USD/CAD firms within bearish weekly correction

- USD/CAD bulls move in as US dollar firms.

- US oil and BoC sentiment supporting the CAD, but weekly technicals remain bullish.

At the time of writing, USD/CAD is trading at 1.2575 and u slightly by 0.14% after climbing from a low of 1.2529 and reaching a high of 1.2594. On Monday, the pair touched a five-month low at 1.2807.

The US dollar is firmer on Thursday after dovish guidance from the European Central Bank helped.

The ECB has pledged to keep interest rates at record lows for even longer as the central bank warns that the Delta variant of the novel coronavirus posed a risk to the euro zone's recovery.

DXY is trading just below 93 after trading yesterday at the highest level since April 1 near 93.191. At the time of writing, the index is 0.13% higher at 92.89 and has travelled between a low of 92.507 and a high of 92.923. Further gains are expected and it could eventually test the March 31 high near 93.437.

Meanwhile, the price of oil remains bid and a supportive factor for the CAD.

Expectations of tighter supplies until the end of the year has helped oil to recover from the 8% drop in WTI from the start of the week.

US crude prices were up 1.9% at $71.57 a barrel.

In domestic data, a preliminary estimate from Statistics Canada showed that manufacturing sales rose 1.9% in June, led by the transportation equipment industry.

Looking ahead, markets will be monitoring the Canadian Retail Sales report for May this coming Friday, which could offer further clues on the strength of the domestic economy.

As for positioning, the latest CFTC data has shown that speculative positioning on CAD remained – even after the recent USD strength - considerably skewed towards the net-long area (+20% of open interest), and above its 1-standard-deviation band.

The BoC recently delivered a broadly upbeat message on the recovery and left its forward guidance for 2H22 unchanged which has supported the currency.

The central bank is expected to end asset purchases by the end of 2021, allowing markets to speculate on an earlier than projected hike.

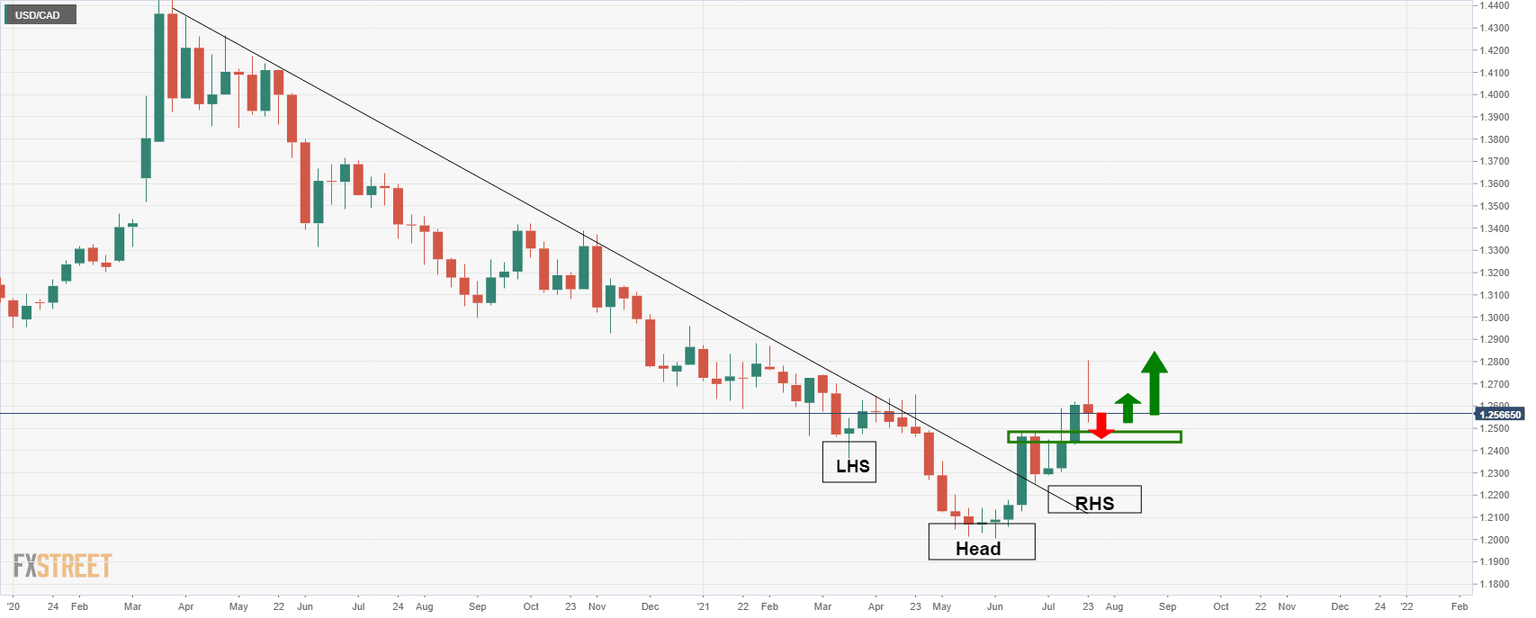

USD/CAD technical analysis

Contrary to the BoC fundamentals, the technical outlook is telling a different story.

The bullish reverse head & shoulders should be noted on the weekly time frame following the break of the dynamic trendline resistance.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.