USD/CAD Price Analysis: Bulls retain control above 1.3800, highest since October 2022

- USD/CAD climbs to its highest level since October and seems poised to appreciate further.

- A slightly overbought RSI on the daily chart might hold back bulls from placing fresh bets.

- Any meaningful corrective slide could be seen as a buying opportunity and remain limited.

The USD/CAD pair attracts some dip-buying near the 1.3785 region and climbs to a fresh high since October 21 during the early North American session on Thursday. The pair currently trades just above the 1.3800 mark and seems poised to extend its recent upward trajectory witnessed over the past three weeks or so.

Crude Oil prices languish near the weekly low amid concerns that a deeper global economic downturn will dent fuel demand and fading optimism over a strong recovery in China. This, in turn, is seen undermining the commodity-linked Loonie and acting as a tailwind for the USD/CAD pair. Bulls, meanwhile, seem rather unaffected by a modest US Dollar pullback from over a three-month peak.

The downside for the USD, however, remains cushioned amid bets for a 50 bps lift-off at the upcoming FOMC policy meeting on March 21-22. Moreover, looming recession risks should benefit the safe-haven buck. This, along with the fact that the Bank of Canada (BoC) became the first major central bank to pause its rate-hiking cycle on Wednesday, validates the positive outlook for the USD/CAD pair.

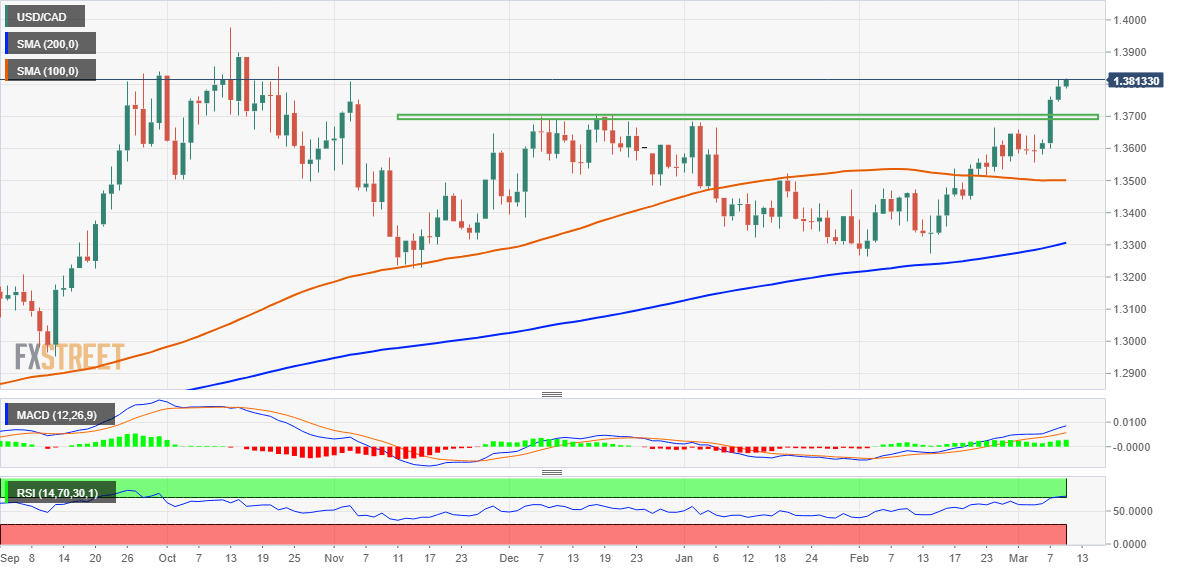

From a technical perspective, a sustained move beyond the 1.3700 horizontal barrier on Tuesday was seen as a fresh trigger for bullish traders. The subsequent move up validates the breakout and supports prospects for a further near-term appreciating move. That said, Relative Strength Index (RSI) on the daily chart is flashing slightly overbought conditions and warrants caution before placing fresh bets.

Nevertheless, the USD/CAD pair remains on track to climb further towards an intermediate hurdle near the 1.3870-1.3880 region en route to the 1.3900 round-figure mark. The positive momentum could get extended further, which should allow bulls to challenge the 2022 swing high, around the 1.3975-1.3980 zone, and then aim to reclaim the 1.4000 psychological mark.

On the flip side, any meaningful corrective decline now seems to find some support near the 1.3750-1.3745 area. Any further decline is more likely to attract fresh buyers near the 1.3700 horizontal resistance breakpoint. The latter should act as a pivotal point, which if broken might prompt some technical selling and drag the USD/CAD pair back towards the 1.3600 mark en route to the 1.3560 support zone.

USD/CAD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.