US Dollar trims part of NPF-inspired losses, remains pressured

- The US Dollar recovered modestly after a discouraging Nonfarm Payrolls report sent it sub-104.00.

- The steady unemployment rate and the uptick in hourly wages have tempered the negative reaction on the USD.

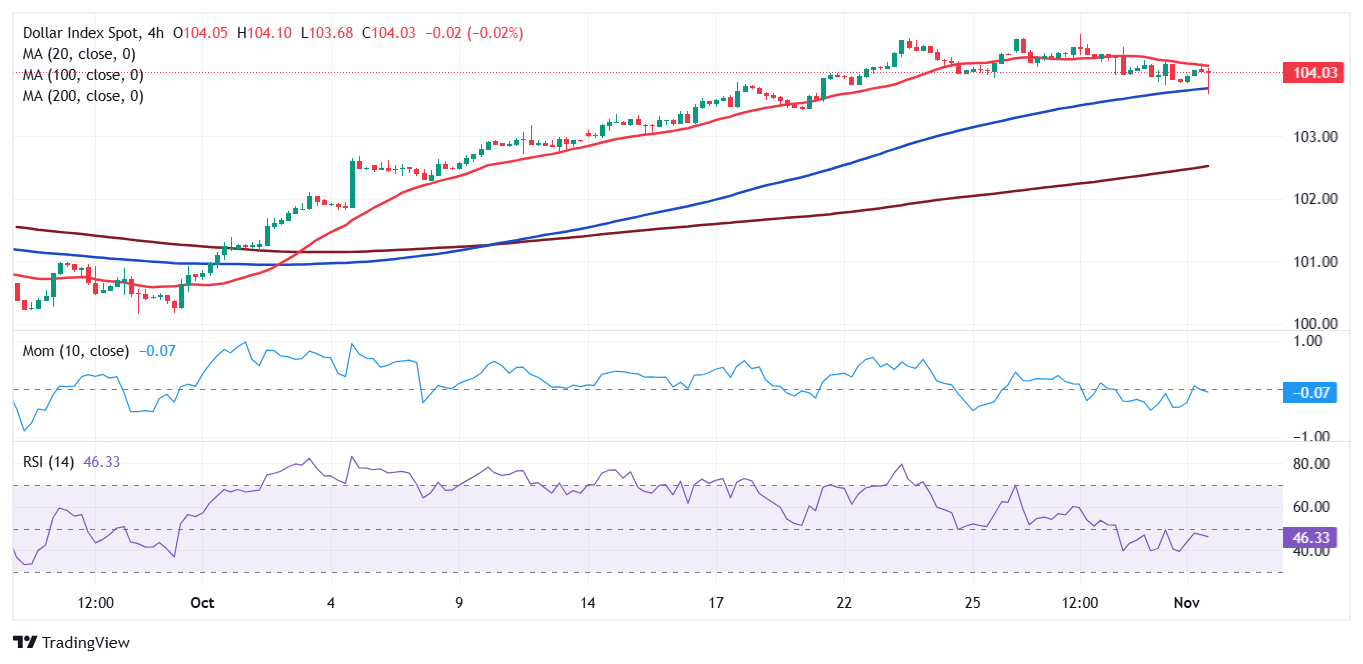

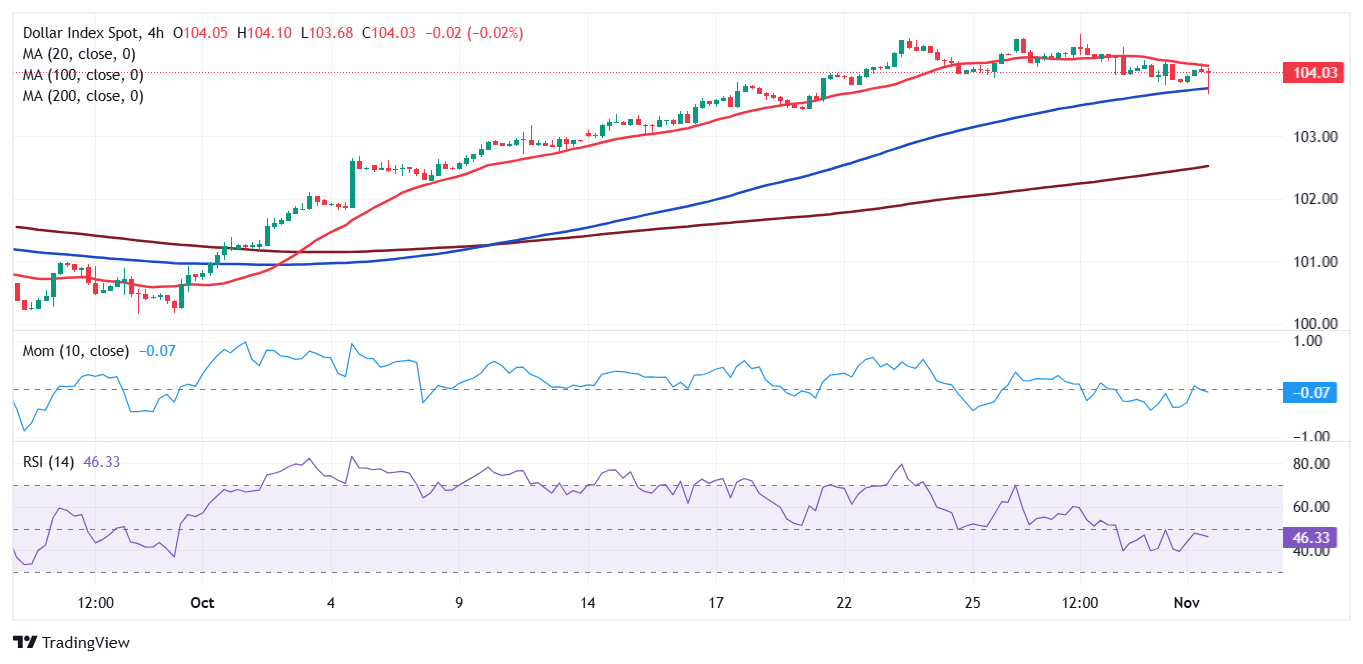

- The index bounced from an intraday low of 103.68, with technical indicators showing a growing bearish momentum.

The US Dollar Index (DXY) has regained 104.00 following Wall Street's opening after plummeting to 103.68 on a weaker-than-expected US Nonfarm Payrolls (NFP) report. The impact on the Dollar has been moderate, as the market has considered strikes and the hurricanes Helen and Milton in the final reading.

Nonfarm payrolls have posted their poorest performance since the pandemic, but the steady unemployment rate and the uptick in hourly earnings have offset investor's concerns about a sharp deterioration of the labour market.

Daily digest market movers: US Dollar ticks up with key US data on tap

- US Nonfarm payrolls have increased by 12K in October, well below the market expectations of 113K. September's reading has been revised to a 223K increase from the 254Kpreviously estimated.

- The negative impact of the headline reading has been tamed by the steady unemployment rate, which remains at 4.1%, and higher hourly earnings, which rose at a 0.3% pace from 0.2% in the previous month.

- The ISM Manufacturing Purchasing Managers Index (PMI) contracted by more than the 47.6 anticipated in October, printing at 46.5 and down from the 47.2 posted in September.

- Data from the CME Group Fed Watch tool reveals that markets remain almost fully pricing a 25 bps cut by the Federal Reserve (Fed) next week and an 85% chance of another 25 bps cut in December, up from 76% in the previous days.

- Investors’ bets that former President Donald Trump will win the US presidential election and implement an inflationary policy of low taxes, big spending, and tariffs on imports is providing additional support to the US Dollar.

DXY technical outlook: Buyers take their chances on dips

The DXY index hovers around 104.00, recovering further after the release of the ISM Manufacturing PMI.

The 4-hour chart shows it keeps trading below a mildly bearish 20 Simple Moving Average (SMA) while the 100 SMA provides intraday support around the daily low. Overall, the index is neutral-to-bearish as the Relative Strength Index (RSI) indicator aims marginally lower, just below its midline. The Momentum indicator develops a similar behaviour, but it is not enough to confirm the next directional movement.

Bears can retake control on a break below the daily low. Below here, the next target would be 103.40. To the upside, the index has some resistance at 104.20 ahead of the October peak at 104.63.

US Dollar Index 4-hour chart

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.