US Dollar Index Price Analysis: Next on the upside comes 94.74

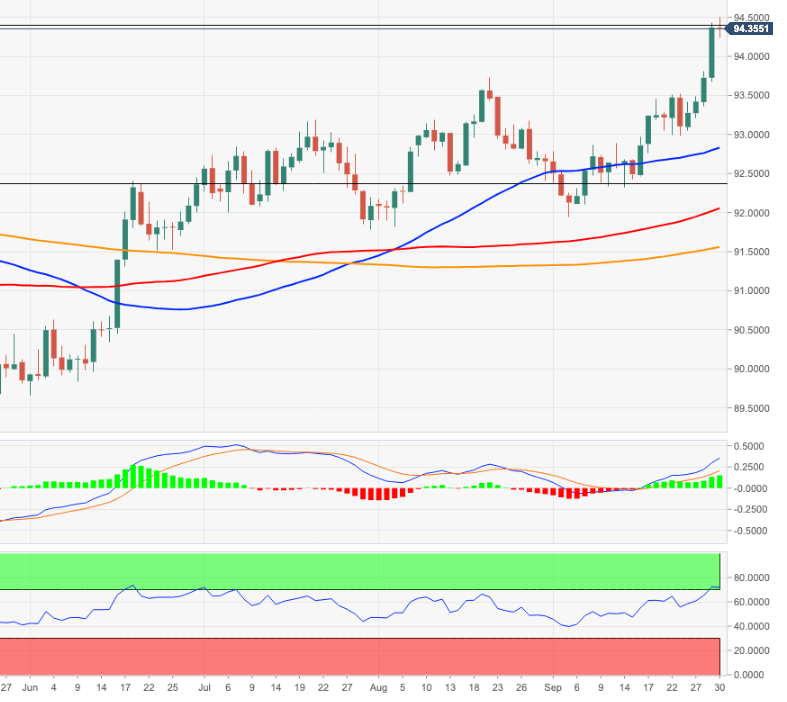

- DXY clinched new 2021 highs around 94.50 on Thursday.

- Further north comes the 94.74 level (September 2020 high).

The rally in DXY stays everything but abated and now extends gains to 94.50, the highest level since September 2020.

If the buying impulse maintains the pace, then the next target of note is seen emerging at the September 2020 high at 94.74 ahead of the round level at 95.00 the figure.

Extra gains remain likely while above August’s peak at 93.72. although a corrective move should not be ruled out, as per the current overbought condition of the index.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.