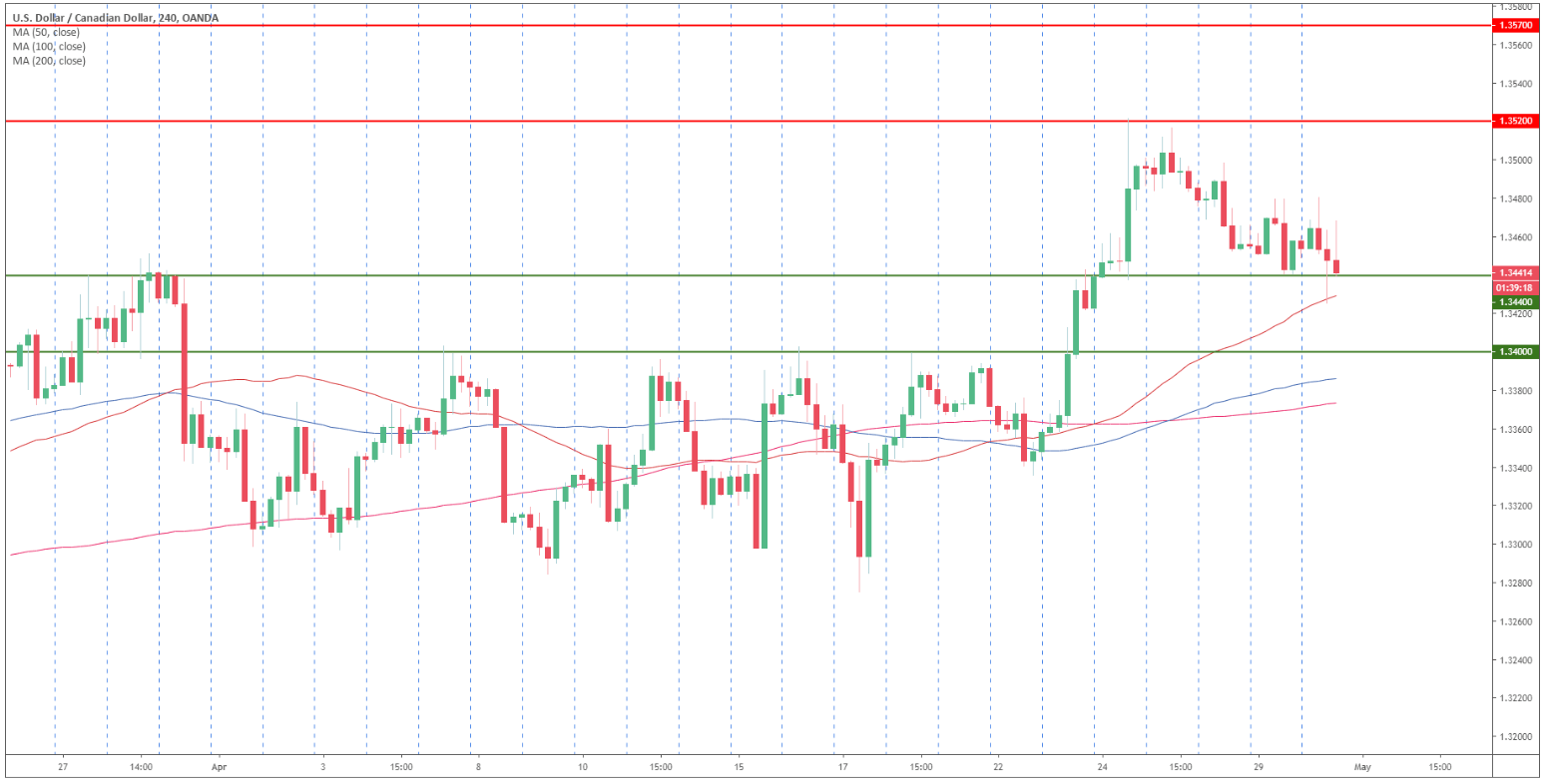

USD/CAD Technical Analysis: Greenback drifting down below 1.3500 figure

USD/CAD daily chart

- USD/CAD is trading in a bull trend above its 200 simple moving average (SMA).

- USD/CAD found resistance at 1.3520 resistance and has been retracing towards 1.3440 support.

- USD/CAD is trading above its main SMAs suggesting bullish momentum.

- If the current correction down break 1.3440 then a drop towards 1.3400 can be on the cards.

- Resistance is seen at 1.3480 and 1.3520 level.

Author

Flavio Tosti

Independent Analyst