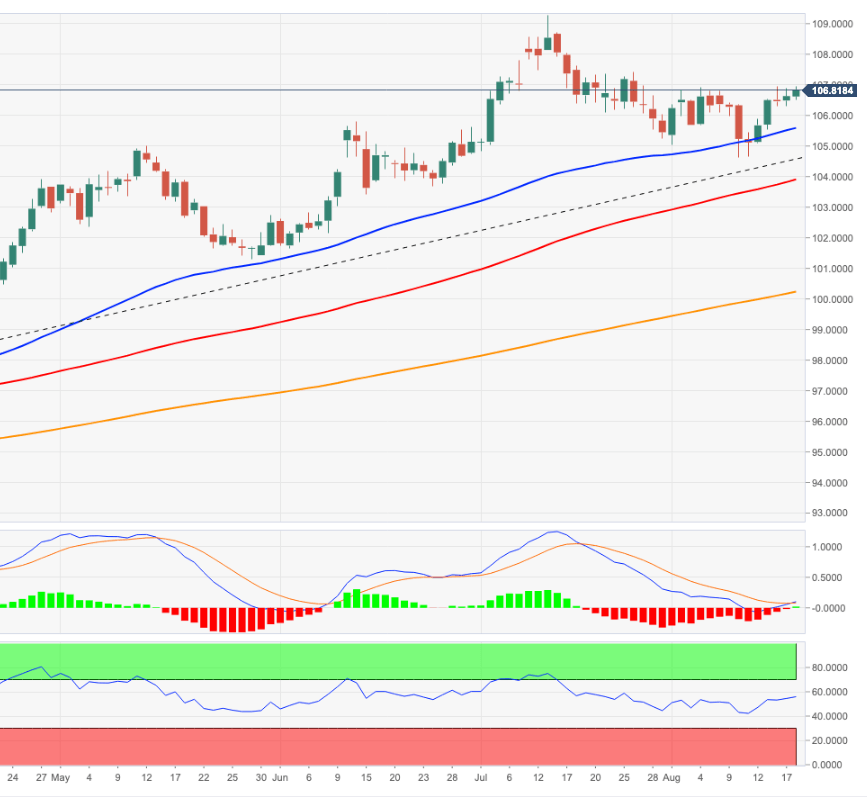

US Dollar Index Price Analysis: Further gains likely above 107.00

- DXY adds to Wednesday’s uptick and retargets 107.00.

- Above 107.00 the index could revisit the weekly high at 107.42.

DXY extends the upside for the second session in a row on Thursday, although another test of the 107.00 neighbourhood remains elusive for the time being.

The continuation of the upside momentum could extend to the August high near the 107.00 mark (August 5). The breakout of this level should motivate the index to challenge the post-FOMC meeting high at 107.42 (July 27).

Looking at the broader scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.28.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.