US Dollar pares losses, DXY holding near three-year lows

- Fears of a US recession amid a trade war with China hit the USD hard.

- Beijing announced on Friday retaliatory levies of 125% on US imports.

- The US Dollar Index fell to a three-year low of 99.02, bearish bias intact.

The US Dollar Index (DXY) bounced from a fresh three-year low of 99.02 achieved on Friday amid escalating tensions between China and the United States (US). The index currently hovers around 99.70, sharply down for a second consecutive day.

The DXY, a measure of the US Dollar (USD) against a basket of major currencies, fell in European morning trade on the back of headlines indicating China would retaliate against the latest White House levies announcement. On Thursday, the US confirmed tariffs on China at 145%, the 20% initially imposed, plus the 125% recently announced.

As a result, the Chinese Finance Ministry announced on Friday that the country will raise additional tariffs on US imports from 84% to 125%, starting April 12. The market sentiment plunged afterwards and pushed the DXY towards the aforementioned low.

Additionally, China's Commerce Ministry urged the US to take a big step forward in eliminating the so-called "reciprocal tariffs" and completely correct its wrong practices.

The sentiment soured on the news that revived speculation of a US recession being around the corner.

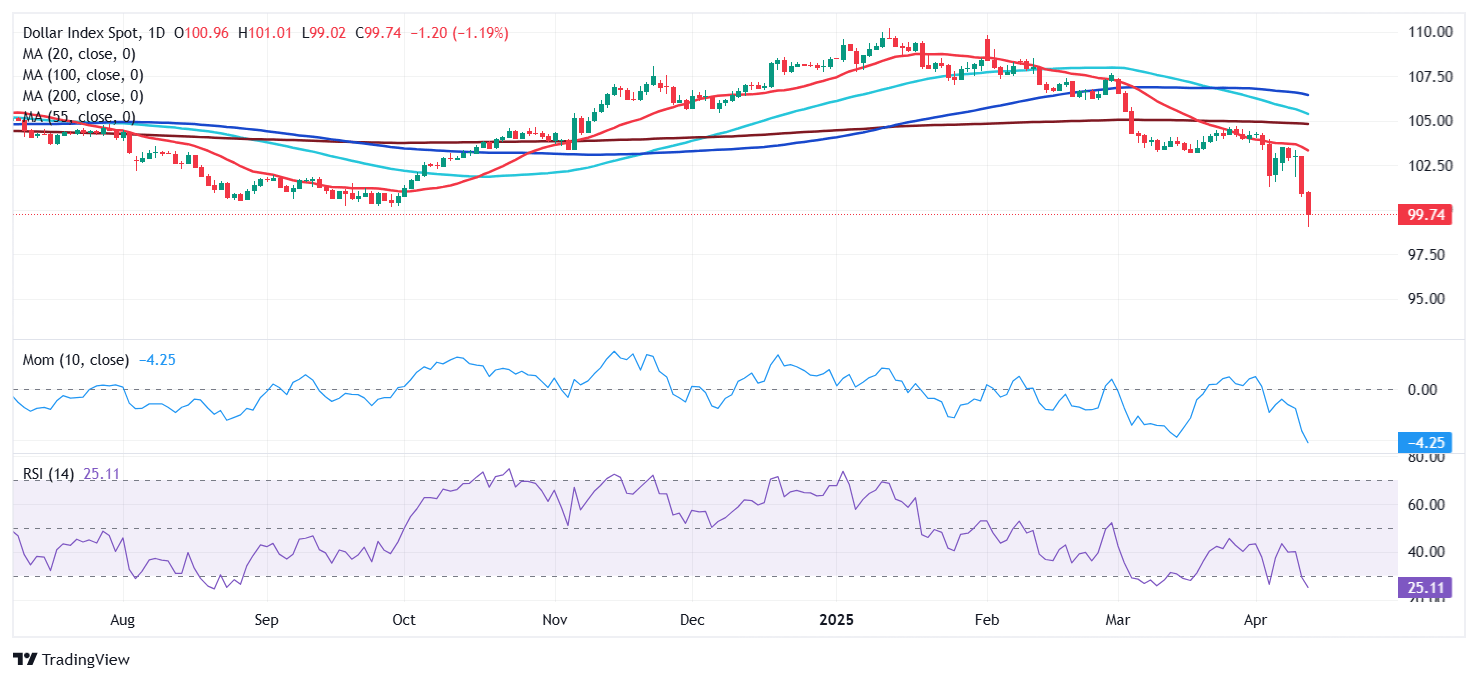

US Dollar Index Technical Outlook

The DXY remains under strong pressure, and technical readings in the daily chart suggest the slide is far from over. The index develops well below all its moving averages, with the 20 Simple Moving Average (SMA) gaining downward traction below the 100 and 200 SMAs, usually a sign of prevalent selling pressure.

At the same time, technical indicators retain their sharp bearish momentum within negative levels, while standing far from oversold readings.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

FXStreet Team

FXStreet