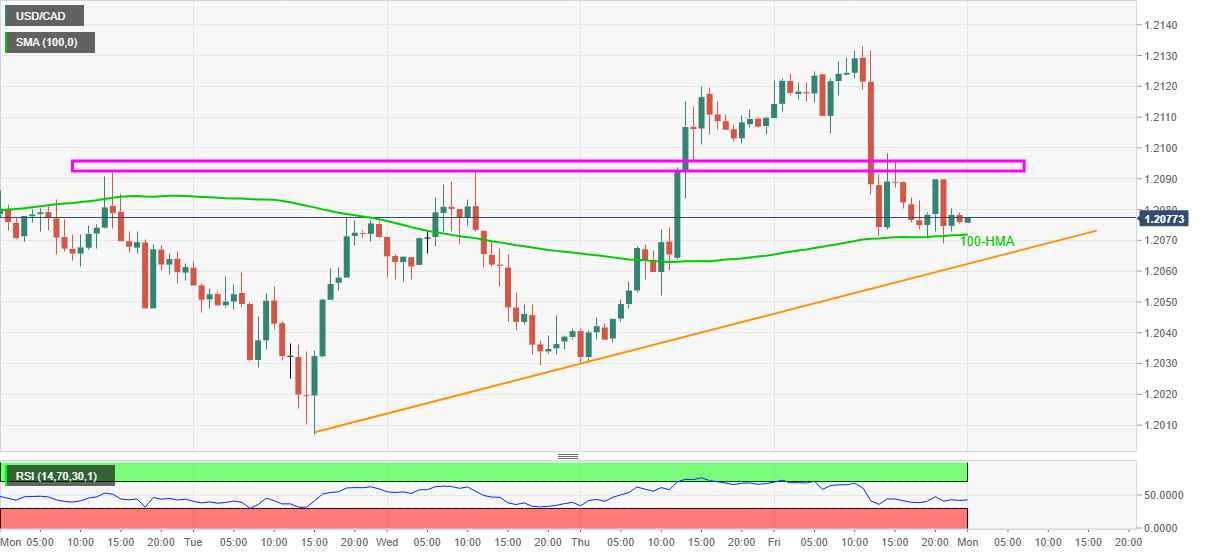

USD/CAD Price Analysis: Sellers attack 100-HMA on the way to weekly support line

- USD/CAD lacks upside momentum beyond 100-HMA amid a sluggish week-start.

- Weekly support line tests bears targeting monthly low.

- Bulls need clear break of 1.2100 to retake controls.

USD/CAD struggles to stay beyond 100-HMA, recently easing to 1.2075, during Monday’s Asian session trading. In doing so, the Loonie pair is likely to extend Friday’s pullback amid the downward sloping RSI line.

However, an ascending trend line from June 01, around 1.2060, adds a filter to the immediate HMA support of 1.2070.

It’s worth noting that the bearish impulse will gain momentum following a downside break of 1.2060, which in turn could drag USD/CAD prices towards the monthly low of 1.2007, also the lowest since May 2015.

Alternatively, a one-week-old horizontal resistance area surrounding 1.2095, followed by the 1.2100 threshold, could test USD/CAD buyers before directing them to the previous day’s top near 1.2135.

During the quote’s sustained run-up beyond 1.2135, the 1.2205 level comprising May 13 becomes the key to watch.

Overall, USD/CAD remains in the downward trajectory but the sellers have a bumpy road ahead.

USD/CAD hourly chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.