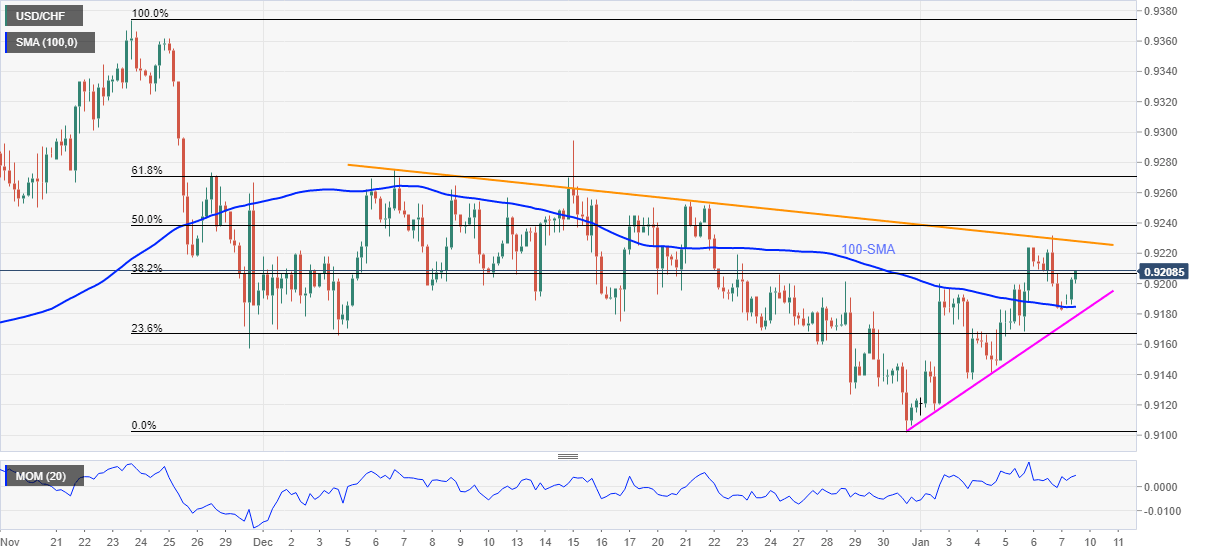

USD/CHF Price Analysis: Rebounds from 100-SMA to pierce 0.9200

- USD/CHF reverses Friday’s pullback from 13-day top, refreshes intraday high.

- Firmer Momentum line, sustained bounce off the key moving average favor buyers.

- Monthly resistance line appears the key for short-term, ascending trend line from December 31 adds to the downside filters.

USD/CHF takes the bids to renew intraday peak to 0.9207 during early Monday morning in Europe.

The Swiss currency (CHF) pair marked the heaviest daily losses since December 22 before bouncing off the 100-SMA. The corrective pullback gains support from a firmer Momentum line to direct the pair buyers towards the monthly resistance line, around 0.9230.

During the quote’s sustained run-up beyond 0.9230, the 61.8% Fibonacci retracement (Fibo.) of November-December downside, around 0.9270, will be crucial to watch for the USD/CHF pair’s further upside.

Meanwhile, a downside break of the 100-SMA, around 0.9185 by the press time, isn’t a green signal for USD/CHF sellers as a one-week-old support line, near 0.9178, will test the south-run towards December’s bottom surrounding 0.9100.

Overall, USD/CHF keeps the bullish consolidation to pare losses marked since late November. However, buyers will have a bumpy road ahead.

USD/CHF: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.