USD/CAD Price Forecast: Edges higher ahead of BoC-Fed policy outcome

- USD/CAD gains marginally to near 1.3760 ahead of monetary policy announcements by the Fed and the BoC.

- Both the Fed and the BoC are expected to lower interest rates.

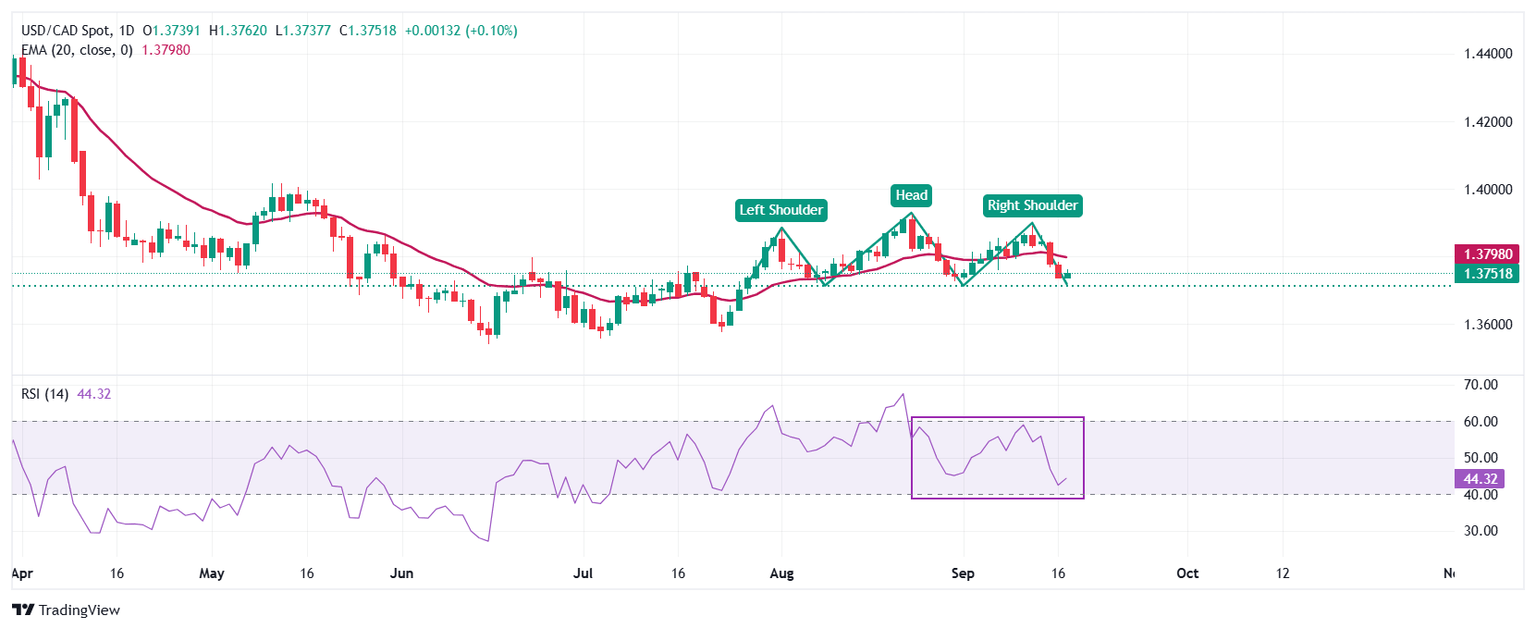

- USD/CAD forms a Head and Shoulder chart pattern.

The USD/CAD pair ticks up to near 1.3760 during the late European session on Wednesday. The Loonie pair gains marginally ahead of monetary policy outcomes by the Bank of Canada (BoC) and the Federal Reserve (Fed) during New York trading hours.

Both the BoC and the Fed are expected to cut interest rates amid mounting labor market conditions in their respective economies. Inflationary pressures in the Canadian economy have cooled down, emerging as another reason behind the BoC’s dovish expectations. However, the Fed is expected to start the monetary-easing campaign despite the United States (US) inflation remaining higher.

Investors will closely monitor press conferences from both Fed Chair Jerome Powell and BoC Governor Tiff Macklem to get cues about whether there will be more interest rate cuts in the remainder of the year.

According to analysts from Barclays, the Fed’s latest median projections for interest rates are likely to call for three interest rate cuts by 2025.

Ahead of the Fed’s monetary policy, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto Tuesday’s losses near 96.60.

USD/CAD forms a Head and Shoulder chart pattern, which indicates a bearish reversal. The neckline of the above-mentioned chart pattern is plotted near 1.3715.

The near-term trend of the pair remains bearish as it stays below the 20-day Exponential Moving Average (EMA), which trades around 1.3800.

The 14-day Relative Strength Index (RSI) slides to near 40.00. A fresh bearish momentum would emerge if the RSI falls below that level.

Going forward, the asset could slide towards the round level of 1.3600 and the June 16 low of 1.3540 if it breaks below the August 7 low of 1.3722.

On the flip side, a recovery move by the pair above the August 22 high of 1.3925 would open the door towards the May 15 high of 1.4000, followed by the April 9 low of 1.4075.

USD/CAD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.