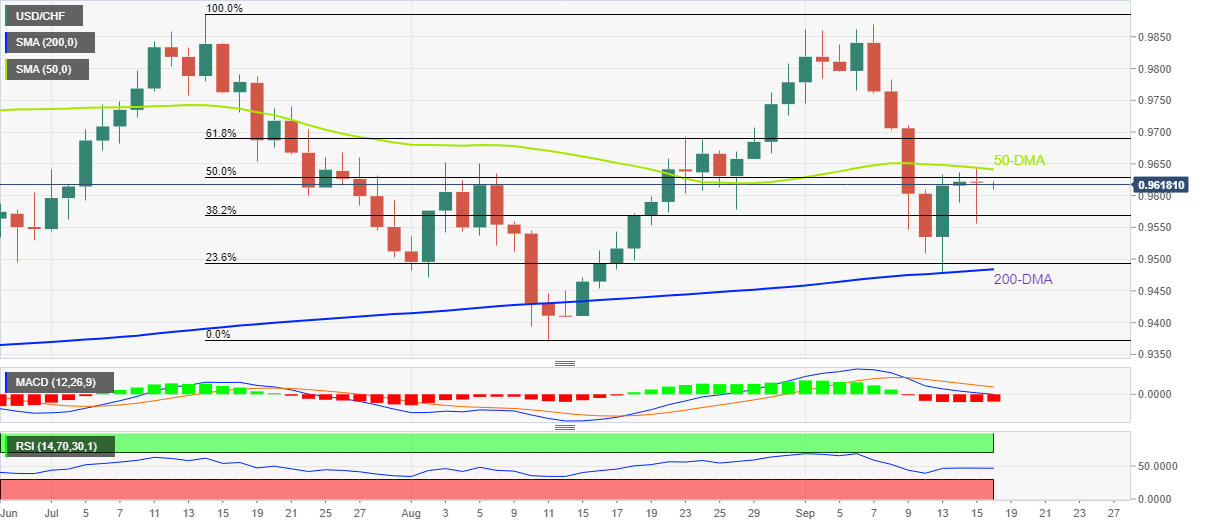

USD/CHF Price Analysis: 50-DMA challenges buyers above 0.9600

- USD/CHF picks up bids to reverse the previous day’s pullback from the key DMA.

- Bearish MACD signals, failures to cross 50-DMA favor sellers.

- Buyers need to cross the 61.8% Fibonacci retracement level to retake control.

USD/CHF redirects the upside momentum towards the 50-DMA hurdle while picking up bids near 0.9620 during Friday’s Asian session.

In doing so, the Swiss currency (CHF) pair defends the previous day’s rebound from the 38.2% Fibonacci retracement level (Fibo.) of July-August downside, around 0.9570, to aim for the 50-DMA resistance, close to 0.9640 by the press time.

However, the bearish MACD signals and steady RSI suggest another failure of the USD/CHF to cross the immediate DMA resistance.

Even if the quote rises past 0.9640 hurdle, the 61.8% Fibonacci retracement level around 0.9690 and the 0.9700 threshold could test the USD/CHF bulls.

Alternatively, the downside break of the 38.2% Fibo. close to 0.9570 could quickly direct the quote towards the 0.9490-80 support confluence including the 200-DMA and the 23.6% Fibonacci retracement level.

In a case where the USD/CHF remains weak past 0.9480, the odds of witnessing a slump towards the previous monthly low of 0.9370 can’t be ruled out.

USD/CHF: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.