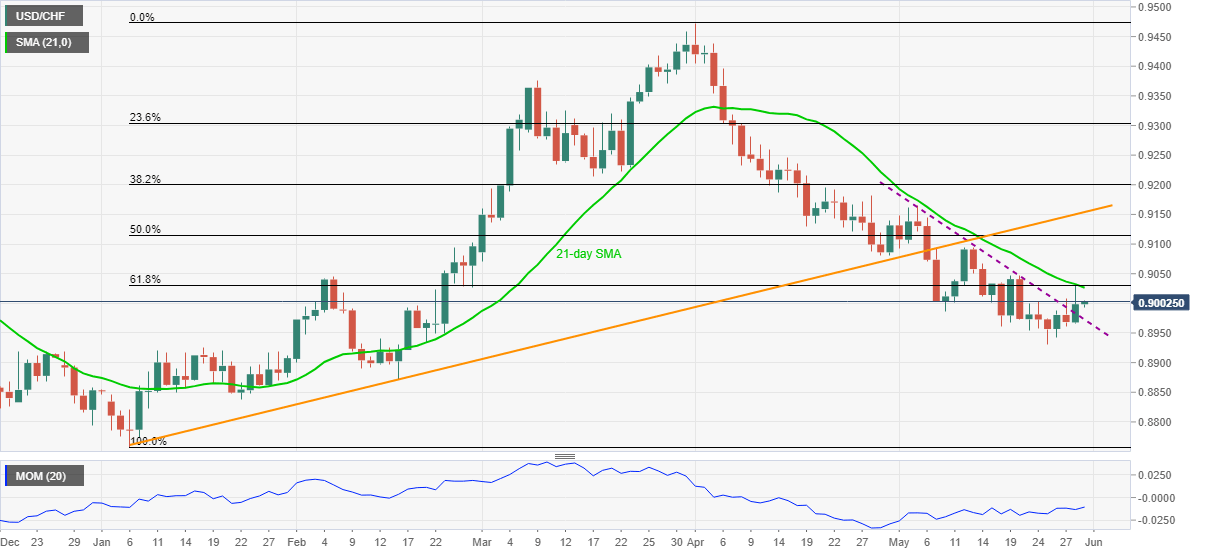

USD/CHF Price Analysis: Corrective pullback needs validation from 0.9030

- USD/CHF extends previous week’s recovery moves, keeps monthly trend line breakout.

- 21-day SMA, 61.8% Fibonacci retracement of January-April upside tests bulls.

- Sellers have a bumpy road towards the yearly bottom.

USD/CHF stays firmer around 0.9000 threshold, up 0.07% intraday, during Monday’s Asian session.

The Swiss currency pair’s U-turn from February 17 low, marked the last Tuesday, crossed a downward sloping trend line from May 05.

Although the Momentum line joins the trend line breakout to favor USD/CHF buyers, a convergence of 21-day SMA and the key Fibonacci retracement level near 0.9030 becomes the key hurdle to the pair’s further upside.

It’s worth mentioning that the bulls’ dominance past 0.9030 could aim for the previous month’s low near 0.9080. However, 50% Fibonacci retracement level and the support-turned-resistance line, respectively around 0.9115 and 0.9155, could challenge any extra rise.

On the flip side, pullback moves may take a rest on the short-term support, previous resistance, near 0.8970, ahead of highlighting the monthly low near 0.8930.

During the quote’s weakness below 0.8930, multiple rest-points near 0.8920 and 0.8870-75 might act as intermediate halts before directing USD/CHF bears to the yearly bottom of 0.8757.

USD/CHF daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.