US Dollar back to session's low after Trump doubles down on Canada tariffs

- The US Dollar at a loss amidst a new chapter in the trade spat with Canada.

- In Europe, the German Green coalition is said to back a defense spending bill.

- The US Dollar Index dives to the lower range of 103.00.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, breaking to lower levels not seen since October 2024. The index trades above 103.40 at the time of writing on Tuesday just minutes United States (US) President Donal Trump lashed out at Canada by increasing steel and aluminium tariffs to 50% for Canada. The Greenback already faced headwinds earlier during the European trading session on comments from the German green coalition, who said to be back on track for an agreement on a German defense spending bill. This pushes the US Dollar (USD) lower in favor of the Euro (EUR).

On the economic data front, the US JOLTS Job Openings report for January came in higher than expected. The January number came in at 7,740,000, beating the 7,630,000 estimate. The US NFIB Business Optimism Index for February already released fell to 100.7, missing the 101 estimate and further down from the previous 102.8 reading.

Daily digest market movers: Every move hurts

- In the early European trading session, a headline was published that the German Green coalition leader said to be hopeful on a defense spending deal this week, Bloomberg reported. This news represents a 180-degree shift from the headline that triggered some US Dollar (USD) strength on Monday, where the Green Party was unwilling to support any defense spending deal.

- US President Donald Trump adds to steel and aluminium tariffs for Canada, totalling a 50% tariff. The move comes in response after Canada issued a 25% surcharge on electricity sent to Minnesota, New York and Michigan, coming from Ontario.

- The US JOLTS Job Openings report for January came in as an uptick to 7.74 million openings, beating the 7.63 million consensus and against the 7.6 million from December.

- Equities dive lower on the lashout from US President Trump on Canada. US equities give up earlier gains with the Dow Jones down over 1%.

- The CME Fedwatch Tool projects a 95.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. However, the chances of a rate cut at the May 7 meeting increase to 47.8% and to 89.9% at June’s meeting.

- The US 10-year yield trades around 4.21%, off its near five-month low of 4.10% printed on Tuesday last week.

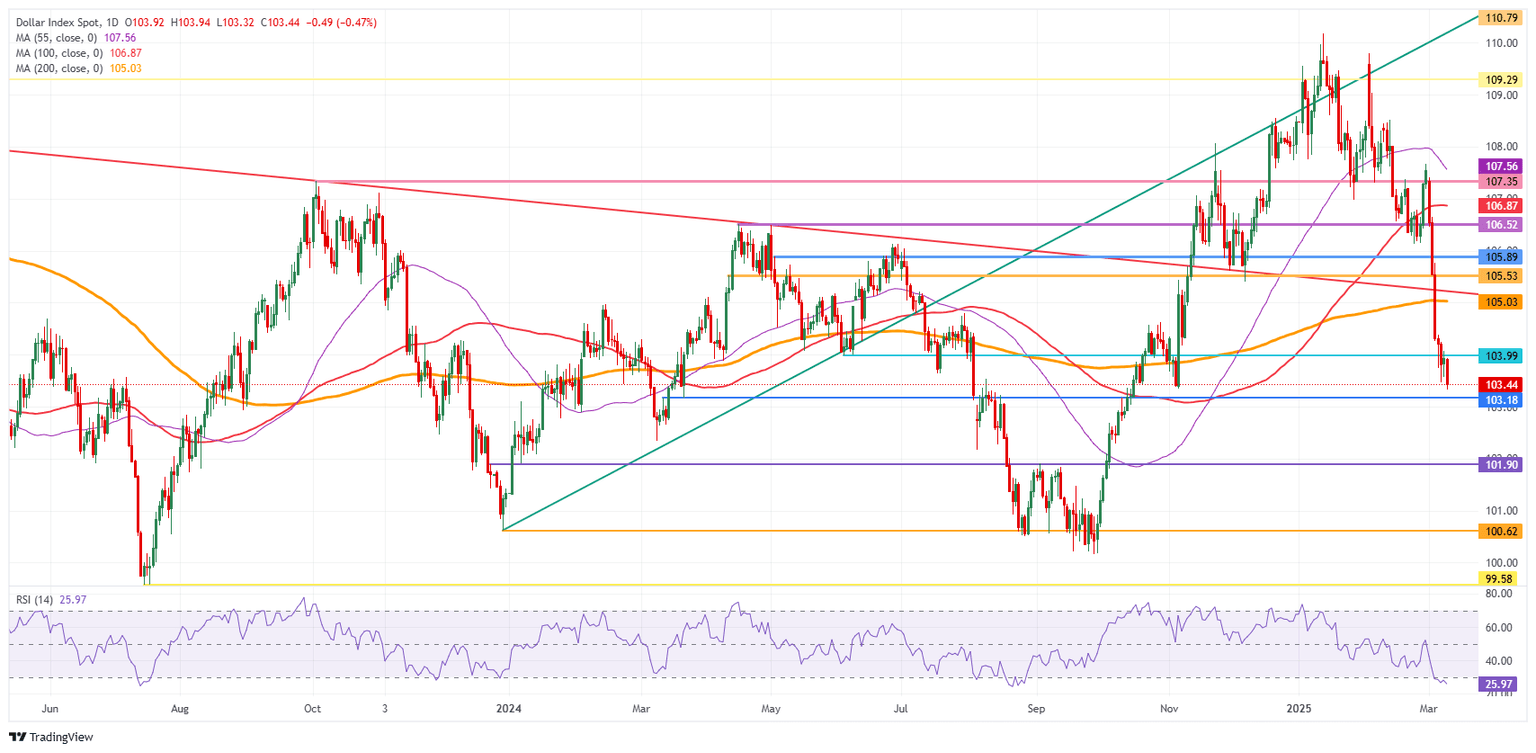

US Dollar Index Technical Analysis: Set to break

The US Dollar Index (DXY) faces more selling pressure on Tuesday as recession fears are not going away. Traders remain concerned about tariffs’ impact and uncertainty on the US economy. Seeing the performance in US equities year-to-date, there is not much reason to be happy and no reason to support a stronger Dollar in the current narrative.

There is an upside risk at 104.00 for a firm rejection. If bulls can avoid that, look for a large sprint higher towards the 105.00 round level, with the 200-day Simple Moving Average (SMA) at 105.03. Once broken through that zone, a string of pivotal levels, such as 105.53 and 105.89, will present as caps.

On the downside, the 103.00 round level could be considered a bearish target in case US yields roll off again, with even 101.90 not unthinkable if markets further capitulate on their long-term US Dollar holdings.

US Dollar Index: Daily Chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.