USD/CHF Price Analysis: Recovers ground but shy of reclaiming 0.9000

- USD/CHF rebounds, trading at 0.8941, showing consolidation around the 0.8900 level.

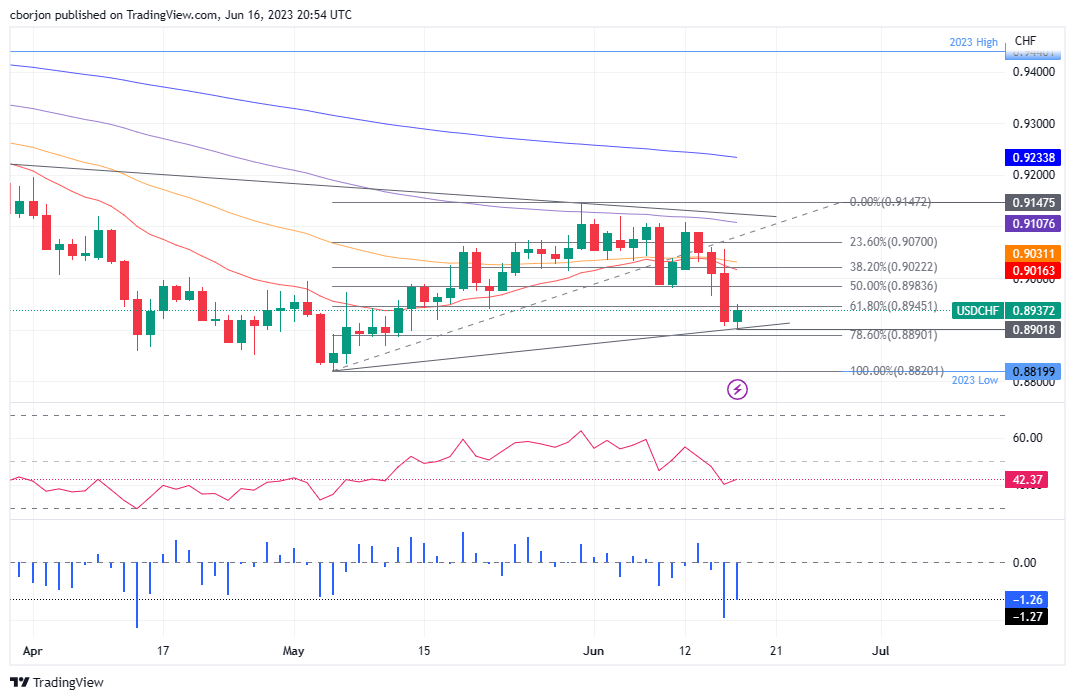

- The pair needs to surpass 0.8949 (61.8% Fibonacci Retracement) to reach the 0.9000 mark.

- A drop below 0.8900 could expose the year-to-date low at 0.8819.

USD/CHF rebounds at around weekly lows, though it remains below the 0.9000 figure, due to a risk-off impulse that bolstered the US Dollar (USD), which is set to finish the week with losses of 1.18%, per the US Dollar Index (DXY). The USD/CHF is trading at 0.8941 after hitting a daily low of 0.8901.

USD/CHF Price Analysis: Technical outlook

The USD/CHF depicts the pair as downward biased, though set to consolidate nearby the 0.8900 figure. During the session, the USD/CHF dropped from around 61.8% Fibonacci Retracement (FR) toward the 78.6% FR level but failed to surpass 0.8900, which would have exacerbated additional losses and a YTD low test of 0.8819.

With the USD/CHF rebounding toward the 61.8% FR at 0.8949, buyers must conquer the latter to lift rates toward the 0.9000 psychological level. In that outcome, the USD/CHF next resistance would be the 50% FR at 0.8983, followed by the 0.9000 mark.

Conversely, the path of least resistance, according to oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), If the USD/CHF drops below 0.8900 and beneath the 78.6% FR, would expose the YTD low at 0.8819.

USD/CHF Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.