US stock markets to open higher as shaky ceasefire continues risk-on sentiment

- President Trump touts ceasefire between Iran and Israel on Tuesday.

- US equity futures rise but pull back moderately after shaky ceasefire.

- Oil trades sharply lower as markets predict end to Israel-Iran conflict.

- Market focus switches to Powell testimony in front of Congress.

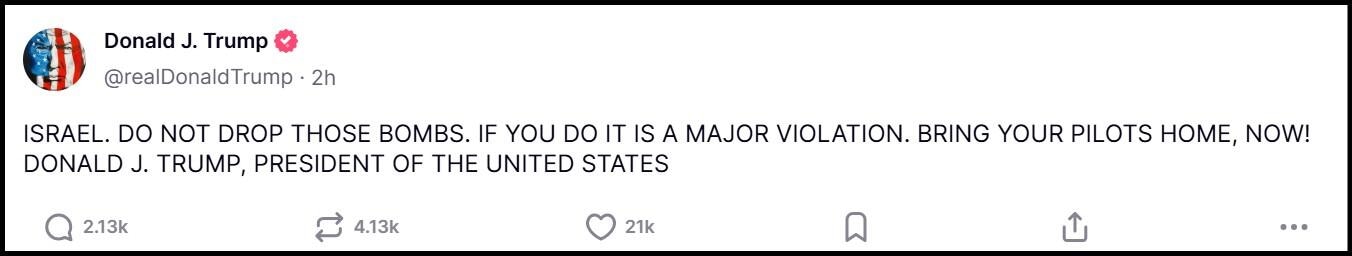

US President Donald Trump touted a ceasefire between Israel and Iran late Monday that markets expect will take hold on Tuesday despite further missile barrages continuing over the subsequent hours. Trump seemed to admit that both sides were in danger of scuttling the deal to end the so-called 12-Day War, but again confirmed that the ceasefire was in place on Tuesday morning.

President Trump's Truth Social Account June 24, 2025

The equity futures market rose more than 1% on Tuesday morning before tempering that rally a bit on news that certain hostilities might continue on Tuesday. Israel said it took out one of Iran's radar systems following an Iranian missile barrage. But WTI Oil fell another 3.8% to $65.90 after starting the week above $73.00, another piece of good news for the US economy.

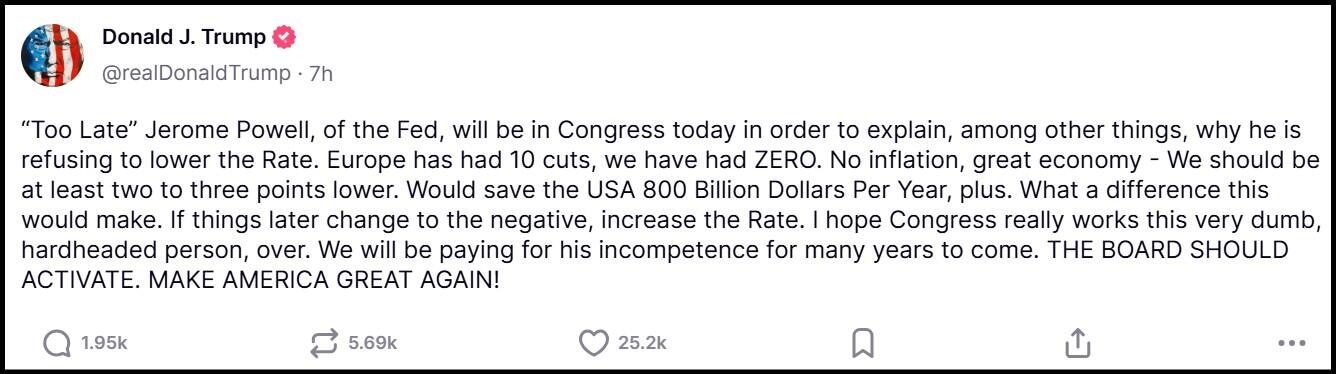

The focus now turns to Congressional testimony from Federal Reserve (Fed) Chair Jerome Powell. Powell is expected to face questioning as to why he hasn't favored trimming interest rates so far this year, particularly from Republicans. President Trump posted a screed against Powell overnight on his Truth Social platform.

President Trump's Truth Social Account June 24, 2025

Powell is of course wary of Trump's tariff policies causing inflation and wants to wait until the central bank is certain that the inflationary pressure is temporary. But recent reports of sharply lower inflation have led two Fed governors to call for cuts as soon as the July meeting, something that Powell will surely have to respond to in Congressional testimony.

NASDAQ 100, S&P 500, Dow Jones futures 1-minute chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.