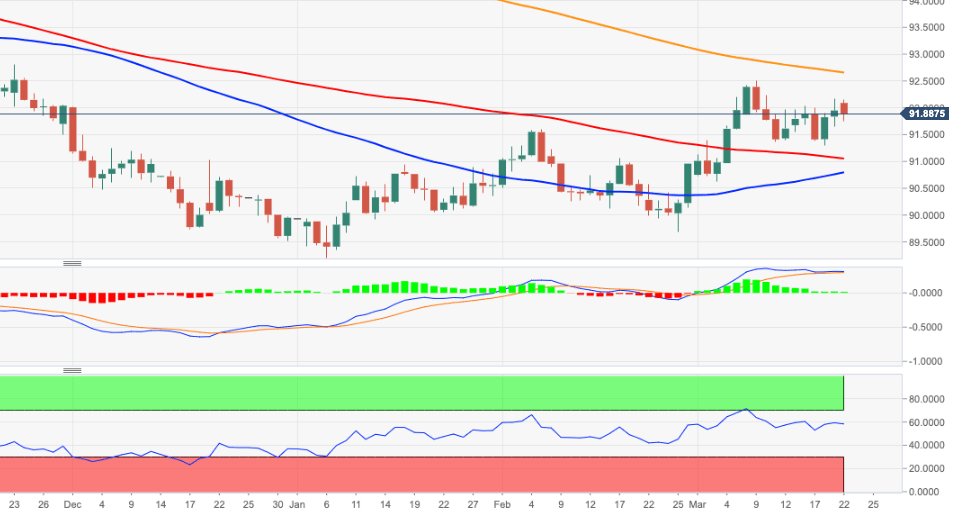

US Dollar Index Price Analysis: Next on the upside comes in 92.50

- DXY corrects lower from tops beyond the 92.00 level.

- The next target of note aligns at the YTD peaks around 92.50.

DXY exchanges gains with losses at the beginning of the week, always around the key 92.00 neighbourhood.

In the meantime, extra gains stay on the cards, with bulls’ aspirations now targeting the so far yearly tops in the mid-92.00s ahead of the critical 200-day SMA, today at 92.65.

A break above the latter should shift the outlook to constructive (from bearish) and allow for further gains in the shorter horizon.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.