US Dollar flat while Nasdaq tanks over 3% lower in recession rout

- The US Dollar muted while the Nasdaq faces 3.3% losses ahead of the opening bell.

- Fed Chairman Powell left comments on Friday that the central bank does not need to make any move right now.

- The US Dollar Index hangs on to 103.50 while traers have concerns on the value of the Greenback.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is staying put at current levels around 103.75 while being unaffected by the current market rout that is taking place. Traders are sending US equities lower while mulling the recent comments from United States (US) President Donald Trump, who commented on the US economy during a Fox News interview over the weekend. The President said the US economy is in a transition period, which comes with a little bit of pain, whilst markets in recent days have questioned if the US economy is not in a recession.

On the economic data front, the focus for this week will be the Consumer Price Index (CPI) data for February on Wednesday. Besides that, it will be a very quiet week on the Federal Reserve (Fed) front as the central bank has started its blackout period ahead of the March 19 meeting.

Traders got to hear from Fed Chairman Jerome Powell on Friday evening. Powell said that the Fed does not need to do anything at this very moment while monitoring incoming data. He also acknowledged the rising economic uncertainties in the US but said they do not need to rush to adjust policy.

Daily digest market movers: Correction ahead

- It is a very calm start to the week with a near-empty economic calendar. Only the US Treasury will auction a 3-month and a 6-month bill at 15:30 GMT.

- During a Fox News interview over the weekend, US President Donald Trump said the economy faced “a period of transition” as he pressed on with his focus on tariffs and federal job cuts, Bloomberg reports.

- Former Bank of Canada (BoC) and Bank of England (BoE) Governor Mark Carney has won the race to replace Justin Trudeau as the new Canada Prime Minister. The upcoming Prime Minister vowed to win the trade war with President Trump, CNN reported.

- Equities are correcting sharply on Monday after the US opening bell. The Nasdaq is leading the decline down 3.3% at the time of writing.

- The CME Fedwatch Tool projects a 63.0% chance of interest rates kept in the current range of 4.25%-4.50% in the May meeting. Probabilities of interest ates being lower in June stands at 85.8%.

- The US 10-year yield trades around 4.20%, off its near five-month low of 4.10% printed on Tuesday.

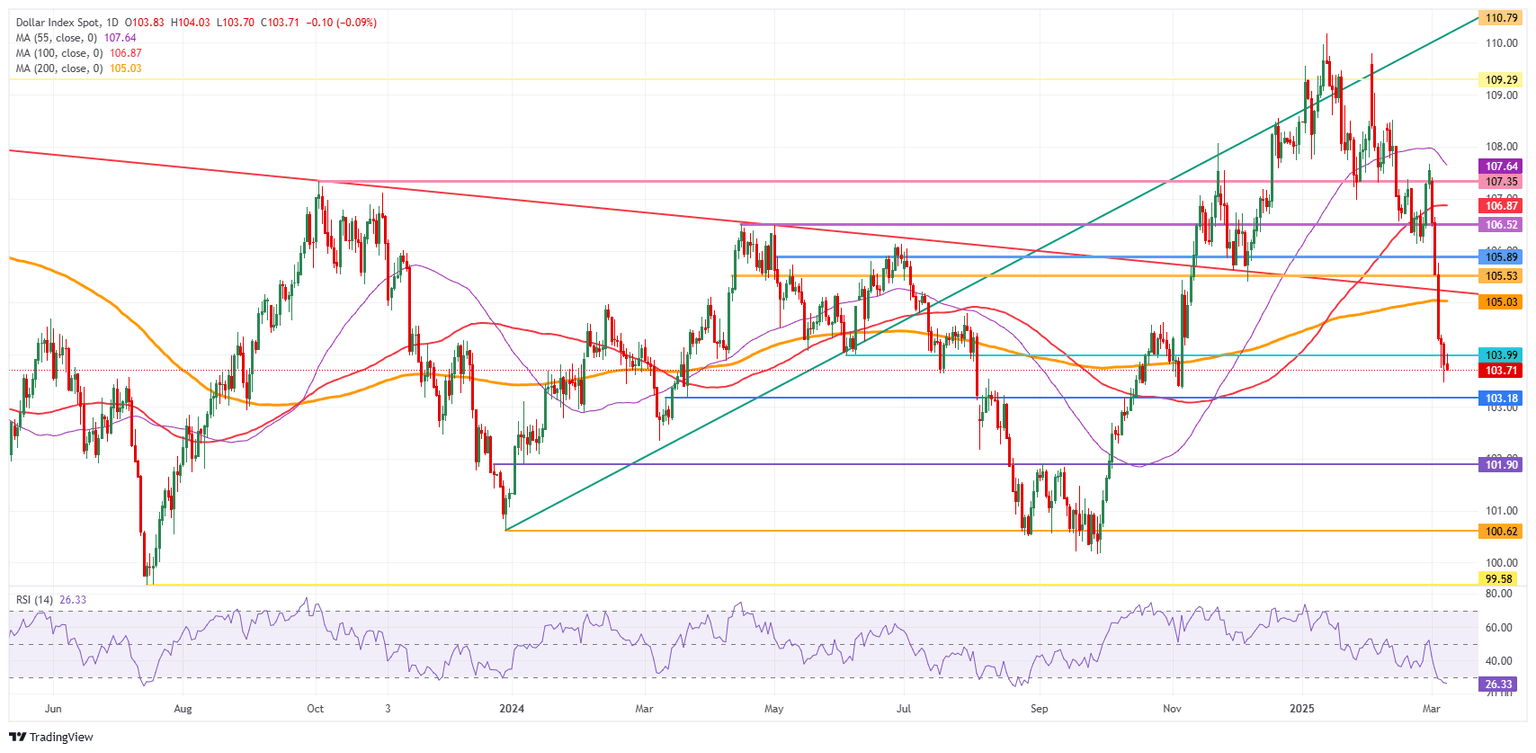

US Dollar Index Technical Analysis: Just a phase

The US Dollar Index (DXY) is under pressure and looks for direction on Monday after some headlines about US President Donald Trump over the weekend. Markets are still mulling whether the US economy is or will be in a recession as President Trump powers through with his tariffs and reciprocal levies by April. Should the US Consumer Price Index (CPI) data reveal a substantial resurgence in inflation later this week, recession fears would spark even more.

There is an upside risk at 104.00 for a firm rejection. If bulls can avoid that, look for a large sprint higher towards the 105.00 round level, with the 200-day Simple Moving Average (SMA) at 105.03. Once broken through that zone, a string of pivotal levels, such as 105.53 and 105.89, will present as caps.

On the downside, the 103.00 round level could be considered a bearish target in case US yields roll off again, with even 101.90 not unthinkable if markets further capitulate on their long-term US Dollar holdings.

US Dollar Index: Daily Chart

Nasdaq FAQs

The Nasdaq is a stock exchange based in the US that started out life as an electronic stock quotation machine. At first, the Nasdaq only provided quotations for over-the-counter (OTC) stocks but later it became an exchange too. By 1991, the Nasdaq had grown to account for 46% of the entire US securities’ market. In 1998, it became the first stock exchange in the US to provide online trading. The Nasdaq also produces several indices, the most comprehensive of which is the Nasdaq Composite representing all 2,500-plus stocks on the Nasdaq, and the Nasdaq 100.

The Nasdaq 100 is a large-cap index made up of 100 non-financial companies from the Nasdaq stock exchange. Although it only includes a fraction of the thousands of stocks in the Nasdaq, it accounts for over 90% of the movement. The influence of each company on the index is market-cap weighted. The Nasdaq 100 includes companies with a significant focus on technology although it also encompasses companies from other industries and from outside the US. The average annual return of the Nasdaq 100 has been 17.23% since 1986.

There are a number of ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer bets using Contracts for Difference (CFD). For longer-term investors, Exchange-Traded Funds (ETFs) trade like shares that mimic the movement of the index without the investor needing to buy all 100 constituent companies. An example ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow traders to speculate on the future direction of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

Many different factors drive the Nasdaq 100 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100 as it affects the cost of credit, on which many corporations are heavily reliant. As such the level of inflation can be a major driver too as well as other metrics which impact on the decisions of the Fed.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.