US Dollar Index treads water around 90.00

- DXY still extends the consolidative mood around 90.00.

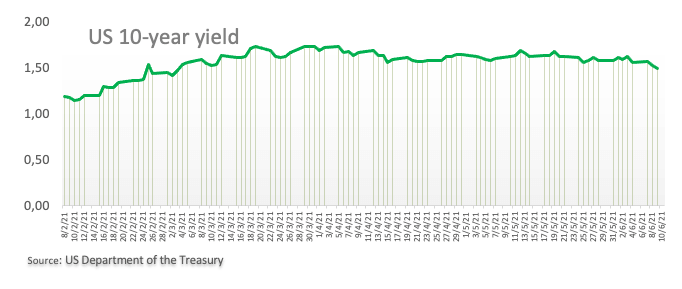

- US 10-year yields slip back to the 1.50% area ahead of key data.

- MBA Mortgage Applications, Wholesale Inventories, EIA next on tap.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, alternates gains with losses in the vicinity of the 90.00 region on Wednesday.

US Dollar Index focuses on data

The index navigates the 90.00 neighbourhood for yet another session and always mirroring the rising cautious tone among investors ahead of the publication of key inflation figures tracked by the CPI on Thursday.

Adding to the prevailing vigilant note, the ECB is also expected to meet on Thursday against the backdrop of increasing rumours of probable announcements regarding the PEEP.

In the meantime, the US economic recovery narrative remains well in place coupled with the vaccine rollout and the perspective of higher inflation in the months to come. Regarding yields, the US 10-year benchmark extends the downward trend to the proximity of the key 1.50% level.

Later in the NA session, weekly Mortgage Applications measured by MBA are due seconded by monthly Wholesale Inventories and the EIA’s report on US crude oil supplies.

What to look for around USD

The index seems to have met a tough barrier in the 90.50/60 band for the time being. Disappointing NFP figures in May now underpin the Fed’s narrative that it is still premature to start the tapering talk. In spite of the recent strength in the dollar, the outlook for the currency remains on the negative side in the longer run. This view stays supported by the perseverant mega-dovish stance from the Federal Reserve (until “substantial further progress” in inflation and employment is made) in place for the foreseeable future and rising optimism on a strong global economic recovery.

Key events in the US this week: Inflation figures tracked by the CPI, Initial Claim (Thursday) – Flash June Consumer Sentiment.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is losing 0.13% at 90.01 and faces the next support at 89.53 (monthly low May 25) followed by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018). On the upside, a break above 90.62 (weekly high Jun.4) would open the door to 90.90 (weekly high May 13) and finally 91.04 (100-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.