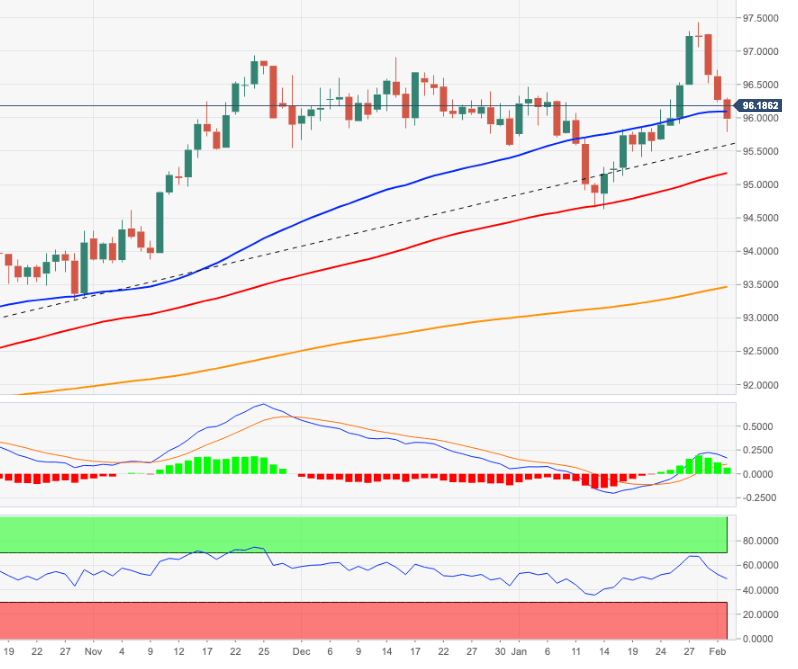

US Dollar Index Price Analysis: Decent contention emerged around 95.80

- DXY extends the corrective downside to 96.20.

- Next on the downside emerges the 96.00 zone.

DXY manages to reverse three consecutive daily losses and regains the 96.00 barrier and above on Thursday.

So far, the corrective move in the index met support in the 95.80 zone. If sellers regain the upper hand, then the retracement could extend further and retest the weekly low at 95.41 (January 20). The resumption of the upside bias should meet the next hurdle at the YTD peak at 97.80 (January 28).

In the near term, the upside pressure remains intact while above the 4-month line just below 95.00. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.40.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.