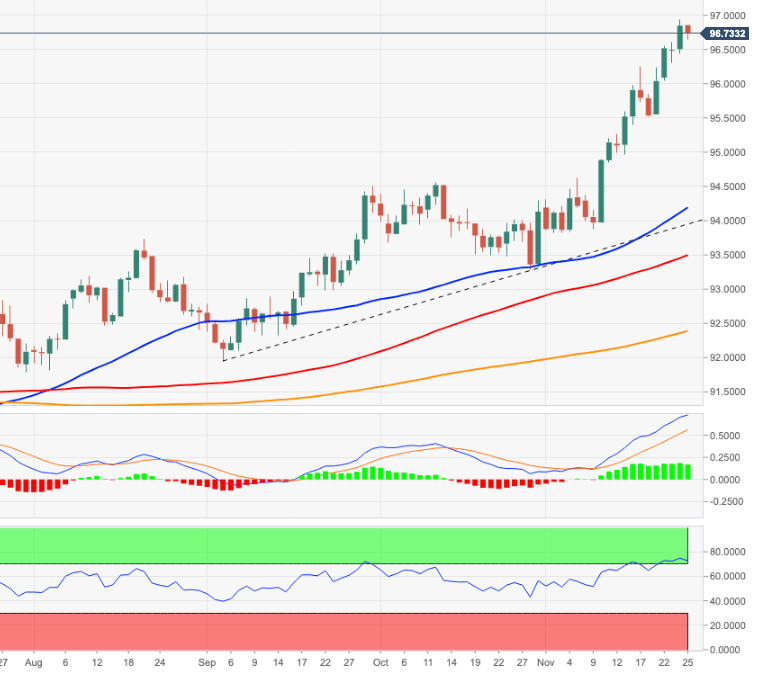

US Dollar Index Price Analysis: Corrective decline temporary only

- DXY gives away part of the recent gains, back near 96.70.

- Further upside is seen testing the 97.00 yardstick.

DXY corrects lower after hitting new cycle peaks in the area just below the 97.00 yardstick on Wednesday.

The continuation of the uptrend looks the most likely scenario despite the ongoing and temporary knee-jerk. That said, the round level at 97.00 now emerges as the immediate target for dollar bulls ahead of 97.80 (June 30 2020).

In the meantime, while above the 2-month support line (off September’s low) just below 94.00, extra gains in DXY remain well on the table. The broader constructive stance remains underpinned by the 200-day SMA at 92.38.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.