USD/CAD strengthens as Middle East tensions support Greenback

- The USD/CAD rises as monetary policy divergence and safe-haven demand support the USD's strength.

- The Strait of Hormuz remains a concern for Oil markets but fails to support the Canadian Dollar on Monday.

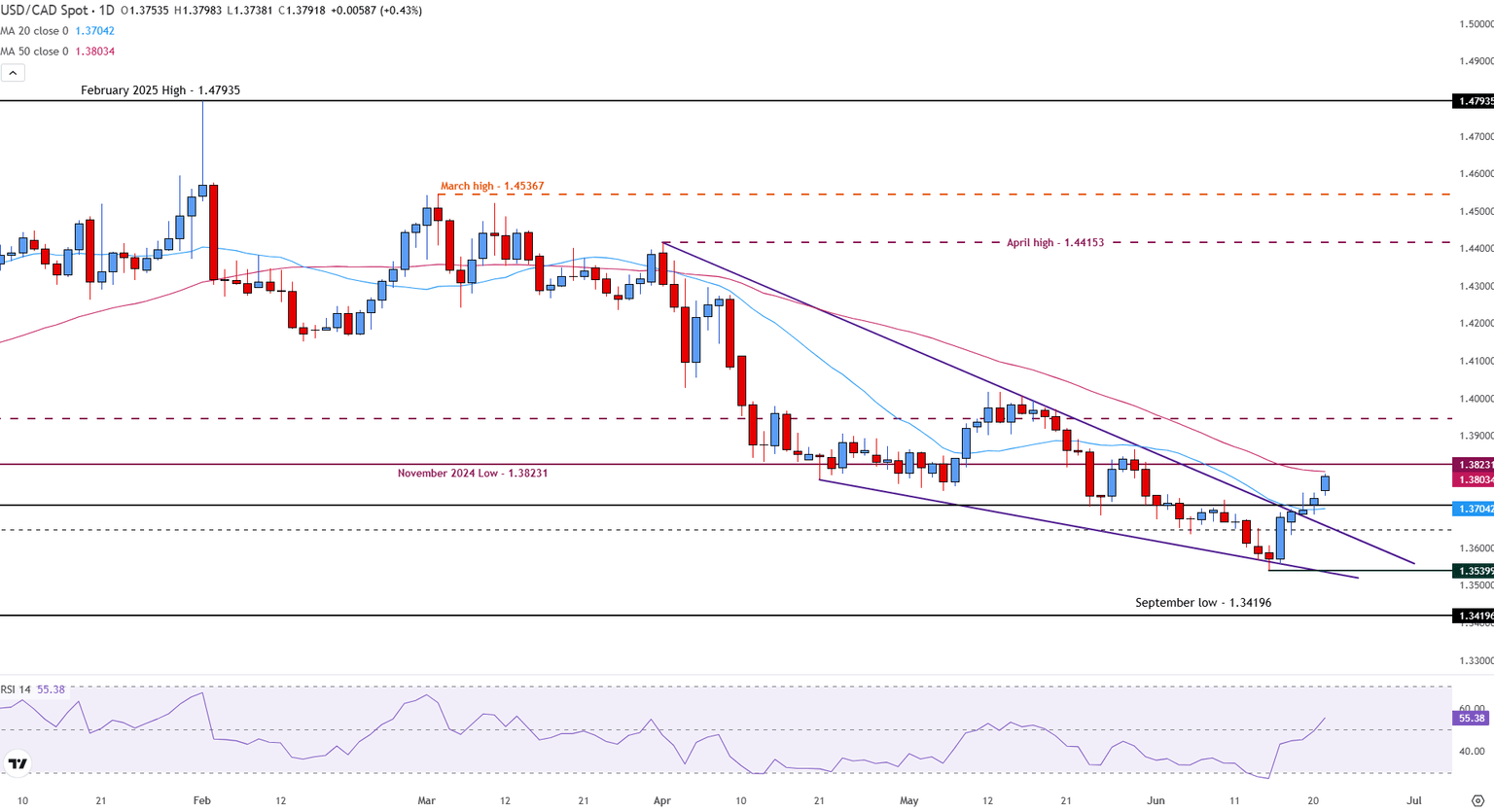

- USD/CAD is approaching the 50-day Simple Moving Average, located below the 1.3800 psychological level.

USD/CAD is trading stronger on Monday, holding around 1.3780 after touching an intraday high of 1.3803 earlier in the session.

The pair is on track for its fifth straight day of gains, driven by a mix of safe-haven flows into the US Dollar and concerns over Canada’s domestic economic outlook.

Risk sentiment remains fragile after the United States launched airstrikes on three Iranian nuclear sites over the weekend. In a televised statement, President Donald Trump said the strikes were a "very successful attack" and warned of further military action if Iran escalates. The strikes heightened tensions across the Middle East, particularly over the Strait of Hormuz, a key Oil shipping route.

This comes after last week’s renewed safe-haven demand for the US Dollar, sparked by the US airstrikes on Iranian nuclear sites, which injected uncertainty into global markets and lifted the Greenback across the board.

The resulting risk-off tone has kept the US Dollar supported, even as oil prices climb. Risk-sensitive assets have seen limited upside, while safe-haven flows have driven strength in the USD against major peers.

Dovish BoC outlook provides additional support for USD/CAD

Meanwhile, Canadian economic fundamentals have provided little support for the loonie. Friday’s preliminary May retail sales data from Statistics Canada showed a sharper-than-expected 1.1% contraction, following April’s modest 0.3% gain. This underscores weakening consumer demand and adds weight to the case for further interest rate cuts by the Bank of Canada.

Technical analysis: USD/CAD nears resistance at the 50-day SMA

From a technical standpoint, USD/CAD faces immediate resistance at the 50-day Simple Moving Average (SMA) near 1.3803.

A sustained break above that level could pave the way for a test of the November 2024 low at 1.3823. On the downside, initial support lies at the 20-day SMA at 1.3704, followed by a more significant floor near 1.3640. The daily Relative Strength Index (RSI) is holding just above 55, suggesting neutral-to-slightly bullish momentum in the short term.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.