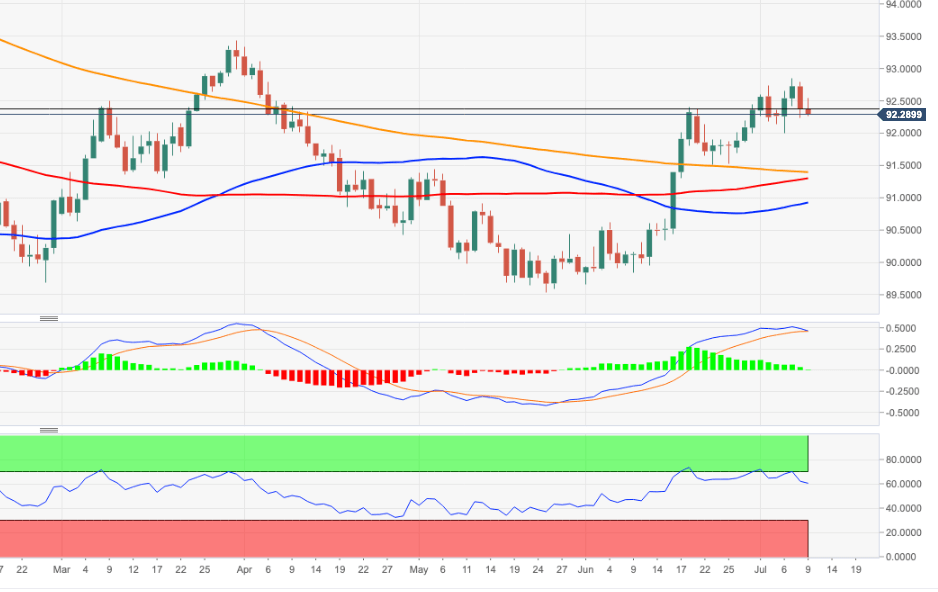

US Dollar Index Price Analysis: Support seen around 92.00

- DXY adds to Thursday’s losses around 92.30.

- Extra downside should meet support in the 92.00 area.

DXY sheds further ground following recent monthly peaks in the 92.80/85 band on July 7.

The corrective decline could extend further, although the 92.00 neighbourhood is forecast to offer strong contention for the time being. This area is reinforced by the 20-day SMA at 91.94.

In the meantime, and looking at the broader scenario, the positive outlook for the dollar is expected to remain unchanged as long as the index trades above the 200-day SMA, today at 91.39.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.