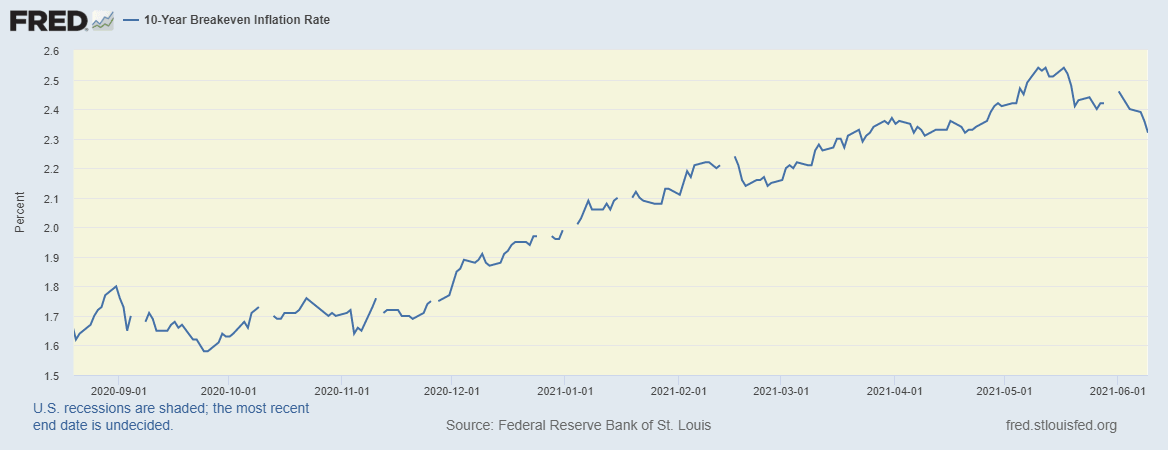

US inflation expectations drop to seven-week low ahead of CPI release

US inflation expectations, as measured by the 10-year breakeven inflation rate, per the St. Louis Federal Reserve (FRED) data, print a six-day downtrend by the end of Wednesday’s forecasts. In doing so, the inflation precursor slumps to the lowest since April 20.

The FRED forecasts point towards a softer inflation figure while posting a 2.32% mark. However, the early signals for price pressure have been stronger and highlight reflation risk for the world’s largest economy, which in turn challenges the Fed’s easy money policies.

The same help the US dollar index (DXY) to consolidate losses since late May, around 90.14 by the press time, due to its safe-haven appeal.

It’s worth noting that the US 10-year Treasury yields also track the inflation expectations and recently dropped to the three-month low near 1.48%.

That said, prices of gold remain pressured while silver marks a subdued performance of late.

Looking forward, the US CPI need not cross the upbeat market forecasts to keep the traders hopeful ahead of the next week’s Federal Open Market Committee (FOMC) meeting.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.