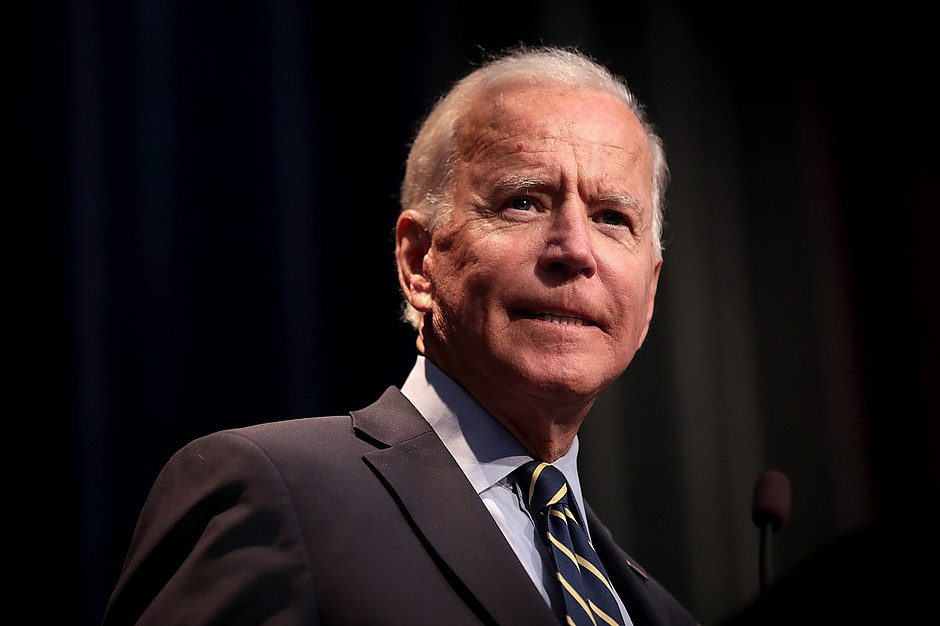

US Elections: Biden-victory to weaken USD – Nordea

Many market participants feared volatility around the first presidential debate due to the risk of a Biden meltdown, but such fears were unfounded. Biden performed much better than feared and markets remained calm throughout the debate. Economists at Nordea expect a Biden-victory and a risk asset rally, including a weaker USD, after the election.

See: Presidential Debate: Stocks set to suffer on Trump's refusal to accept the results

Key quotes

“The first presidential debate did not lead to material market moves as fears of a Biden meltdown were proven unfounded. Biden performed (much) better than feared by many and was never close to a ‘melt-down’ as some market participants saw a risk-off. All debate on whether Biden is mentally healthy should rightfully end after tonight, but it probably won’t.”

“It is still clear when watching the debate, that Trump gains the most from 1-to-1 debates against Biden. Biden struggles to bite back fully when Trump bullies and constantly interrupts, while Biden performs better when Trump allows him to speak freely. The three planned debates between Trump and Biden will likely work to ‘tighten the gap’ in opinion polls, but we still don’t think the momentum will be big enough to tilt the current Biden lead in polls.”

“Should Biden win, it would be good news for markets outside of the US, and we would expect both a weaker USD and a relative outperformance of assets in the rest of the world versus the US. The direct effect on US equities is a bit more mixed as the risk of a corporate tax increase could lead to some profit-taking on the back of a Biden victory.”

“What is good for Donald is on the other hand good for the USD, probably mostly due to his foreign policy mix. The most recent resurgence in Trump’s approval ratings is hence another one to watch for the USD over the coming month. Trump's trade policy has been the main culprit behind the strong USD during his era as trade flows have been subdued, which leads to a less good access to USD liquidity for markets outside of US borders. Biden’s less aggressive trade policy will hence likely be reflected via an improving access to USD liquidity for Emerging Markets in particular, why the suffering EM currencies and markets should be on the receiving end of inflows in case of a Biden victory.”

Author

FXStreet Team

FXStreet