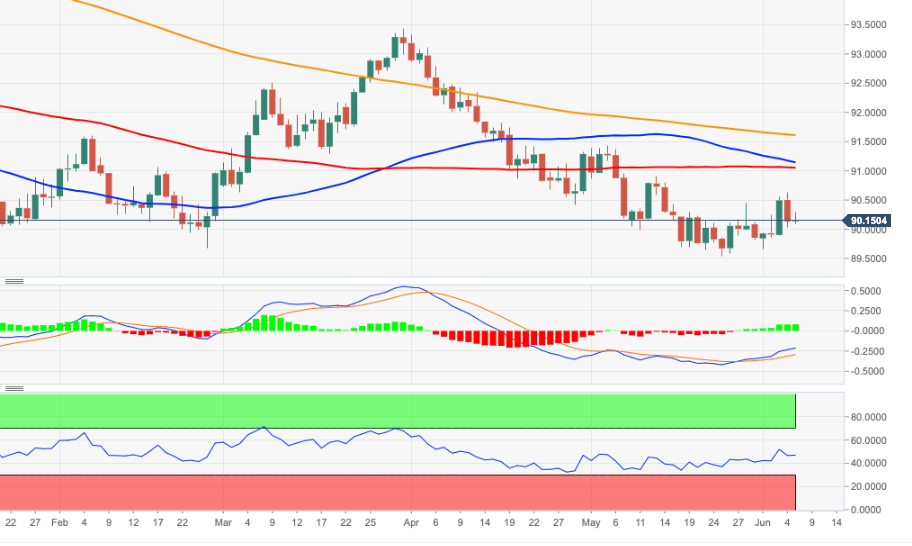

US Dollar Index Price Analysis: A drop to 89.50 remains on the cards

- DXY failed to extend the recent bullish attempt beyond 90.60.

- The leg lower could re-test the May lows in the mid-89.00s.

DXY navigates without a clear direction in the lower bound of the recent range and following Friday’s post-NFP sell-off.

If the selling impulse picks up extra pace, then a re-test of the 90.00 mark should emerge on the horizon in the near-term. A breach of it should open the door to a deeper retracement to the May’s low near 89.50.

In the meantime, and looking at the broader scenario, while below the 200-day SMA, today at 91.61 the outlook for the buck is forecast to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.