USD/CAD Price Analysis: Further upside hinges on 1.2980 breakout

- USD/CAD bulls keep reins around weekly high, up for the third consecutive day.

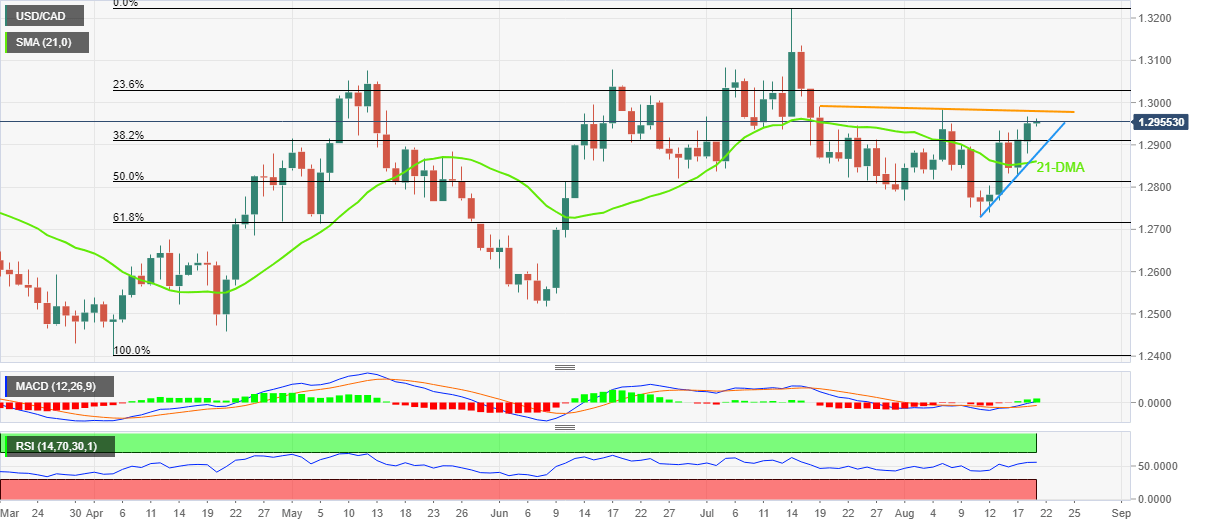

- One-month-old descending resistance line challenges immediate upside.

- RSI, MACD signals back buyers while sellers need validation from weekly support line, 21-DMA.

USD/CAD remains firmer for the third consecutive day, around 1.2960 during Friday’s Asian session after rising to the fresh high in two weeks the previous day. Even so, the Loonie pair is yet to cross the key resistance line from July 19.

It’s worth noting, however, that the firmer RSI (14) and the bullish MACD signals join the pair’s successful trading above the 21-DMA, as well as the one-week-old support line, to keep USD/CAD bulls hopeful of overcoming the immediate hurdle surrounding 1.2980.

Also acting as an upside filter is the 1.3000 psychological magnet, a break of which could give a free hand to the buyers during their run-up to June’s peak of 1.3078.

Alternatively, pullback moves remain elusive unless staying beyond the aforementioned support line near 1.2880, as well as the 21-DMA support of 1.2860.

Following that, the 50% Fibonacci retracement of the April-July upside and the monthly low, close to 1.2810 and 1.2725 in that order, will be important for the USD/CAD bears to watch.

Overall, USD/CAD prices are likely to remain firmer and can overcome the nearby resistance.

USD/CAD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.