USD/CHF Price Analysis: Bulls prod 0.9100, further upside appears difficult

- USD/CHF grinds higher after bouncing off 0.9040 support confluence, mildly bid of late.

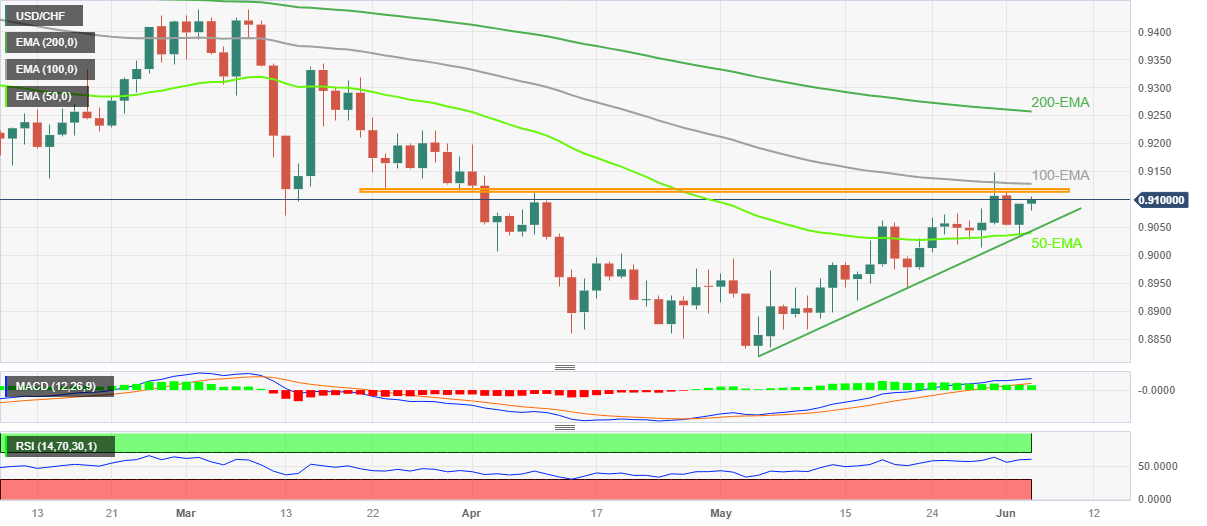

- 50-EMA, one-month-old rising trend line prods bears amid upbeat oscillators.

- Bulls have a tough road to travel amid presence of multiple EMAs, horizontal resistance.

USD/CHF picks up bids to 0.9105 as it clings to mild gains around 0.9100 during early Monday morning in Europe. In doing so, the Swiss Franc (CHF) pair rises for the second consecutive day while defending the previous day’s rebound from the 0.9040 support confluence.

That said, a convergence of the 50-day Exponential Moving Average (EMA) and an upward-sloping trend line from early May, facilitates the USD/CHF pair’s recovery amid bullish MACD signals and a firmer RSI (14) line, not overbought.

With this, the USD/CHF is likely to conquer the 10-week-old horizontal resistance area, as well as the 100-EMA, respectively around 0.9120 and 0.9130.

However, the RSI line is near the overbought territory and may prod the upside limit in case of the Swiss Franc (CHF) pair’s further upside, which in turn can challenge the USD/CHF bulls afterward.

In a case where the USD/CHF buyers remain hopeful past 0.9130, the late March swing high of around 0.9225 and the 200-EMA level of 0.9260 will challenge the pair buyers.

On the flip side, a daily closing below the aforementioned support confluence near 0.9040 can quickly fetch the USD/CHF price towards the 0.9000 round figure.

It’s worth noting, however, that the USD/CHF pair’s weakness past 0.9000 will make it vulnerable to revisiting the yearly low marked in May around 0.88220.

USD/CHF: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.