USD/CHF holds ground after tariff relief, jobs data

- USD/CHF trades near the 0.8900 zone after the US Commerce Secretary unveiled auto industry relief plans and risk sentiment improved slightly.

- Dollar demand remains supported by trade developments and weaker-than-expected US labor data, fueling monetary policy speculation.

- Technical outlook stays cautiously bullish while USD/CHF navigates key moving averages and consolidates recent gains.

The USD/CHF pair is trading around 0.8900 during the North American session on Tuesday, benefiting from broader US Dollar (USD) strength. United States (US) Secretary of Commerce Howard Lutnick revealed White House plans aimed at easing tariffs on US automakers, supporting a mild recovery in global risk appetite. Meanwhile, the US Dollar Index (DXY) edges higher towards 99.30, underpinned by expectations that weaker labor market data and soft consumer confidence could steer the Federal Reserve (Fed) toward a more cautious policy stance. However, uncertainty remains around US-China trade negotiations, preventing a stronger USD rally.

Data from the US Bureau of Labor Statistics (BLS) showed the Job Openings and Labor Turnover Survey (JOLTS) for March slumped to 7.192 million, missing expectations of 7.5 million and marking the lowest reading since September. In parallel, the Conference Board's Consumer Confidence Index fell sharply to 86.0 in April, suggesting rising economic pessimism. Despite weaker labor and sentiment readings, the USD gained modestly as markets anticipated possible trade tariff relief and awaited key economic figures later in the week, including GDP and ISM PMI releases.

Elsewhere, geopolitical headlines influenced risk sentiment. US Treasury Secretary Scott Bessent emphasized that China should take the initiative to de-escalate trade tensions, while Beijing’s move to waive the 125% tariff on US ethane imports was seen as a marginal positive. Markets remain cautious, particularly as conflicting messages from Washington and Beijing add to uncertainty.

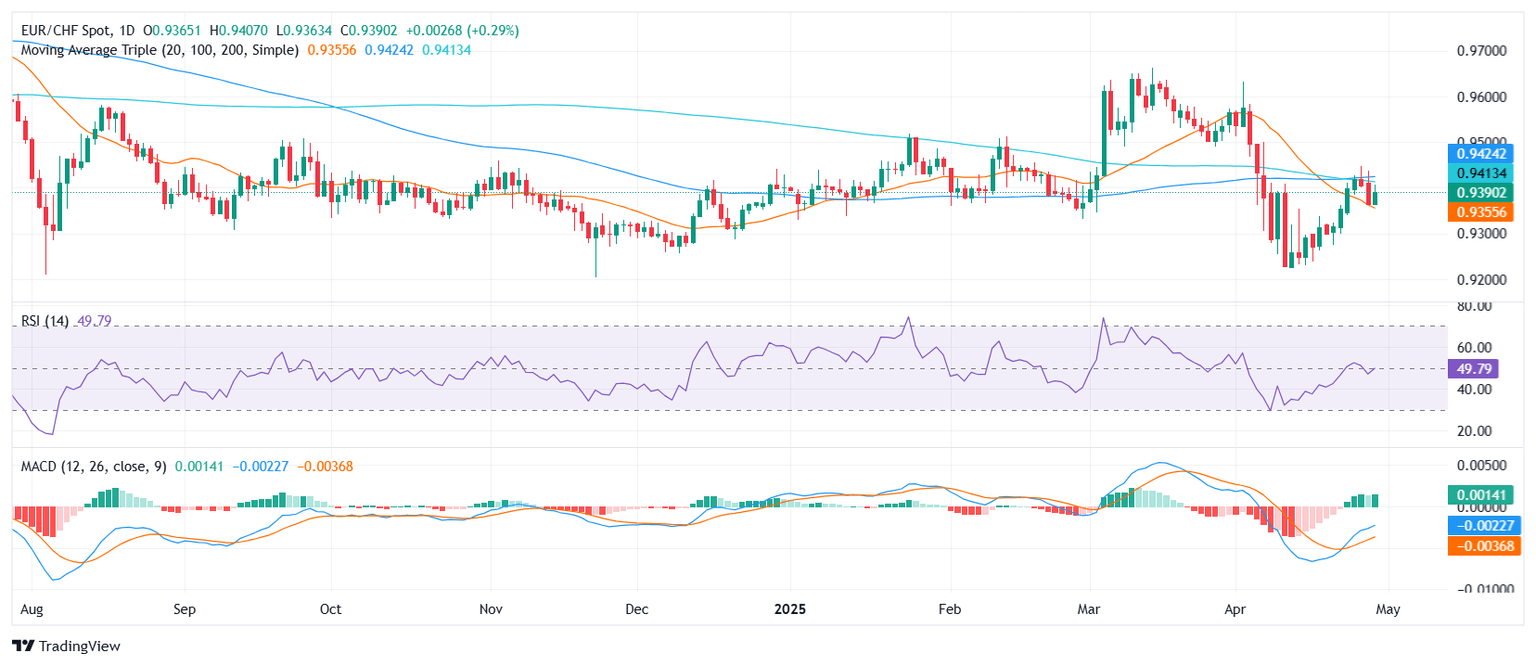

Technical Analysis

USD/CHF holds a constructive tone above 0.8880, leaning towards a gradual advance. The 20-day Simple Moving Average (SMA) stands around 0.8870, offering immediate support, while the 50-day SMA near 0.8820 provides a secondary floor. Momentum indicators reflect modest bullishness: the 14-day Relative Strength Index (RSI) stabilizes around the 55 mark, while the MACD is approaching a bullish crossover. On the upside, if bulls push above 0.8915, the next resistance could emerge around 0.8950, followed by the psychological barrier at 0.9000. A breakdown below 0.8870 could expose 0.8820 and 0.8780 as support areas.

With a mild improvement in risk sentiment, White House support for automakers, and mixed US economic data, USD/CHF remains biased to the upside in the short term. However, broader moves will hinge on upcoming US economic releases and further trade-related developments.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.