US Dollar closes week off with a total more than 3% loss

- The US Dollar must be happy that its worst week in over one year is near its end.

- Traders have devalued the Greenback throughout this week.

- The US Dollar Index faces devastation and set to close off this week with a 3% loss for this week

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, has written a bit of history this week, with at one point a 3.5% devaluation since Monday and trading near 103.80 at the time of writing on Friday. The Greenback is undergoing a regime shift where the US Dollar is no longer in the graces of traders. The interest rate differential between the Federal Reserve (Fed) and other central banks is set to narrow after Fed Governor Christopher Waller said on Thursday that there might be two to three rate cuts this year.

On the economic data front, all eyes were on the Nonfarm Payrolls release this Friday. Expectations were for 160,000 jobs gained in February with the actual number coming in at 151,000. The jobimpact from DOGE and other influences looks not to have materialized yet in the job numbers.

Daily digest market movers: Small miss means nothing

- The US employment report for February is due:

- The Nonfarm Payrolls came in at 151,000, just below the 160,000 estimate and against the previous 143,000 reading from January.

- The Average Hourly Earnings month-on-month came in softer at 0.3% against 0.5%.

- The Unemployment Rate ticked up to 4.1%, coming from 4%.

- At 15:15 GMT, Fed Governor Michelle W. Bowman discusses "Monetary Policy Transmission Post-COVID" at The University of Chicago Booth School of Business 2025 US Monetary Policy Forum in New York.

- At 15:45 GMT, Federal Reserve Bank of New York President John Williams participates in a discussion of the US Monetary Policy Forum Report titled "Monetary Policy Transmission Post-Covid" at the University of Chicago Booth School of Business in Chicago, Illinois.

- At 17:20 GMT, Fed Governor Adriana Kugler speaks on 'The Rebalancing of Labor Markets Across the World' at the Bank of Portugal's Conference on Monetary Policy Transmission and the Labor Market in Lisbon, Portugal.

- At 17:30 GMT, Fed Chair Jerome Powell delivers a speech on the economic outlook at The University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum in New York.

- At 18:00 GMT, Fed Governor Adriana Kugler delivers a speech on the economic outlook at the University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum, in New York.

- Equities are all heading lower after this Nonfarm Payrolls report which could be last positive one for now.

- After recent US economic data and Fed policymakers’ comments, the CME Fedwatch Tool projects a 46.8% chance of an interest rate cut in the May meeting compared to a 33.3% probability one week ago.

- The US 10-year yield trades around 4.24%, off its near five-month low of 4.10% printed on Tuesday.

US Dollar Index Technical Analysis: Curious for next week

The US Dollar Index (DXY) is facing a chunky loss this week, with over 3.5% in the red at the time of writing on Friday. The question is whether the Nonfarm Payrolls report can push back and deliver some relief on these losses. However, markets will want to see if the Department of Government Efficiency (DOGE) effect is already impacting the unemployment rate and the change in the Nonfarm Payrolls going forward.

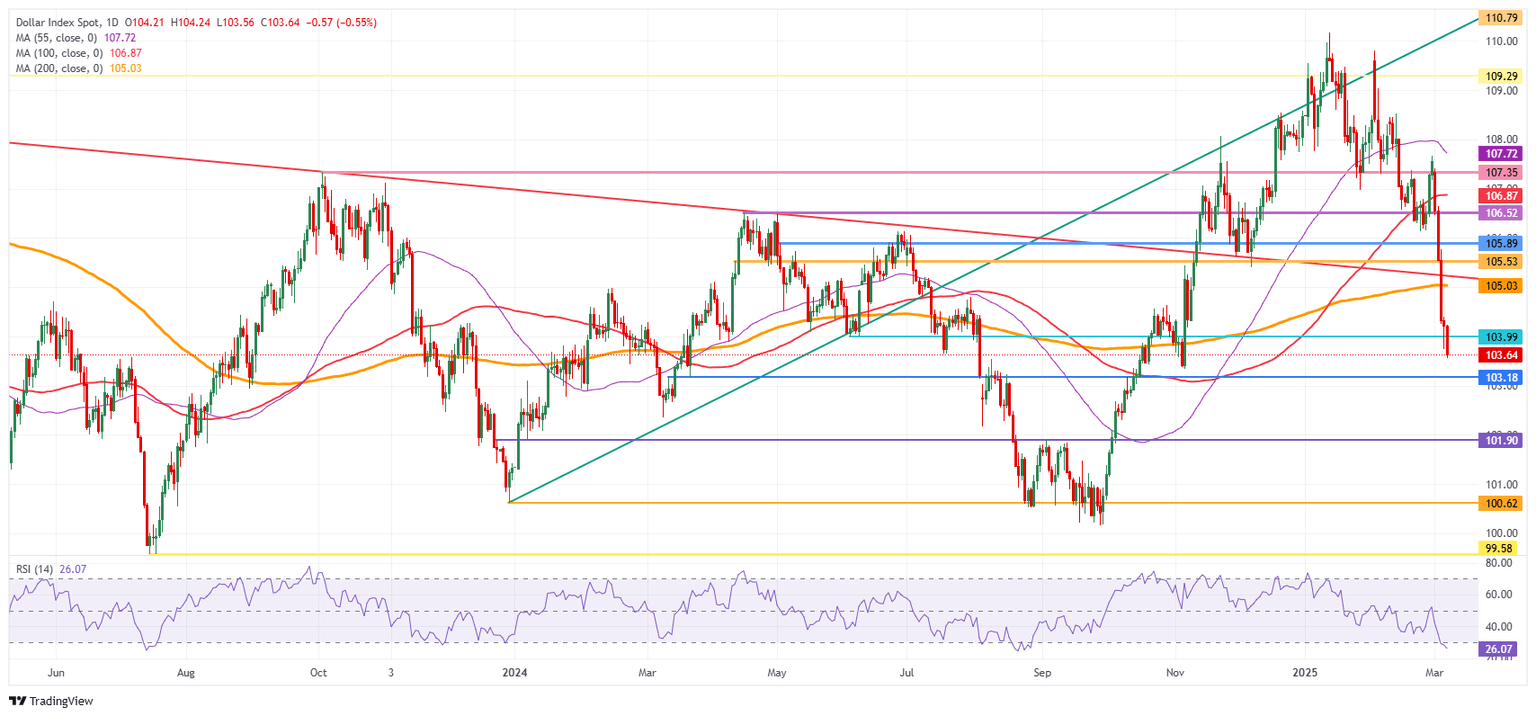

With this week’s sharp decline, the 104.00 round level is being broken at the time of writing on Friday and looks unfit to see a return soon. Further up, the first upside target is to recover the 105.00 round level and the 200-day Simple Moving Average (SMA) at 105.03. Once that zone has been recovered, several near-term resistances are lined up, with 105.53 and 105.89 identified as two heavy pivotal levels before breaking back above 106.00.

On the downside, the 103.00 round level could be considered a bearish target in case US yields roll off again, with even 101.90 not unthinkable if markets further capitulate on their long-term US Dollar holdings.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.