USD/CAD Price Analysis: Remains poised to test 100-DMA, focus on US/Canadian data

- USD/CAD drops further to hit three-week lows below 1.2450.

- Bears target 100-DMA at 1.2368 amid renewed downside pressure.

- RSI remains below the midline, allowing room for more declines.

- Key US, Canadian data in focus for fresh direction on the major.

USD/CAD is extending the recent downtrend into the third straight day on Friday, hitting the lowest levels in three weeks near 1.2430, as the selling pressure remains unabated amid a recovery in WTI prices and easing US dollar.

WTI recaptures ground above $73.50 amid a calmer risk tone while the US dollar resumes its downside, fuelled by the dovish Fed stance and a big miss on the US Q2 GDP figure.

Traders now look forward to the US PCE inflation and Canadian GDP data releases for fresh trading opportunities in the major.

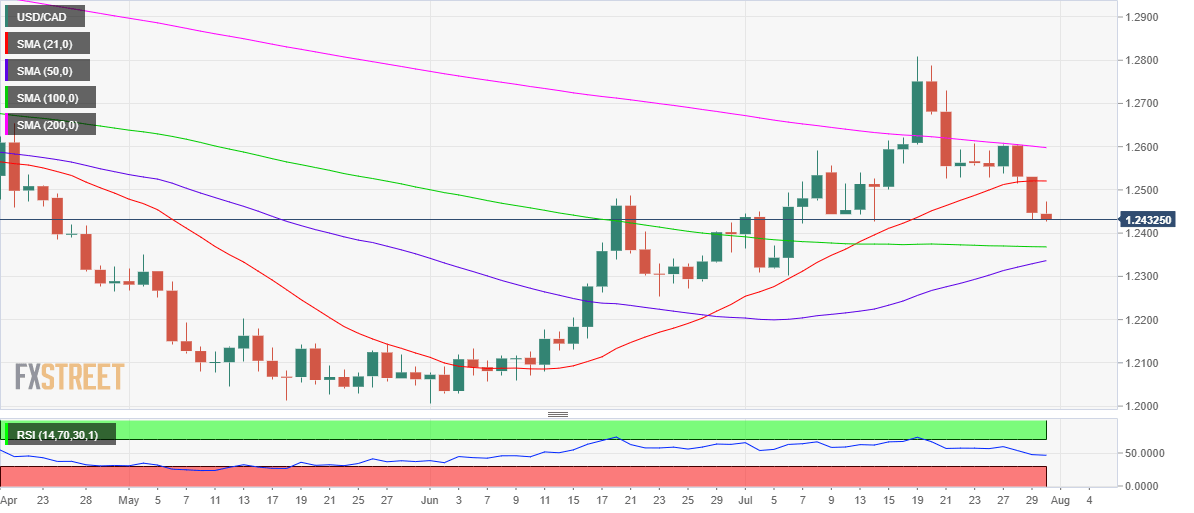

From a near-term technical perspective, USD/CAD remains vulnerable, especially after it faced rejection at the 200-Daily Moving Average (DMA) at 1.2605 earlier this week.

The downside momentum picked up pace after the spot closed Thursday below the 21-DMA at 1.2520, which opened floors for deeper declines.

The bears now target 1.2400, below which the horizontal 100-DMA at 1.2368 could come into play.

The 14-day Relative Strength Index (RSI) trades flat but remains below the midline, suggesting that there is room for more declines.

USD/CAD: Daily chart

Alternatively, the bulls need to find acceptance above the daily highs of 1.2472 to recapture the 1.2500 round number.

The price will face resistance at the abovementioned 21-DMA. The next relevant resistance will be then seen at the 1.2550 psychological level.

USD/CAD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.