USD/CAD Price Forecast: Falls to near 1.3700, eight-week lows

- USD/CAD may test primary support at the eight-week low at 1.3674.

- The 14-day RSI remains above 30, indicating continued bearish bias.

- The primary resistance appears at the nine-day EMA of 1.3764.

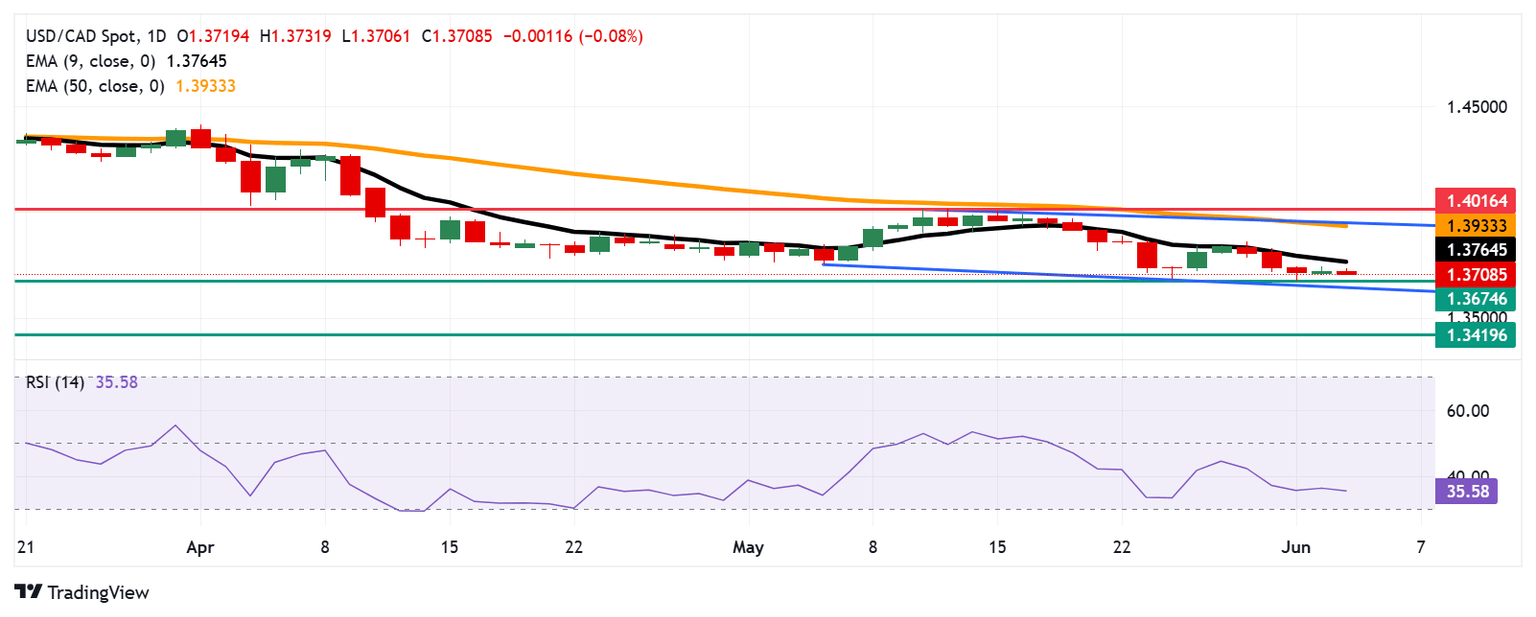

The USD/CAD pair is retracing its recent gains registered in the previous session, trading around 1.3710 during the European hours on Wednesday. The daily chart's technical analysis suggested a persistent bearish sentiment, as the pair consolidates within the descending channel pattern.

The 14-day Relative Strength Index (RSI) consolidates above 30, indicating continued bearish pressure. A break below the 30 mark would indicate an oversold situation and a potential upward correction soon. Additionally, the USD/CAD pair is also remaining below the nine-day Exponential Moving Average (EMA), pointing to weaker short-term momentum.

The USD/CAD pair may find initial support near the eight-week low at 1.3674, which was recorded on June 2, followed by the lower boundary of the descending channel around 1.3650. A break below the channel would reinforce the bearish bias and put downward pressure on the pair to navigate the region around 1.3419, the lowest since February 2024.

On the upside, the USD/CAD pair may encounter primary resistance at the nine-day EMA of 1.3764. A break above this level could improve the short-term price momentum and support the pair to explore the area around the 50-day EMA at 1.3933, followed by the descending channel’s upper boundary around 1.3960.

A surpassing of the above-mentioned crucial resistance zone could cause the emergence of the bullish bias, driven by the improved medium-term price momentum, and support the pair to approach the eight-week high of 1.4016, which was reached on May 13.

USD/CAD: Daily Chart

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.23% | -0.17% | 0.01% | -0.08% | -0.18% | -0.24% | -0.17% | |

| EUR | 0.23% | 0.04% | 0.23% | 0.15% | 0.07% | -0.01% | 0.05% | |

| GBP | 0.17% | -0.04% | 0.14% | 0.10% | -0.00% | -0.05% | 0.00% | |

| JPY | -0.01% | -0.23% | -0.14% | -0.06% | -0.23% | -0.18% | -0.14% | |

| CAD | 0.08% | -0.15% | -0.10% | 0.06% | -0.10% | -0.16% | -0.10% | |

| AUD | 0.18% | -0.07% | 0.00% | 0.23% | 0.10% | -0.08% | -0.01% | |

| NZD | 0.24% | 0.01% | 0.05% | 0.18% | 0.16% | 0.08% | 0.06% | |

| CHF | 0.17% | -0.05% | -0.01% | 0.14% | 0.10% | 0.01% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.