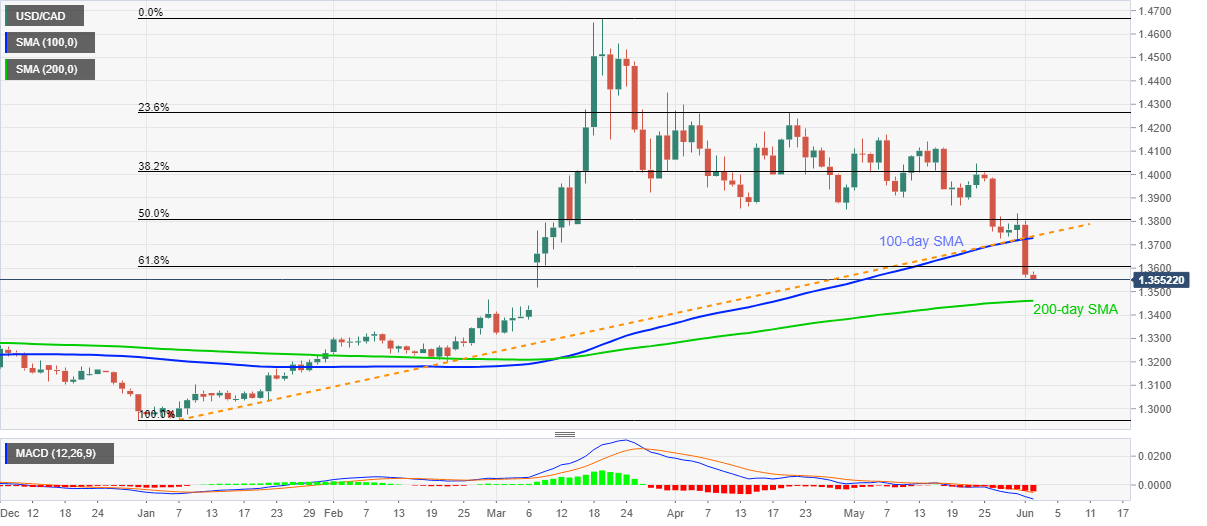

USD/CAD Price Analysis: Bears cheer break of key support below 1.3600

- USD/CAD drops to three-month low, under 61.8% Fibonacci retracement.

- 200-day SMA, February month’s high on the sellers’ radar.

- Buyers will refrain entries unless regaining the 1.3730/35 support-turned-resistance.

USD/CAD extends the previous day’s heavy fall to 1.3553, down 0.13% on a day, amid the initial Asian session on Tuesday. In addition to the pair’s declines below 100-day SMA and an ascending trend line from the early-March, sustain trading below 61.8% Fibonacci retracement of December 2019 to March 2020 upside also portrays the bears’ dominance.

With that in the backdrop, sellers are targeting a confluence of 200-day SMA and February month high, around 1.3465/60 during the further downside.

However, the quote’s additional weakness under 1.3460 makes it vulnerable to visit February 10 high near 1.3330.

Alternatively, a daily closing beyond 61.8% Fibonacci retracement near 1.3610 could trigger the pair’s fresh recovery towards the support-turned-resistance area of 1.3730/35.

Even so, 50% Fibonacci retracement and April month’s low, respectively around 1.3810 and 1.3850, could keep the tab on buyers.

USD/CAD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.