US Stocks Weekly Forecast: GME hearing, CCIV merger and new records

- Major US stock market indices keep making all-time record highs.

- Alternatives to ETFs and equities in a negative interest rate environment are few.

- Inflation concerns are growing around the world, strengthening the bullish outlook for stocks.

- Corporate earnings continue to impress, beating most expectations.

Stock markets continued their broadly positive tone last week with most indices ending in positive territory. The rally struggled for momentum as the week wore on with profit-taking ahead of the long weekend setting in. The major US indices, Dow, S&P and Nasdaq all hit record highs last week as money continued to pour into ETFs. Bank of America reported record ETF inflows of $58.1 billion according to Bloomberg. The alternatives in a negative rate environment are few and with continued records in stocks, it appears that institutional investors are also suffering from FOMO (fear of missing out) trading.

US stock news: Inflation is back

The dollar suffered last week despite inflation concerns inching their way back into traders' minds. US yields had risen last week but doveish comments from multiple Fed officials, mediocre employment data, and further stimulus-related money supply all hit the dollar.

Oil prices continued to strengthen as the equity-induced economic recovery story continues to push commodity prices higher. Energy stocks have been one of the stock market's strongest performers in 2021.

While US CPI last week was reasonably subdued, yields on the US 10 year hit yearly highs Wednesday and again on Friday. Inflation concerns have also started bubbling in other parts of the world with Chinese factory gate prices rising and UK inflation picking up sharply in December.

Central Banks and governments around the world will likely accept some rise in inflation as they look to reboot economies. The Fed has already stated its 2% inflation target is not set in stone.

Inflation data this week will therefore garner more than its usual attention. US PPI on Wednesday will give a lead as to future CPI developments and should be watched closely.

Vaccine recovery hopes

Recent reports from the UK on opening the economy sooner than expected have played into the global recovery theme. Influential members of the Conservative government have demanded a sharp opening of the economy by April. Separately both the US and EU agreed increased vaccine deals with Modena, Pfizer, and AstraZeneca respectively, further aiding hopes for a summer 2021 return to economic normality. While this may seem optimistic investors have little alternative to stocks in the current environment.

Earnings continue to impress

Corporate results continue to largely outperform. So far this year the tech sector has strongly beaten analyst estimates with Facebook, Google, Apple, Netflix all stunning analysts. That trend appears not to be diminishing with last week seeing GM, Coca-Cola, Pepsi, Kraft Heinz, Disney, Twitter, Uber, and UnderArmour all impressing.

This week sees the earnings season slow down but we still have some big names to keep an eye on. Walmart, AIG, Roku, Applied materials, and Deere all announce this week. Travel and Leisure are set to be in focus as the covid wracked industry sees Hilton, Marriott, TripAdvisor, Norwegian Cruise all release earnings this week. Results will understandably be poor and investors will focus on who is managing cash burn and future outlook rather than on past results.

We are still talking about stimulus

Investors are still focusing on just how much stimulus the US government is going to pump into the economy. The dollar has been weakening on the assumption that the figure will largely be higher than expected as Democrats look to go it alone in pursuing a bill through. Initial fears of a watering down of the stimulus to nearer $1 billion to appease Republicans and some Democrats appear to have waned.

The Gamestop debate

Is likely to rage on as representatives from Robinhood, Melvin Capital, and Citadel are to testify before a House Financial Services Committee on Thursday. Gamestop and related retail stocks continue to suffer as the retail trade wears out and switches attention to other sectors, leaving a trail of recriminations in its wake. Other stocks have been taking up the slack left in the Gamestop wake. CCIV has been the subject of retail attention as merger rumours with Lucid Motors continue to swirl on social media.

Noted Earnings for the week ahead

2021-02-16 After Market Close American International Gr

2021-02-18 After Market Close Applied Materials

2021-02-16 Before Market Open AutoNation

2021-02-18 Before Market Open Barclays

2021-02-17 After Market Close Baidu

2021-02-17 After Market Close Banco Macro

2021-02-18 After Market Close BanColombia

2021-02-18 Before Market Open Credit Suisse Group

2021-02-16 Before Market Open CVS Health

2021-02-17 After Market Close Cosan

2021-02-19 Before Market Open Deere

2021-02-16 Before Market Open General Mills

2021-02-18 Before Market Open Walmart

Economic releases (see all)

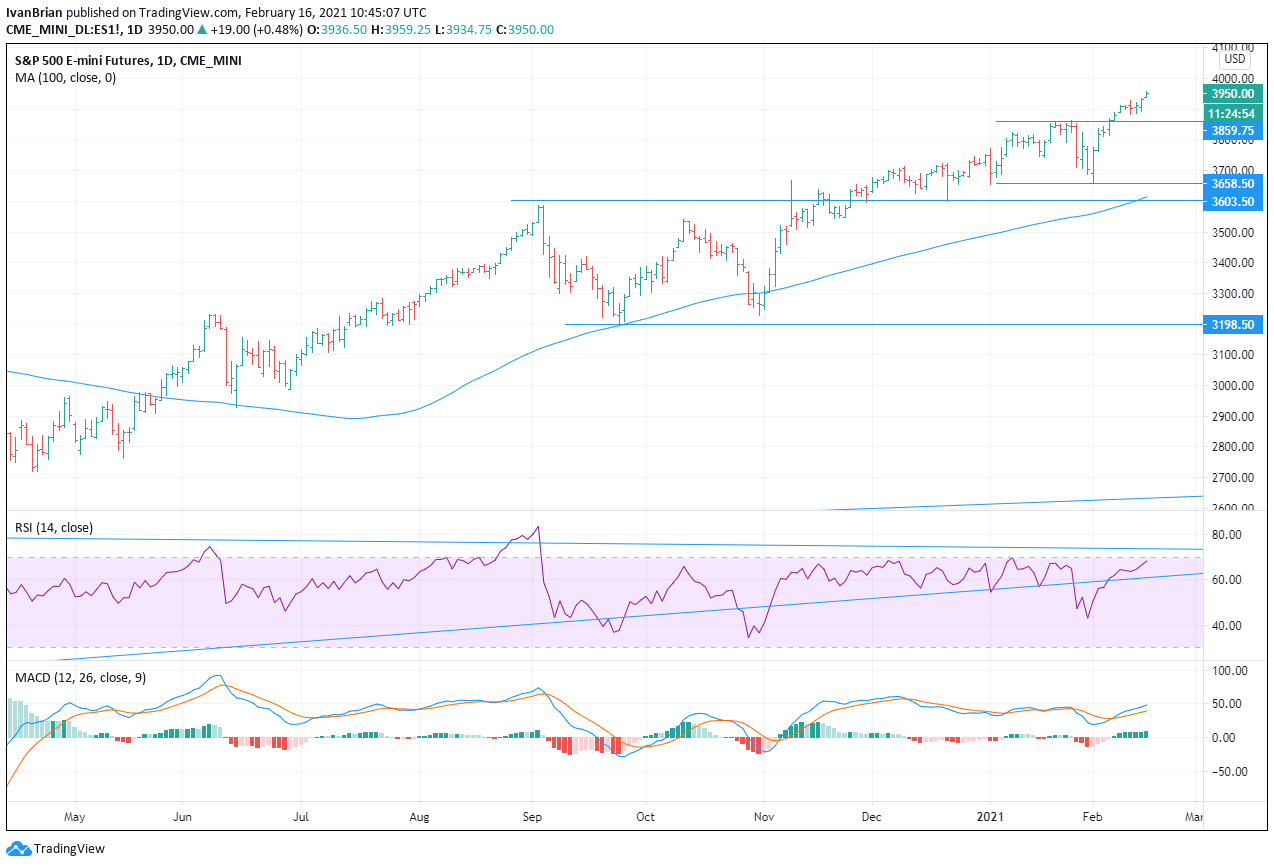

S&P 500 technical analysis

Clearly, the S&P 500 bullish trend remains in place with the classic series of higher highs and lows. The recently sideways pattern may have been a cause for concern but thankfully, the S&P 500 has broken out to the upside giving further credence to the bullish trend. In this respect, support at 3860 is first support, with 3656 (Feb 1 low) below the key support to the short-term bullish trend. Longer-term, the bullish trend is held by support at 3198 – the last significant low.

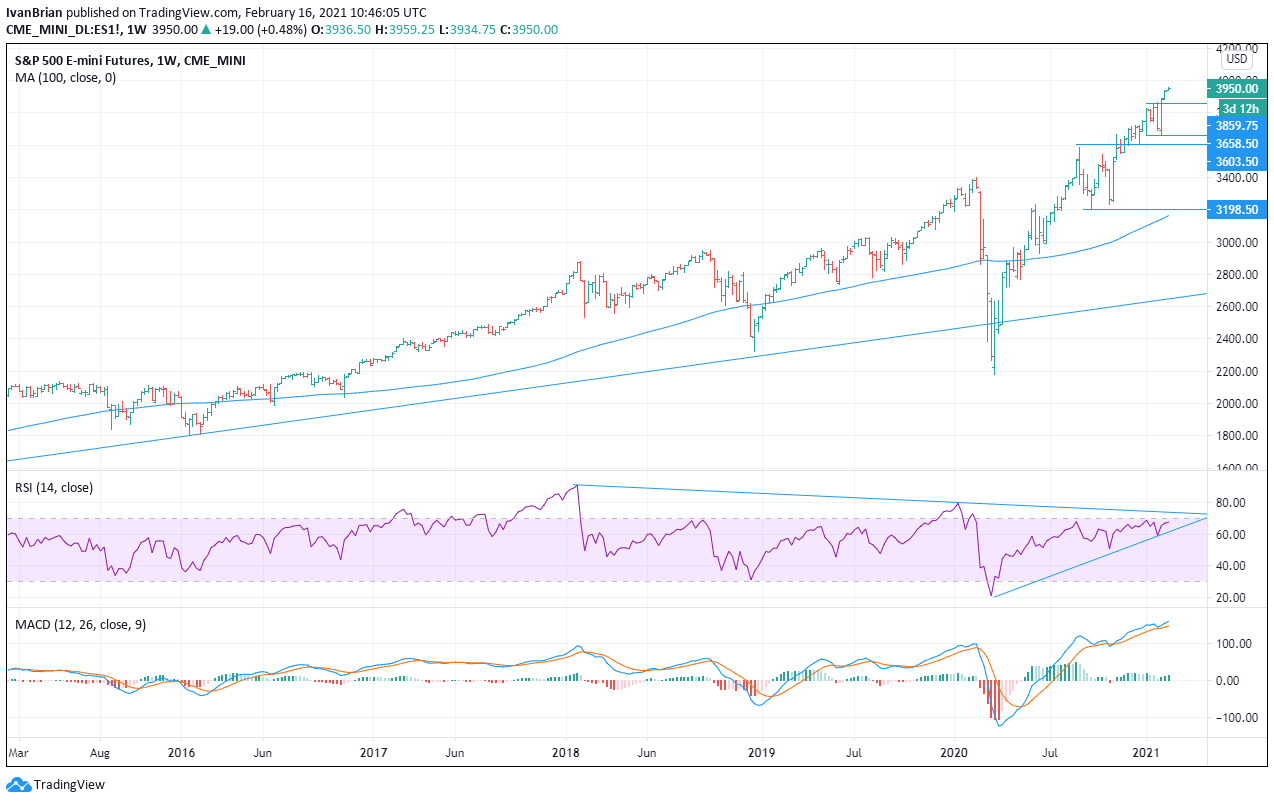

On the longer-term chart, you can see the significance of this 3198 support, holding the bullish trend from the March 2020 lows in place. The RSI is trending lower but not in overbought range.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637490042386365235.png&w=1536&q=95)