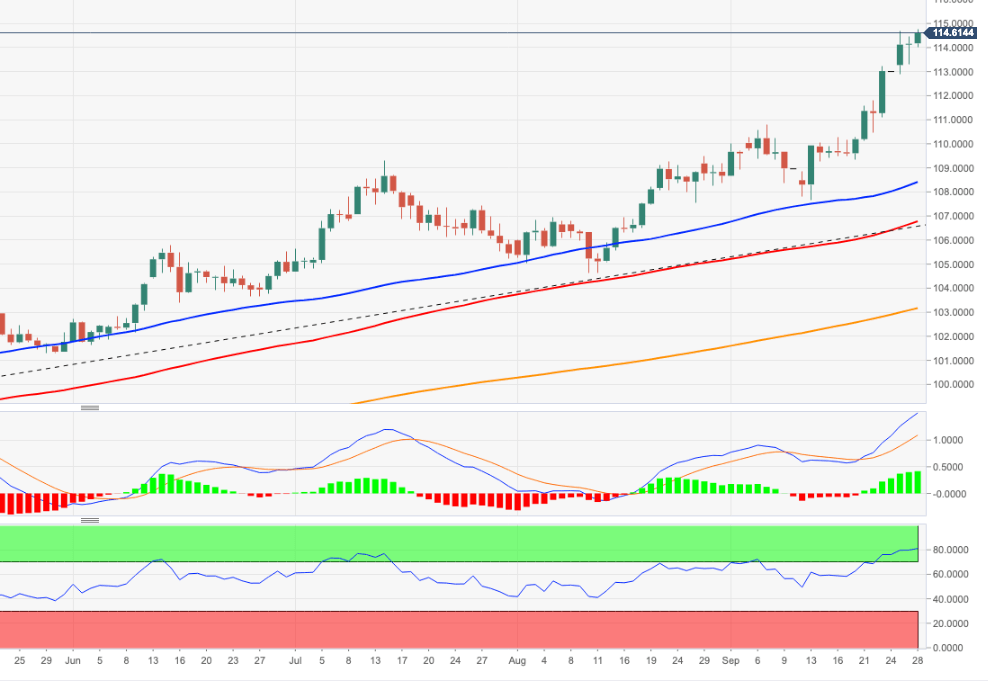

US Dollar Index Price Analysis: Next on the upside emerges 115.00

- DXY keeps the rally well in place and flirts with 114.80.

- Extra gains should meet the next hurdle at the 115.00 level.

DXY keeps pushing higher and clinches new 2-decade peaks in the 114.75/80 band on Wednesday.

The index seems to ignore the current extreme overbought levels and could extend the march north to, initially, the round level at 115.00 prior to the May 2002 top at 115.32.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line just above 107.00.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.30.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.