US Dollar Index Price Analysis: Next on the downside comes 105.80

- DXY remains under pressure in the lower end of the range.

- Further weakness could see the post-FOMC top at 105.80 retested.

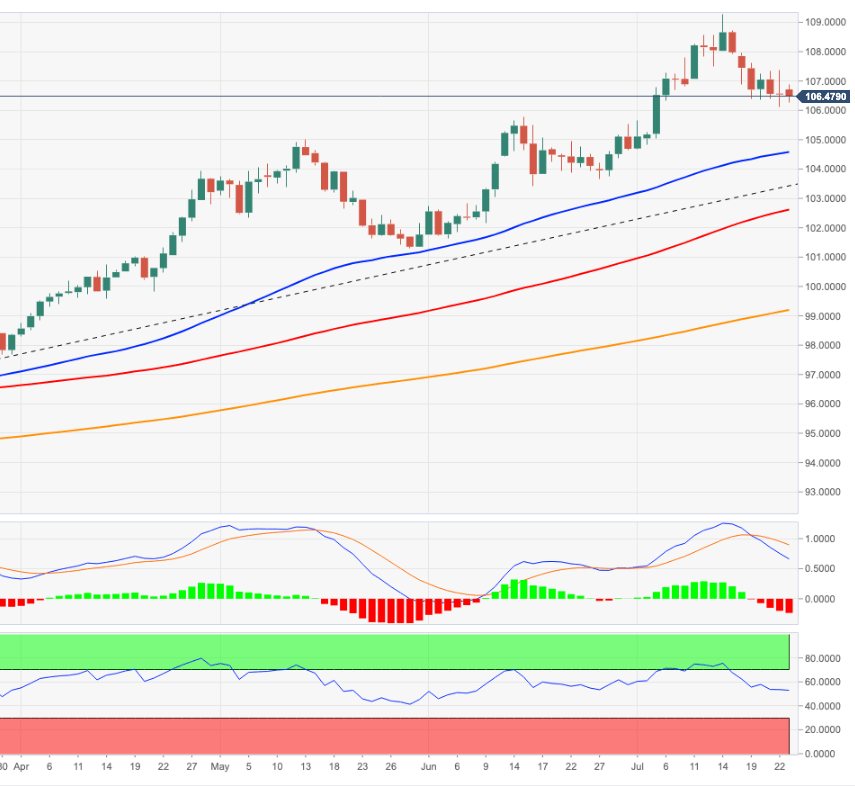

DXY extends the bearish mood and revisits the low-106.00s, where some initial support appears to have turned up so far on Monday.

Considering the ongoing price action, a break below the 106.00 zone should not be ruled out in the short-term horizon. Against that, the index carries the potential to drop further and retest the post-FOMC peak at 105.78 (June 15).

Despite the ongoing downside, the near-term outlook for DXY is seen constructive while above the 5-month support line near 103.60.

In addition, the broader bullish view remains in place while above the 200-day SMA at 99.18.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.