USD/CAD Technical Analysis: Forming a holding pattern at the top just south of 1.3600

- The Dollar-Loonie pairing caught some lift from the bottom in early Thursday action, rising from 1.3566 to clip just shy of 1.3600, and the pair is beginning to run in the middle again as the intraday runs out of steam.

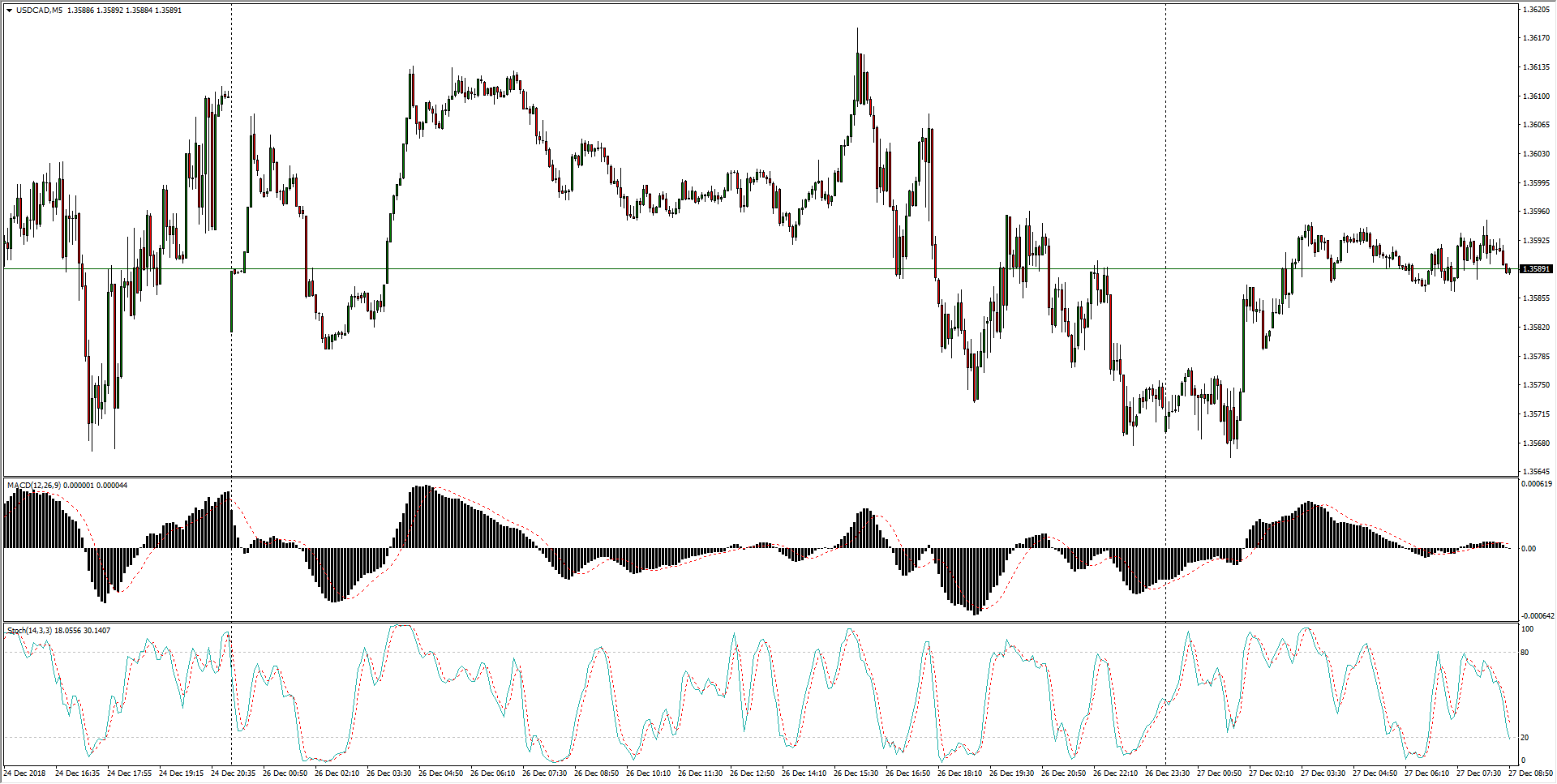

USD/CAD, 5-Minute

- The USD struck a new near-term high against the Loonie this week, and is setting up for a sideways holding pattern near the high side as the Greenback maintains its market position.

USD/CAD, 30-Minute

- The past two months have seen the CAD give up ground to the US Dollar in one-way action, but the overextended chart pattern is likely to see buyers holding back as they wait for a pullback into the 1.3300 zone before reloading long positions on USD/CAD.

USD/CAD, 4-Hour

USD/CAD

Overview:

Today Last Price: 1.3592

Today Daily change: 22 pips

Today Daily change %: 0.162%

Today Daily Open: 1.357

Trends:

Previous Daily SMA20: 1.3436

Previous Daily SMA50: 1.3273

Previous Daily SMA100: 1.3143

Previous Daily SMA200: 1.3054

Levels:

Previous Daily High: 1.4134

Previous Daily Low: 1.3568

Previous Weekly High: 1.3602

Previous Weekly Low: 1.3372

Previous Monthly High: 1.336

Previous Monthly Low: 1.3048

Previous Daily Fibonacci 38.2%: 1.3784

Previous Daily Fibonacci 61.8%: 1.3918

Previous Daily Pivot Point S1: 1.3381

Previous Daily Pivot Point S2: 1.3192

Previous Daily Pivot Point S3: 1.2816

Previous Daily Pivot Point R1: 1.3946

Previous Daily Pivot Point R2: 1.4322

Previous Daily Pivot Point R3: 1.4511

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.