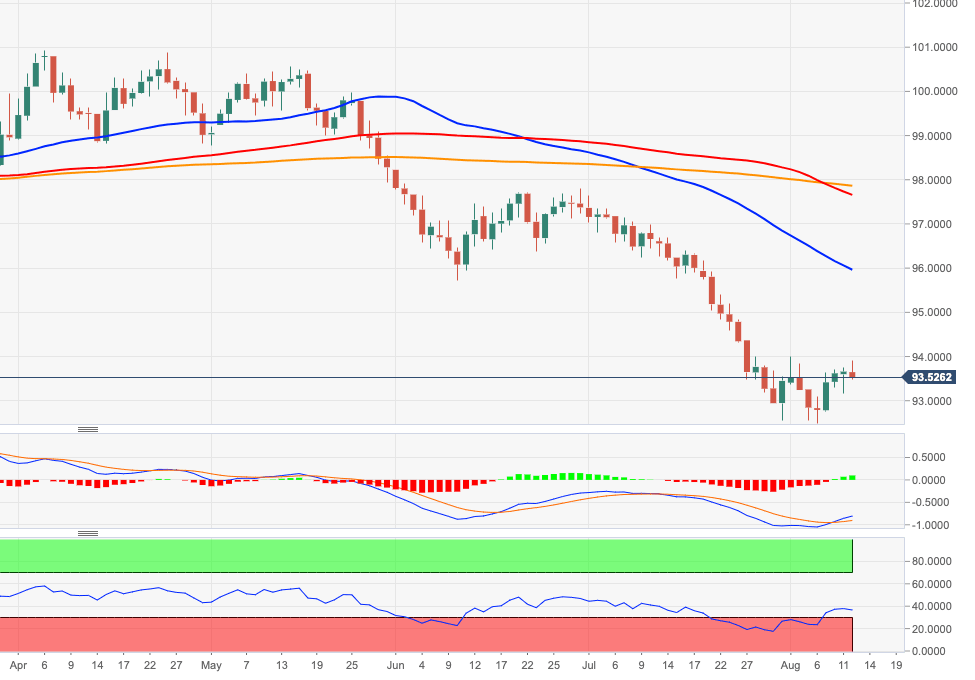

US Dollar Index Price Analysis: Tough barrier emerges around 94.00

- DXY’s recovery faltered just ahead of the key 94.00 barrier.

- The reversion of the bullish attempt should target the 92.50 area.

DXY keeps struggling to advance further north of the monthly tops in the 94.00 neighbourhood so far this week.

The inability of the index to surpass this area of resistance in the (very) short-term could motivate sellers to return to the markets. In that scenario, the focus of attention is expected to re-shift to the YTD lows in the mid-92.00s.

The bearish view on the dollar is expected to remain unchanged while below the 200-day SMA, today at 97.85.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.