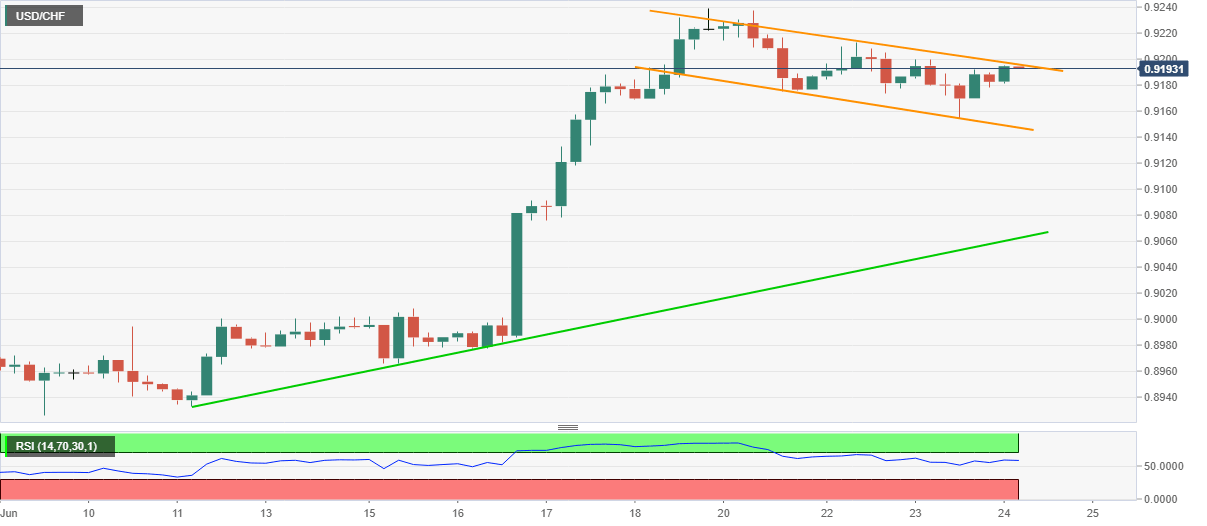

USD/CHF Price Analysis: Bulls attack flag resistance around 0.9200

- USD/CHF holds onto previous day’s recovery moves from weekly low.

- Bullish chart formation, upbeat RSI keep buyers hopeful.

- Sellers may wait for two-week-old support break for fresh entries.

USD/CHF buyers jostle with the key short-term hurdle around 0.9195, up 0.10% intraday, ahead of Thursday’s European session. The major currency pair’s rebound on Wednesday forms a bullish chart pattern on the four-hour (4H) play.

With the RSI line flashing a strong level, above 50 but not overbought, the pair becomes capable to cross the 0.9200 resistance and confirm the bullish flag formation.

The sustained break of the 0.9200 enables the USD/CHF bulls to aim for a theoretical target surrounding the 0.9300 mark, also comprising multiple tops marked during mid-March.

During the move, the latest high near 0.9240 may probe the pair’s upside whereas March’s top near 0.9375 could test the run-up challenging the yearly peak of 0.9472.

Alternatively, pullback moves seem less challenging until staying beyond an ascending support line from June 11, near 0.9060. However, the stated flag’s support line near 0.9145 can offer immediate rest should the USD/CHF sellers sneak in.

Overall, USD/CHF portrays a bullish trend and the confirmation of flag can add strength to the upside momentum.

USD/CHF four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.