US Dollar Index wavers around 105.00 as the market awaits Fed’s decision

- DXY retreats 0.25% to 105.06, marking consecutive days of losses, as falling US Treasury yields and risk-on sentiment weigh on the greenback.

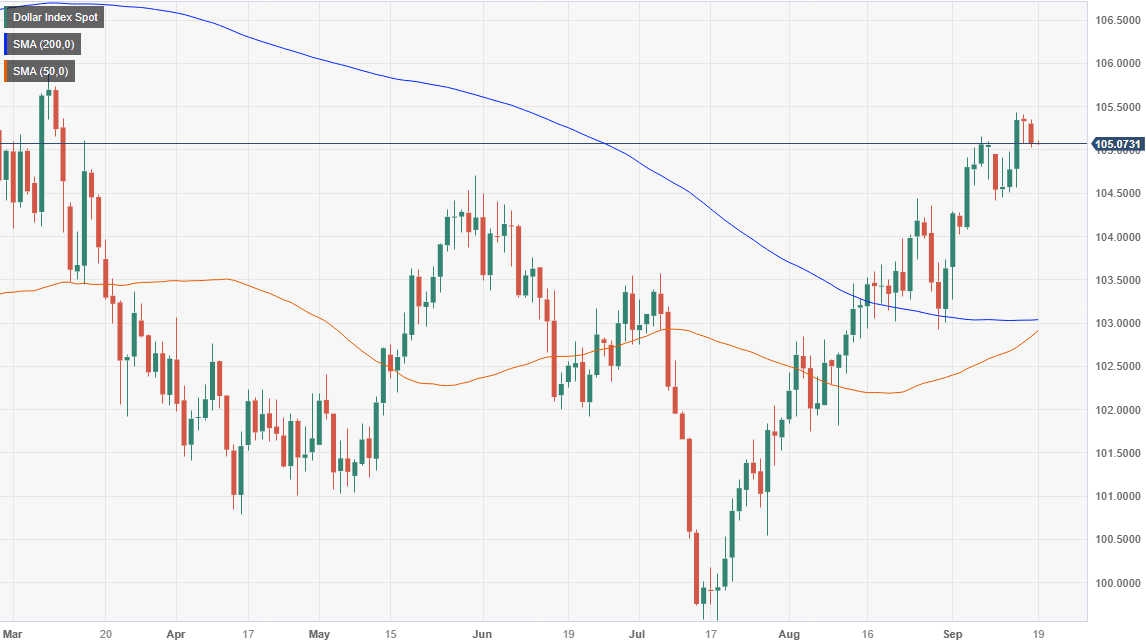

- Technical indicators point to a golden cross, with the 50-day and 200-day Moving Averages nearing convergence.

- A hawkish hold from the Fed could propel the DXY towards March highs, while a dovish tone may send it tumbling to key support levels.

The US Dollar Index (DXY), a basket of six currencies that trades against the US Dollar, retreats a minuscule 0.25%, sponsored on a risk-on impulse and falling US Treasury bond yields, ahead of the Federal Reserve’s September meeting. Hence, the DXY is trading at 105.06, printing back-to-back days of losses.

From a technical perspective, the DXY is about to achieve a golden cross, with the 50-day Moving Average (DMA) closing into the 200-DMA, each at 102.83 and 103.02, respectively. In addition, the DXY reached a new five-month high at 105.43, breaking the previous resistance, so the trend is up from a market structure perspective.

If the Fed delivers a hawkish hold, the DXY could test the March 8 swing high at 105.88, followed by the 106.00 threshold. A breach of the latter could expose the November 30 daily high at 107.19

Conversely, the DXY first support would be the 105.00 mark. If sellers reclaim that level, the next support would be a three-month-old upslope support trendline at around 104.40/60, followed by the 104.00 figure.

US Dollar Index Price Action – Daily chart

US Dollar Index: Technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.