US Dollar retreats to below104.00 in the DXY after ECB's Lagarde issues warnings on volatile period ahead

- The US Dollar remains stuck on the backfoot and is unable to recover against the major peers.

- ECB's Lagarde props up concerns by saying the ECB will need to be vigilent and fast to act under any circumstances.

- The US Dollar Index lost already over 3% of its value so far this week.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is residing below the 104.00 marker this Thursday in a week filled with turmoil. Besides warning signs from the European Central Bank (ECB), several banks and traders are reporting that big clients are repatriating their foreign investments denominated in US Dollars back into their domestic currencies. This might mean such volumes will not come back anytime soon, the FT reports.

The repatriation comes after weakening US economic data which has worried markets about the possibility of Trump’s tariffs having an impact on domestic inflation and has brought back firm recession fears this week. Clearly, United States (US) President Donald Trump’s approach is starting to have some negative fallout.

Meanwhile, the focus will now shift to Europe where a high-stakes European meeting is taking place this Thursday. EU leaders will discuss the spending bill on defense after Trump made clear the US will no longer be playing an active part in NATO. US support to Ukraine has been rolled back by now as well. The European Central Bank (ECB) has lowered its policy rate by 25 basis points as expected, though changed the language of its statement to a bit more hawkish.

Daily digest market movers: Lagarde keeps DXY on the downside

- The US Challenger Job Cuts were due for February. A very negative number with a surge by more than 100% to 172,017 head counts compared to 49,795 last month.

- The European Central Bank (ECB) has released its monetary policy decision. As expectated, an interest rate cut by 25 basis points (bps) from 2.75% to 2.50% on its benchmark deposit rate.The ECB revised its inflation outlook to 2.3% for 2025 against 2.1% initially.

- The US weekly Jobless Claims and US Trade Balance data for January has been released:

- Initial claims for the week ending on February 28 came in at 221,000, stronger than the expected 235,000 and lower than last week’s print of 242,000. Continuing Claims for the week ending on February 21 came in higher at 1,897 million, a miss on the 1.880 million expected and from the previous 1.862 million.

- The US Goods Trade Balance for January saw a wider deficit by $156.8 billion, a big miss on the $127.4 billion deficit expected, coming from a $153.3 billion deficit in December.

- ECB Chairman Christine Lagarde is still speaking at the time or writing. ECB's Lagarde issues quite a few warning on the current change in trading regime and that the ECB will need to be vigilant in these very uncertain and unclear times. The ECB Chariman reiterates that the ECB now, even more than during the Covid and post-Covid era, will be data dependent than ever.

- Equities are falling further after ECB's Lagarde's statements are not revealing a positive outlook for the markets on what's to come.

- The CME Fedwatch Tool projects a 79,6% chance of an interest rate cut in the June meeting, with only a 20.4% chance to keep interest rates at the current range of 4.25%-4.50% in June.

- The US 10-year yield trades around 4.28%, off its near five-month low of 4.10% printed on Tuesday.

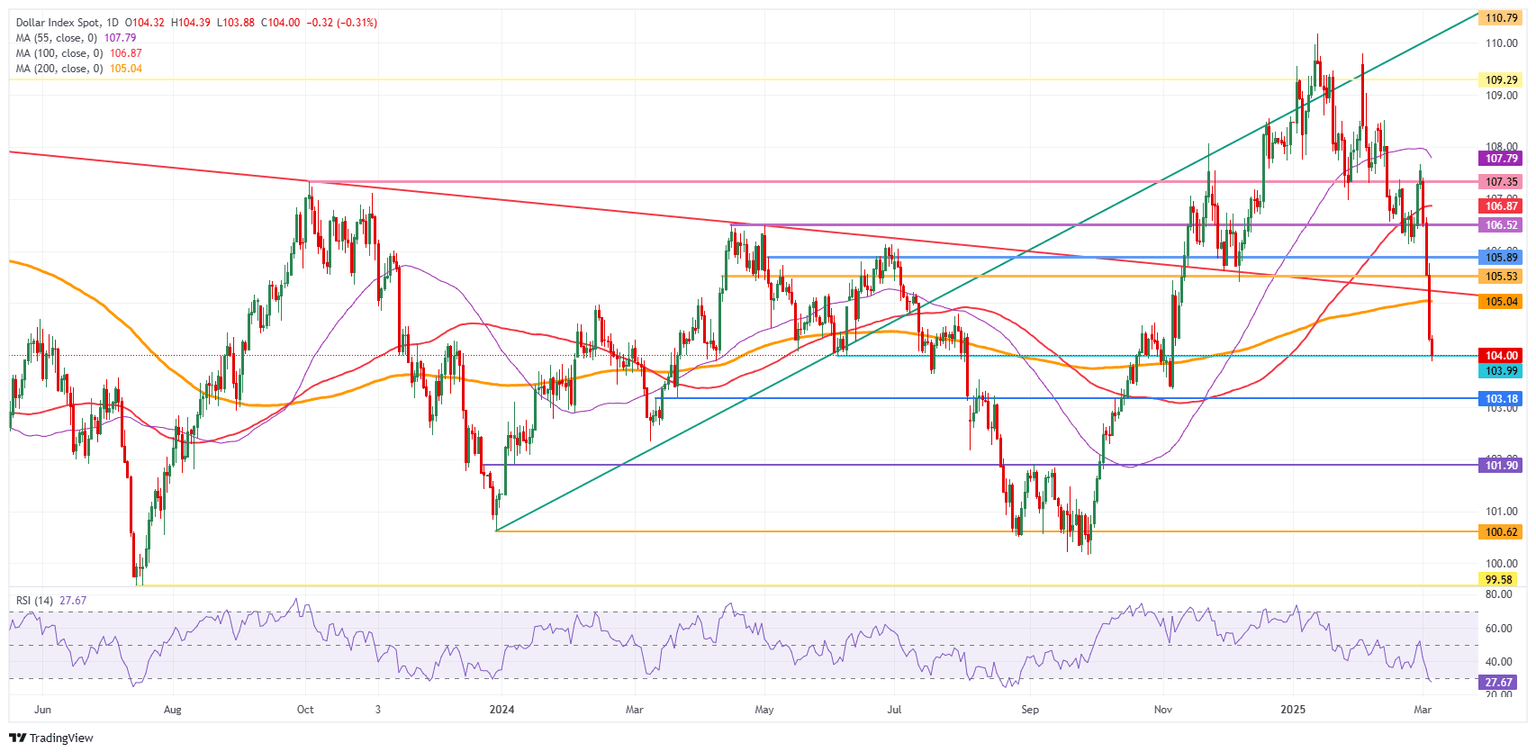

US Dollar Index Technical Analysis: Just a flavor

The US Dollar Index (DXY) is bleeding this week, and the reason for the outflows is worrisome. Several trading desks report that many European pension funds, hedge funds, and other big institutions are repatriating their US Dollar-denominated assets back to their domestic currencies. That means a substantial volume parked for years under the US Dollar has now been moved and does not seem to be coming back anytime soon as long these recession fears will still take place.

On the upside, the first upside target is to recover the 200-day Simple Moving Average (SMA) at 105.04. Once that level has been recovered, several near-term resistances are lined up, with 105.53 and 105.89 identified as two heavy pivotal levels before breaking back above 106.00.

On the downside, 104.00 has seen selling pressure but tries to hold for now. Further down, 103.00 could be considered as a bearish target in case US yields roll off again, with even 101.90 not unthinkable if markets further capitulate on their long-term US Dollar holdings.

US Dollar Index: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.