US Dollar downs as markets asses labor market data and Fed official's signals

- The US DXY index falls below 106.50 amid trade optimism.

- Trump signals potential easing of China tariffs before April deadline.

- US Jobless Claims disappoint, rising above market expectations.

- Fed officials voice concerns over inflation risks and economic outlook.

The US Dollar Index (DXY), which tracks the US Dollar’s (USD) performance against six major currencies, extends its decline on Thursday, slipping near 106.30. The pullback follows United States (US) President Donald Trump’s announcement of potential progress on a trade deal with China, offering markets a temporary reprieve from tariff concerns. Despite this relief, weak US jobless claims data and mixed Federal Reserve (Fed) commentary keep traders cautious.

Daily digest market movers: US Dollar softens amid trade optimism and weak data

- US President Donald Trump suggests a trade deal with China could be reached before April, easing tariff concerns.

- Initial Jobless Claims for the week ending February 14 rose to 219,000, missing expectations of 215,000.

- Continuing Jobless Claims increase to 1.869 million, slightly below the forecast of 1.87 million.

- Philadelphia Fed Manufacturing Survey for February hits 18.1, below the 20 forecast and down from 44.3 in January.

- St. Louis Fed President Alberto Musalem warns of potential stagflation risks and rising inflation expectations.

- Atlanta Fed President Raphael Bostic maintains the possibility of two rate cuts this year, depending on economic developments.

- The Fed sentiment index remains fairly neutral but in hawkish terrain which might limit the downside.

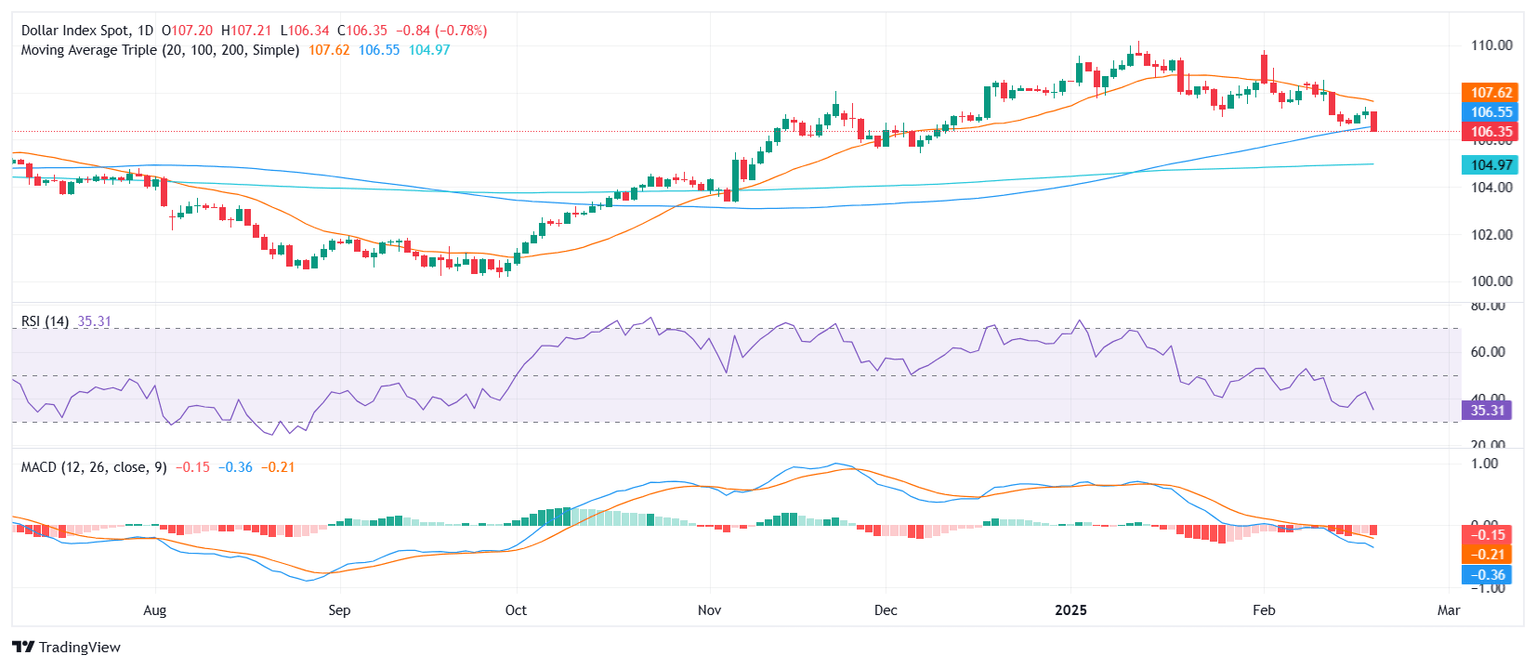

DXY technical outlook: Bears keep control as downside pressure builds

The US Dollar Index remains under pressure after falling below 106.50, with bearish momentum gaining traction. The index struggles to reclaim the 20-day Simple Moving Average (SMA), signaling continued weakness. Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain entrenched in negative territory, suggesting persistent downside pressure. A decisive drop below the 100-day SMA at 106.30 could signal a further bearish breakout, with 106.00 emerging as the next significant support level. Bulls need to reclaim the 107.50 resistance zone to shift momentum in their favor.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.