US Dollar swandives over Fed's Powell's comments but bulls are back in

- The US Dollar longs were cleared out on Fed chairman Powell.

- However, the drop in the greenback could be seen as a discount to the most bullish of the US Dollar bulls.

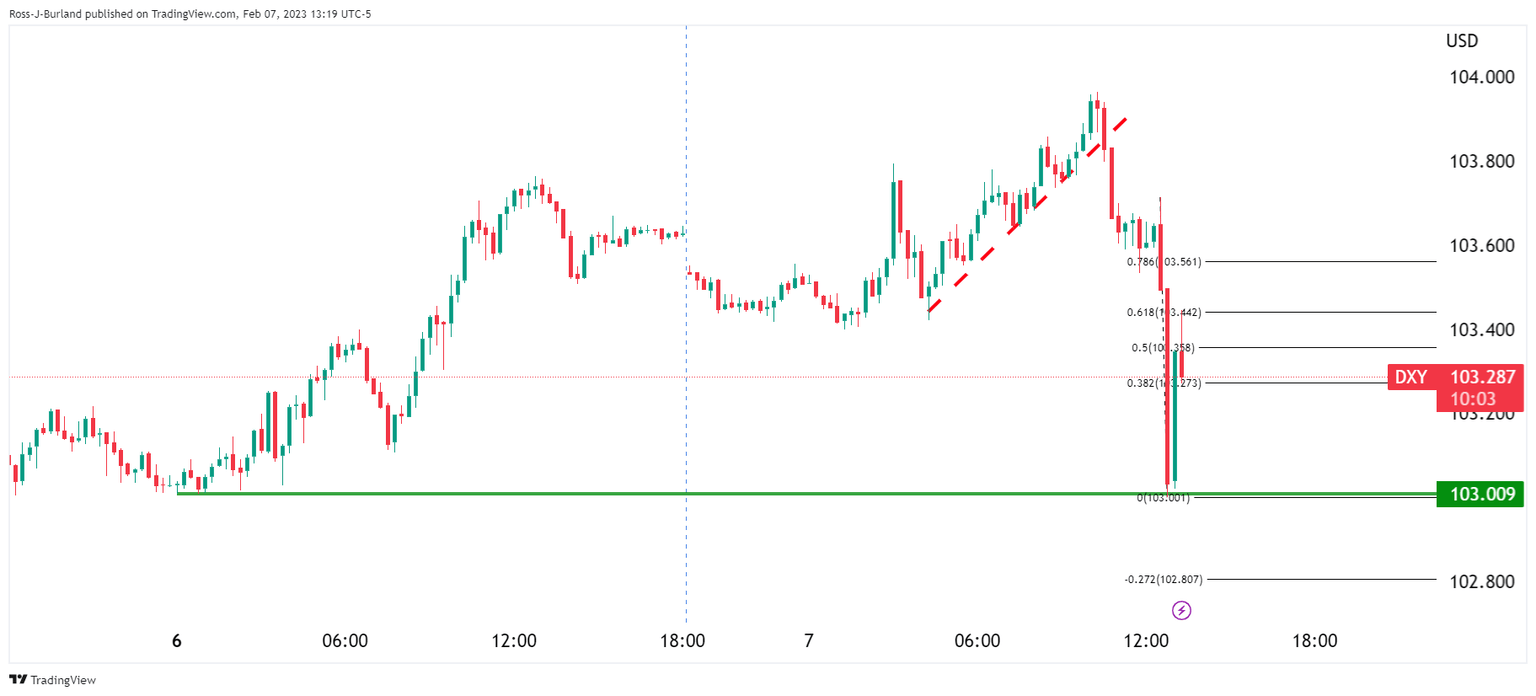

The US Dollar, as measured by the DXY index, fell from a high of 103.49 to a low of 103.001 after comments from Federal Reserve's Jerome Powell circulated the wires. Powell is speaking at The Economic Club of Washington, D.C. Signature Event and repeated much of the same as he did at the press conference that followed last week's interest rate decision.

Key comments

The jobs report was certainly stronger than anyone expected.

The strong jobs report shows you why we think this will be a process that takes a significant period of time.

Expect 2023 to be a year of significant declines in inflation.

We probably need to do further interest-rate increases.

If data were to continue to come in stronger than expect, would certainly raise rates more.

2% inflation is a global standard and not something the Fed is looking to change.

Fiscal authorities are concerned about the debt limit.

The debt limit debate can only end with congress raising it, which has to happen.

Congress needs to raise debt ceiling in timely fashion

If debt ceiling isnt raised no one should think fed can shield economy from effects.

I am not actively contemplating the sale of securities.

It will be a couple of years before the fed's balance-sheet decline comes to an end.

The US is ‘just at the beginning’ of the disinflation process.

Worries most about when disinflation will take hold in larger services sector, also concerned about outside events.

The US economy added 517K jobs in January, the most since July and much more than market expectations of 185K. Following the release of the Nonfarm Payrolls data on Friday, ISM services data pointed to a strong services sector, adding to concerns about persistent inflation and bolstering the case for more rate increases.

EUR/USD and US Dollar reactions

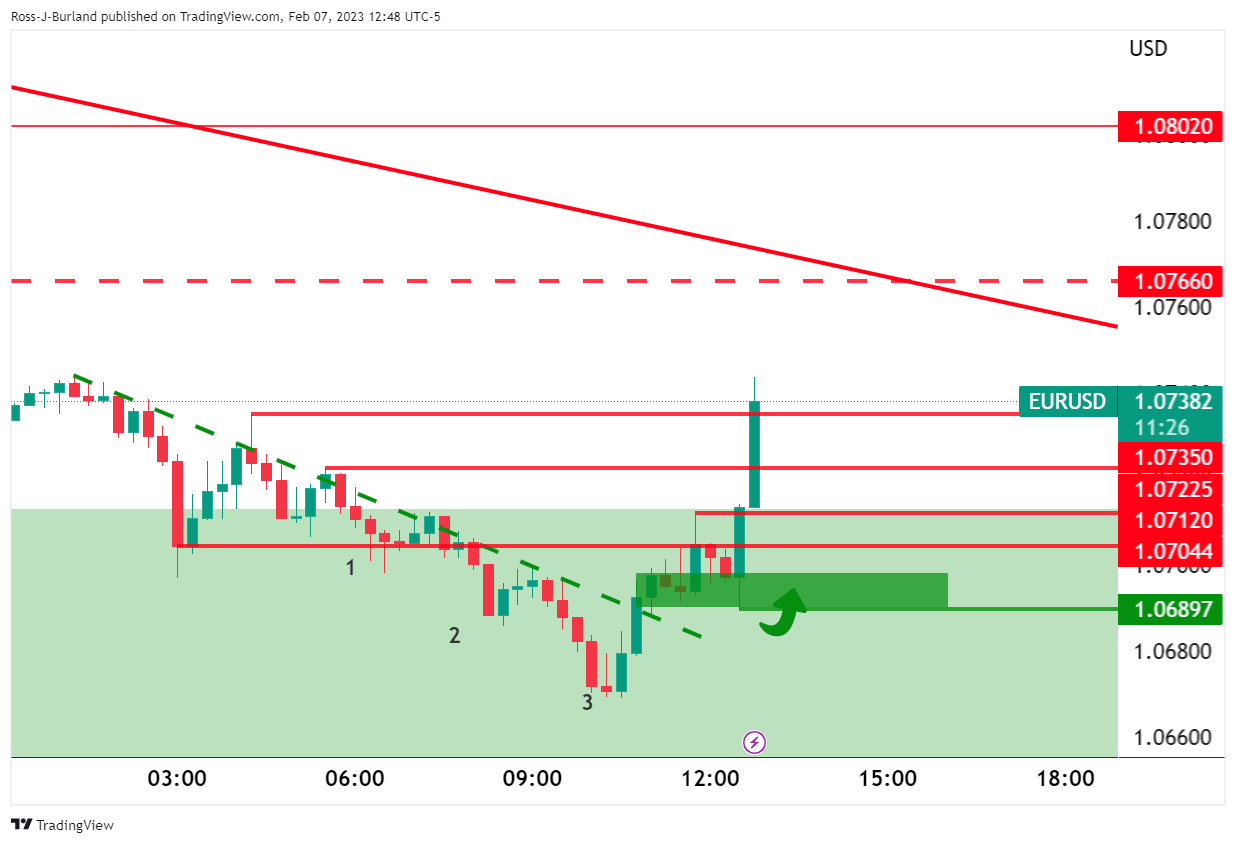

However, we have seen a shake out of the in-the-money US Dollar longs during this event with a rally in the Euro, for instance:

However, there was a bounce in the greenback in more recent moments during his comments which has sunk the Euro as risk appetite dwindled:

This is a 61.8% ratio retracement in the DXY index and a firm one at that with support at 103.00 holding steadfast. The longs were cleared out, but this could be seen as a discount to the most bullish of the US Dollar bulls.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.