USD/CHF Price Analysis: Reaches another fresh two-year-high, shy of the 0.9800 mark

- The USD/CHF rallied for the eight-straight session, up by some 3.50%.

- A dismal market mood boosted the greenback, with the US Dollar Index meandering around 103.600.

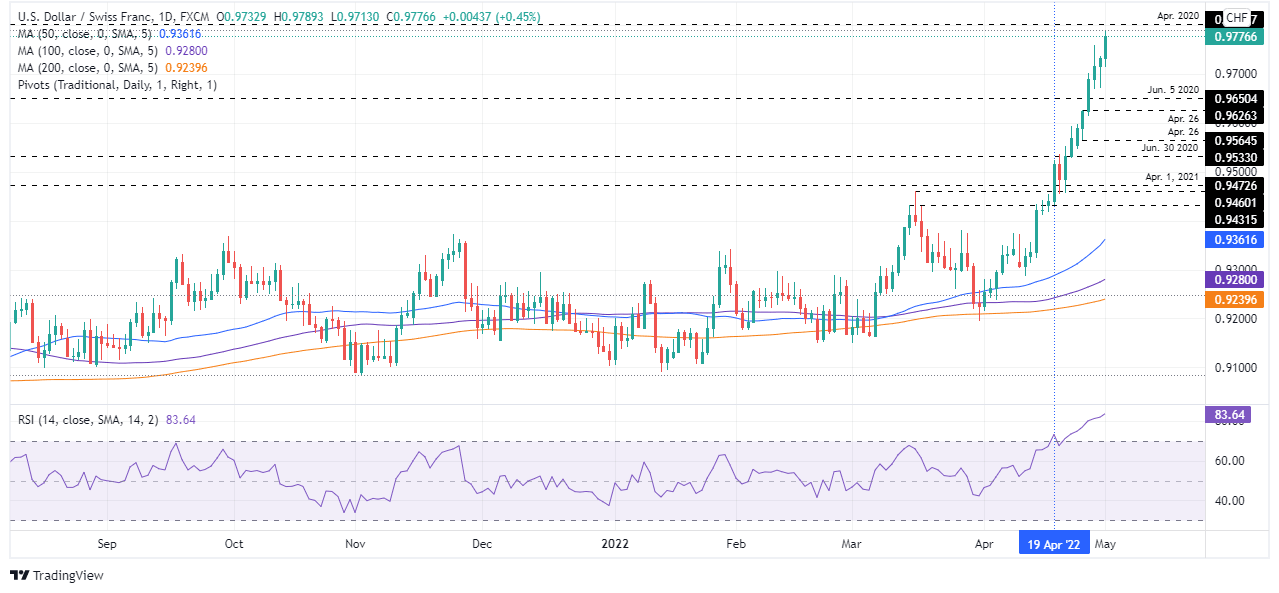

- USD/CHF Price Forecast: Despite RSI at overbought territory, it remains to trend higher, but it could be subject to a mean reversion move.

The USD/CHF edges higher during the North American session as the New York session winds down for the first time in May and is trading at around 0.9779, shy of two-year-highs, gaining some 0.47%.

Wall Street is set to record losses on May’s first trading day, courtesy of a dismal sentiment. US Treasury yields are soaring, with 5s, 7s, and 20s above the 3% threshold, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of six rivals, edges higher, up some 0.37%, sitting at 103.600.

On Monday, in the overnight session, the USD/CHF opened near the daily pivot at 0.9710, though some pips above the 50-hour simple moving average (SMA), lying around the aforementioned area. Nonetheless, around the mid-European session, the USD/CHF managed to rally towards fresh two-year-highs at 0.9789, some pips shy of the 0.9800 mark, around the R2 daily pivot.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart shows the pair remains in a steep uptrend and has just one day of losses, compared to eight days of gains once it broke above the 0.9500 mark. Oscillators already show the pair as overbought, as the Relative Strength Index (RSI) at 83.00 illustrates. However, it remains with an upslope, a signal that the USD/CHF might keep trending higher before posting a reversal.

With that said, the USD/CHF first resistance would be April’s 2020 swing high at 0.9802. Break above would expose 0.9850, followed by 0.9901, March 23, 2020, daily high.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.