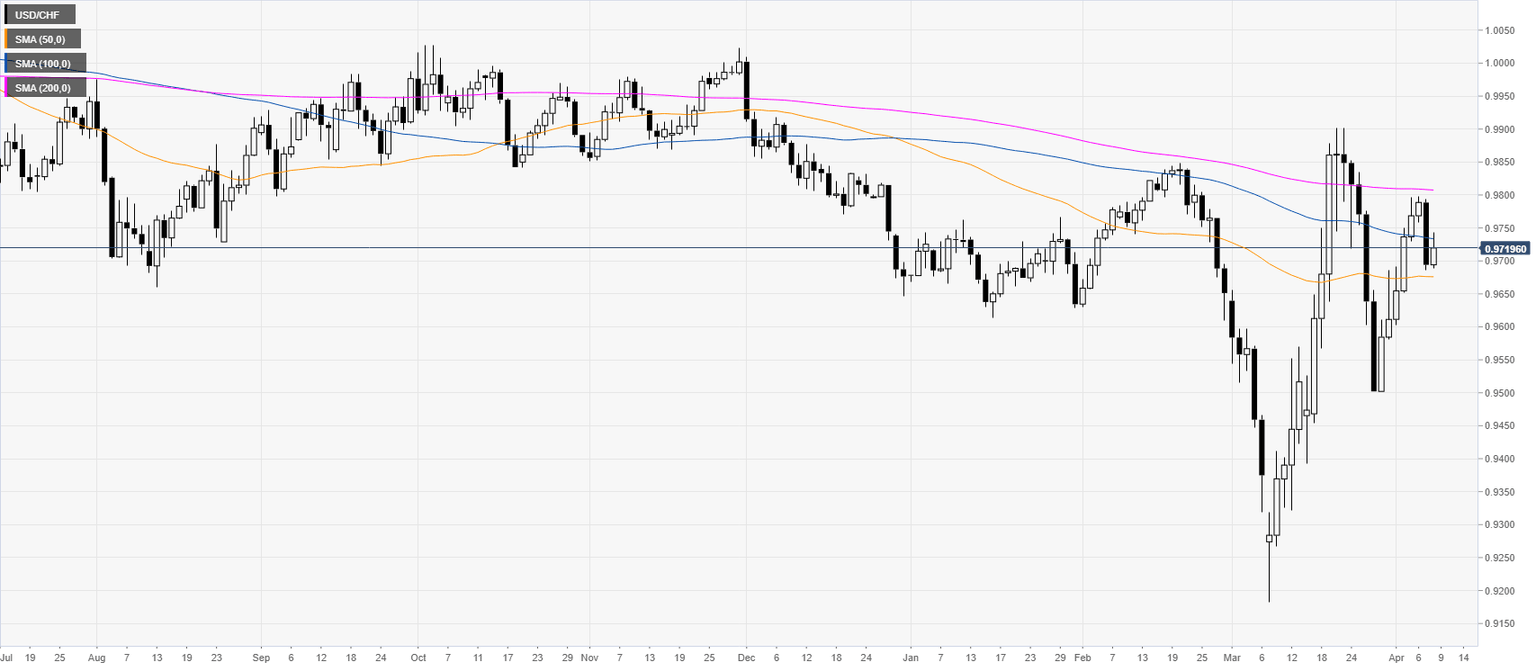

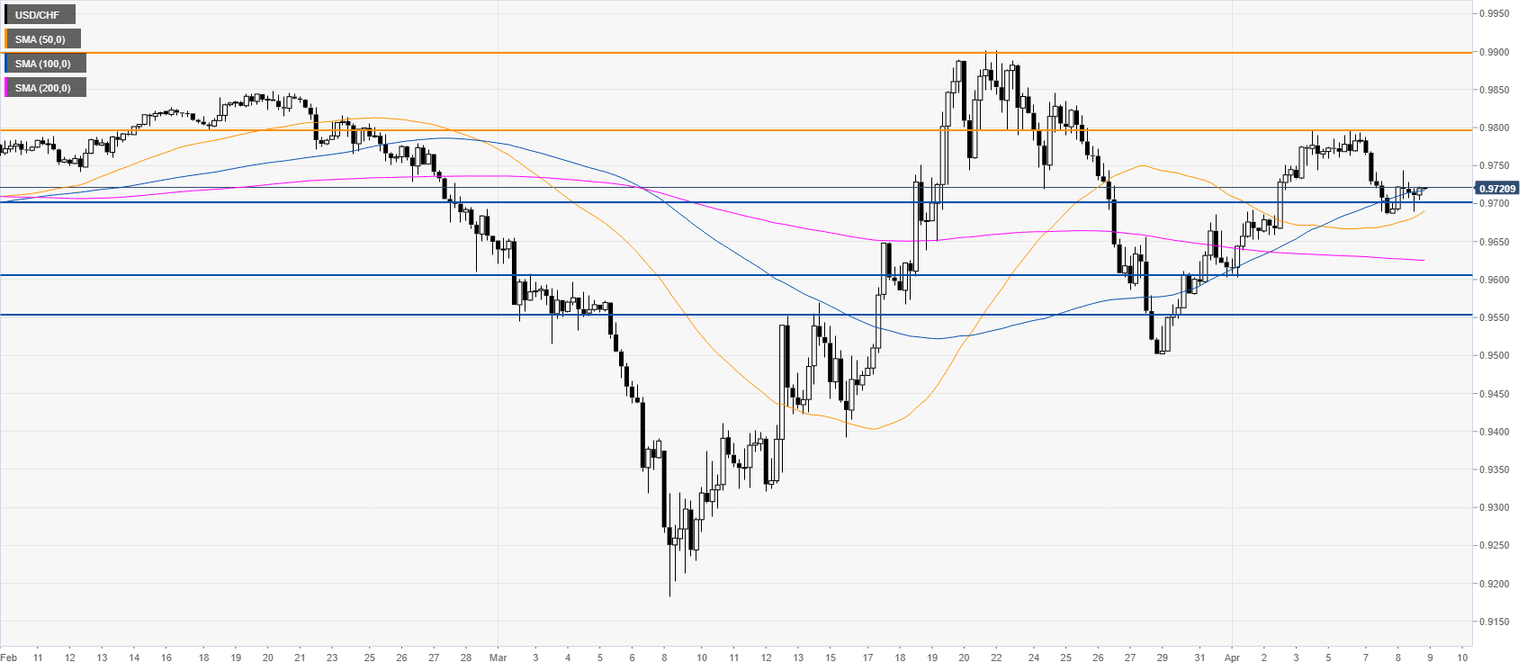

USD/CHF Asia Price Forecast: Greenback holds above 0.9700 vs. Swiss franc

- USD/CHF’s bull trend remains intact as the spot holds above the 0.9700 figure.

- The level to beat for bulls is the 0.9800 resistance.

USD/CHF daily chart

USD/CHF four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst