US Dollar Index remains depressed below 90.00

- DXY stays well on the defensive in sub-90.00 levels.

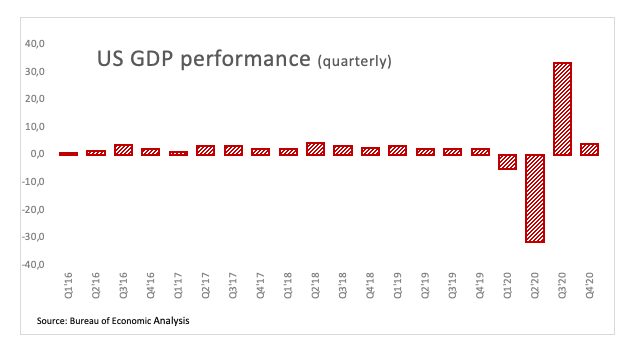

- Flash Q4 GDP figures see the economy expanding 4.1% QoQ.

- Initial Claims drop to 3-month lows at 730K during last week.

The greenback manages to bounce off weekly lows near 89.70, although it keeps navigating a sea of red when gauged by the US Dollar Index (DXY).

US Dollar Index now looks to YTD lows at 89.20

The index resumes the (strong) downside and now hovers around the key 2020-2021 support line in the 89.80 region after bottoming out near 89.70 earlier on Thursday.

Investors’ preference for the riskier assets in a context dominated by the reflation talk and following the recent dovish message from Chairman Powell at Capitol Hill encouraged USD-sellers to return to the markets, pushing DXY to new 7-week lows despite the strong bounce in US yields.

In the US data sphere, the second revision of Q4 GDP showed the economy is now expected to expand 4.1% inter-quarter. Additional results saw Durable Goods Orders expanding more than forecast 3.4% MoM during the first month of 2021 and weekly Claims rose to 730K, the lowest level in the last three months.

What to look for around USD

The index flirts with the key 90.00 support, as the selling bias around the dollar has accelerated as of late. In the meantime, bullish attempts in the buck should remain short-lived amidst the broad-based fragile outlook for the currency in the medium/longer-term. The latter is propped up by the reinforced mega-accommodative stance from the Fed until “substantial further progress” is seen, persistent chatter of extra fiscal stimulus and prospects of a strong recovery in the global economy, which are all seen underpinning the better sentiment in the risk complex.

Key events in the US this week: Inflation figures gauged by the PCE and the final Consumer Sentiment measure are due on Friday.

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is losing 0.41% at 89.81 and faces the next support at 89.69 (weekly low Feb.25) seconded by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018). On the flip side, a breakout of 91.05 (weekly high Feb.17) would open the door to 91.35 (100-day SMA) and finally 91.60 (2021 high Feb.5).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.