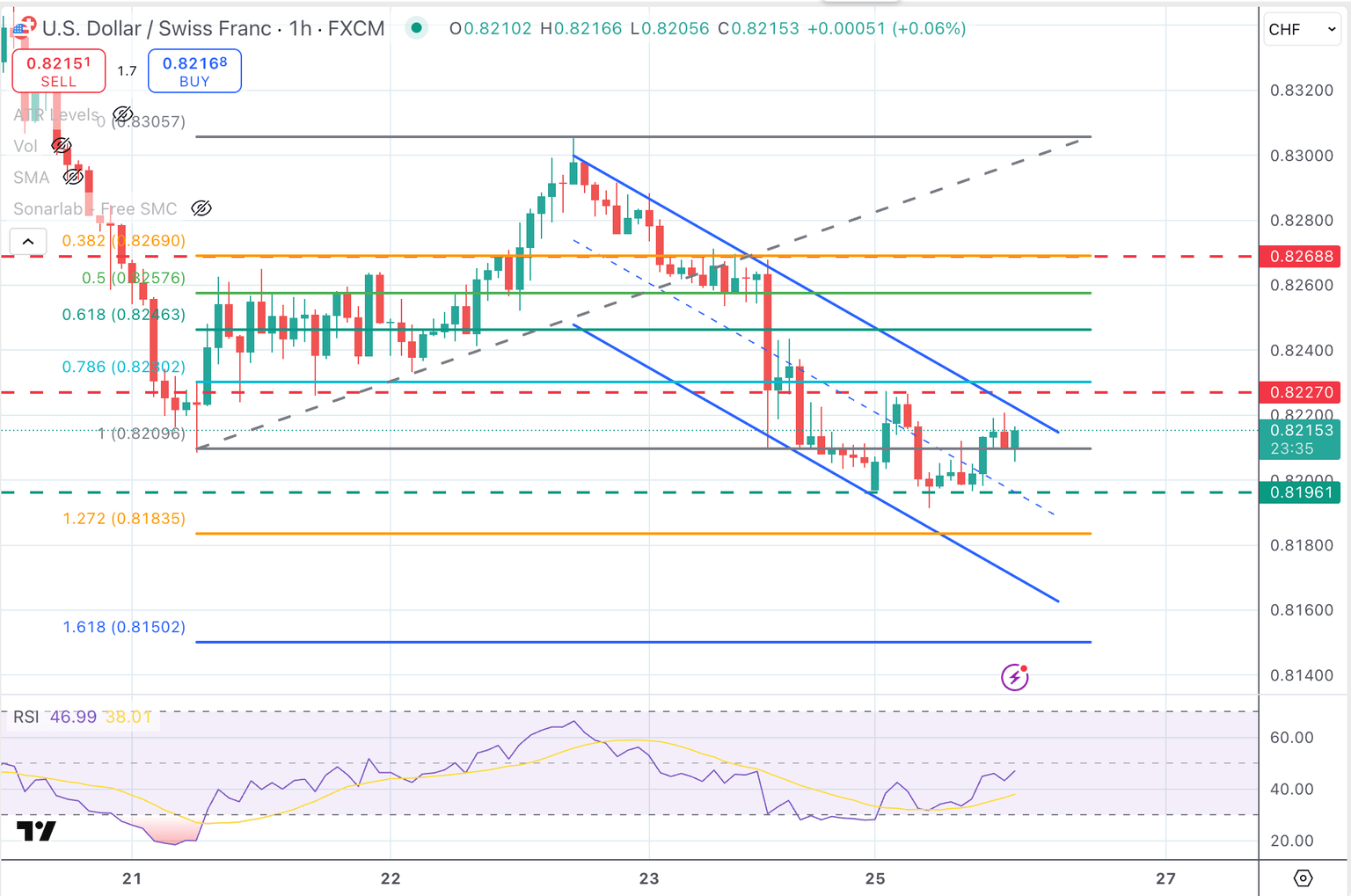

Price action keeps posting lower highs and lower lows, in a descending channel, with the 4-hour RSI capped below the 50 line that divides the bearish from the bullish territory.

Bulls have been capped at the 0.8225 resistance area twice on Monday, which keeps sellers hopeful for a retest of the 0.8200 support area. A break below here might increase pressure towards the channel bottom, now at 0.8170, ahead of the 161.8% retracement of the May 21.22 correction, at 0.8150.

On the upside, a break of the mentioned intra-day high, at 0.8225, would shift bulls’ focus towards the 0.8270 intra-day level.

USD/CHF 1-Hour Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.