US inflation expectations retreat from monthly high

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, ease from the monthly high by the end of Wednesday’s North American session. The inflation gauge recently flashed the 2.38% mark, reversing from the previous day’s multi-day of 2.39%.

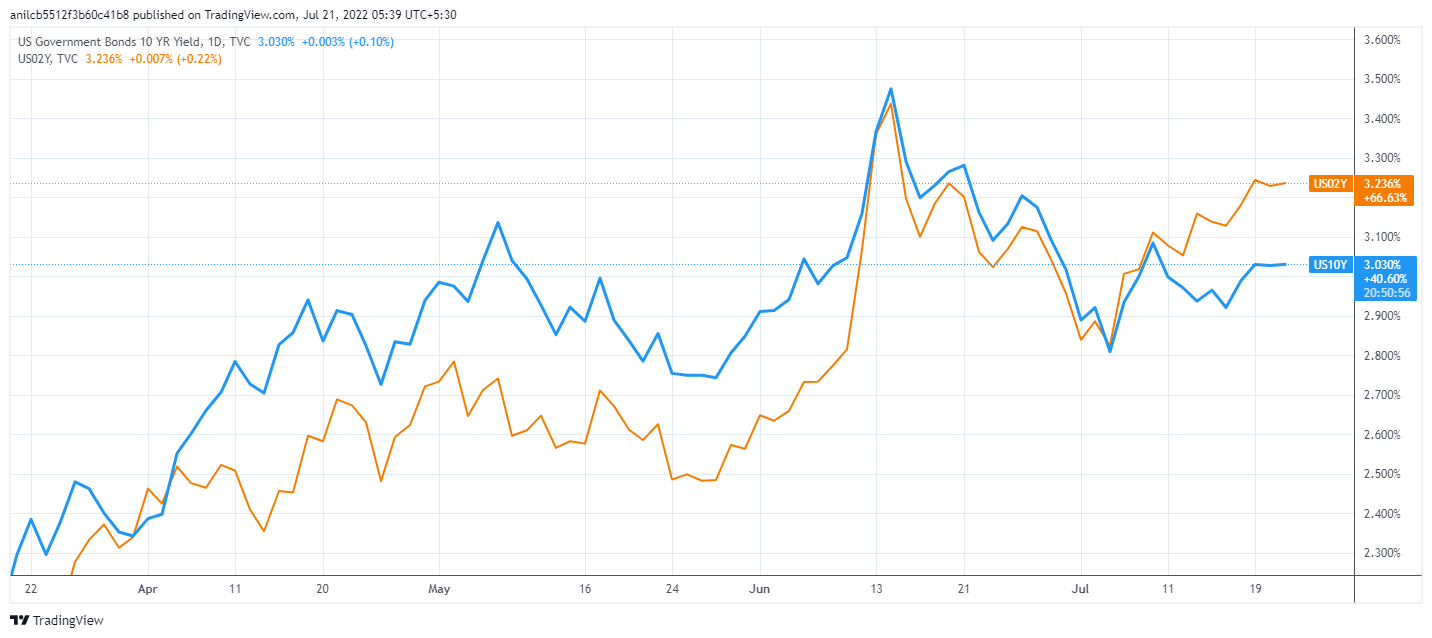

The recent weakness in the US inflation expectations failed to defy the recession fears, signaled by the inversion of the 2-year and the 10-year Treasury yield curve. That said, the US 2-year Treasury yields are higher, around 3.23%, while the 10-year bond coupon seesaws near 3.03% at the latest.

Overall, the inflation expectations are in recovery mode and appear to weigh on the market sentiment, which can help the US dollar regain its upside momentum after a week of a pullback from a nearly 20-year high.

It’s worth noting that the US Dollar Index (DXY) bounced off a two-week low to snap the three-day downtrend the previous day as market sentiment soured.

Also read: Forex Today: Sentiment sours amid recession fears and ahead of the ECB

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.