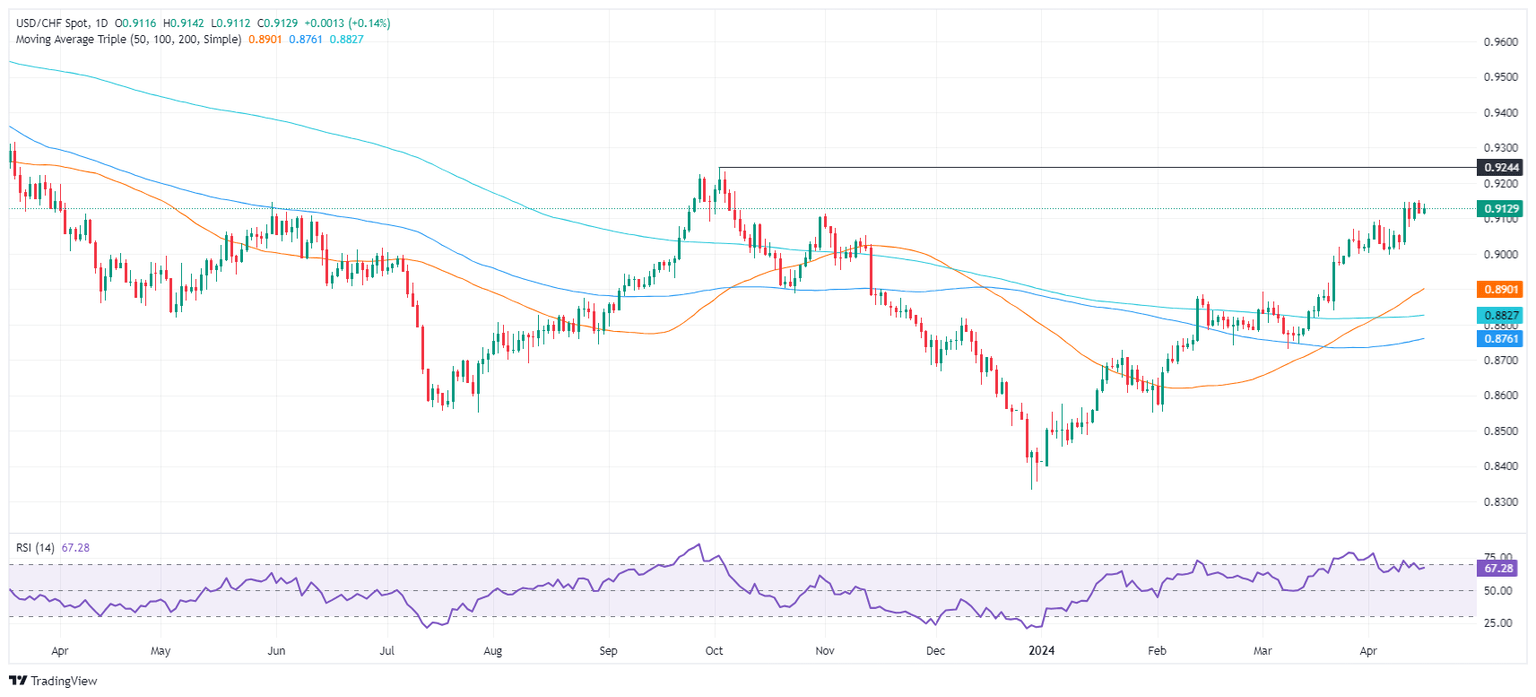

USD/CHF Price Analysis: Consolidates above 0.9100 near YTD highs

- USD/CHF climbs 0.12% amid global risk aversion, boosting demand for the US Dollar.

- Breaking past the November 1, 2023, high of 0.9112 suggests potential for more gains, targeting the 0.9200 resistance.

- A fallback below 0.9100 could prompt a test of the major support trendline around 0.9040.

The US Dollar posts minimal gains versus the Swiss Franc in the mid-North American session and gains 0.12%, trading at 0.9127 at the time of writing. Risk aversion, higher US Treasury yields, and solid US Retail Sales data boost the Greenback.

USD/CHF Price Analysis: Technical outlook

The pair remains upward biased after cracking the last cycle high of 0.9112 on November 1, 2023, which could pave the way for further upside. The USD/CHF peaked at around 0.9151, which, once surpassed, will expose the 0.9200 mark. A breach of the latter, and the pair could rally towards October 3, 2023, a high of 0.9245, with the next key resistance level seen at 0.9300.

On the other hand, if USD/CHF drops below 0.9100, that could open the door to challenge a three-and-a-half-month-old support trendline that passes around 0.9040. A further downside is seen at 0.9000.

USD/CHF Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.