US Dollar drops while President Trump says markets to be cool

- The Greenback dips against most major currencies as US tariffs impact markets.

- Equities sink with China lashing back at US, Bessent warns China and other countries not to join forces.

- The US Dollar Index is on the backfoot, though it starts to recover during the European session.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, extends the previous day’s correction and hovers around 102.00 at the time of writing on Wednesday. The Chinese Finance Ministry has issued counter-tariffs on all US goods at 84% as of the 10th of April. United States Secretary of the Treasury Scott Bessent was quick to respond after the Chinese communication.

Bessent said that China will be the only losing nation in this tariff war, they should better come to the table to negotiate, Bloomberg reports. The secretary also warned China on devaluing its currency, that it will not be able to circumvent these tariffs by doing just that. Bessent also called a possible alignment from Europe with China, being Europe "cutting its own throat".

Meanwhile United States (US) President Donald Trump tweeted on his Truth Social network on Wednesday, urging the nation to "be cool", as everything 'is going to work out well', Baha news reports. The comments together with the earlier comments from US Treasury Secretary Scott Bessent are seeming to try and calm markets as clearly nervousness is starting to spread amongst all ranks in the US business, political and social classes.

On the economic calendar front, some light data is set to be published on Wednesday ahead of the Federal Open Market Committee (FOMC) Minutes for the Federal Reserve (Fed) monetary policy meeting in March. However, not much is expected from the Minutes, as Fed Chairman Jerome Powell said last week that the central bank will be in a “wait-and-see” mode. Meanwhile, markets are piling in for more interest rate cut bets by the Fed in 2025.

Daily digest market movers: Fed members are trying to stay calm

- China has issued comments that it is set to impose a near 84% tariffs on all US goods starting 10th of April, Bloomberg reports.

- At 11:00 GMT, the Mortgage Bankers Association released its weekly mortgage application numbers. The actual number was a firm jump of 20% in comparison to the previous number of -1.6%.

- Minneapolis Fed President Neel Kashkari said all options are on the table, both rate cuts and rate hikes, Bloomberg reports.

- The February Wholesale Inventory data came in as expected at 0.3% growth.

- AT 16:30 GMT, Richmond Fed President Thomas Barkin will speak at the economic club in Washington.

- At 18:00 GMT, the FOMC Minutes from their last meeting in March will be released.

- Equities are sinking lower again after China retaliated on US tariffs. All major equities are down at least 2% on average on the day. US equities are an outlier for now and are turning green with the Nasdaq leading the recovery 1% up.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in May’s meeting surging to 53.5%, compared with only 10.6% a week ago. For June, the chances of lower borrowing costs are 100%, with 55.2% anticipating a 50 basis point (bp) rate cut.

- The US 10-year yields trade around 4.36%, and keeps rallying higher while the Fedwatch tool is seeing more rate cut bets being priced in.

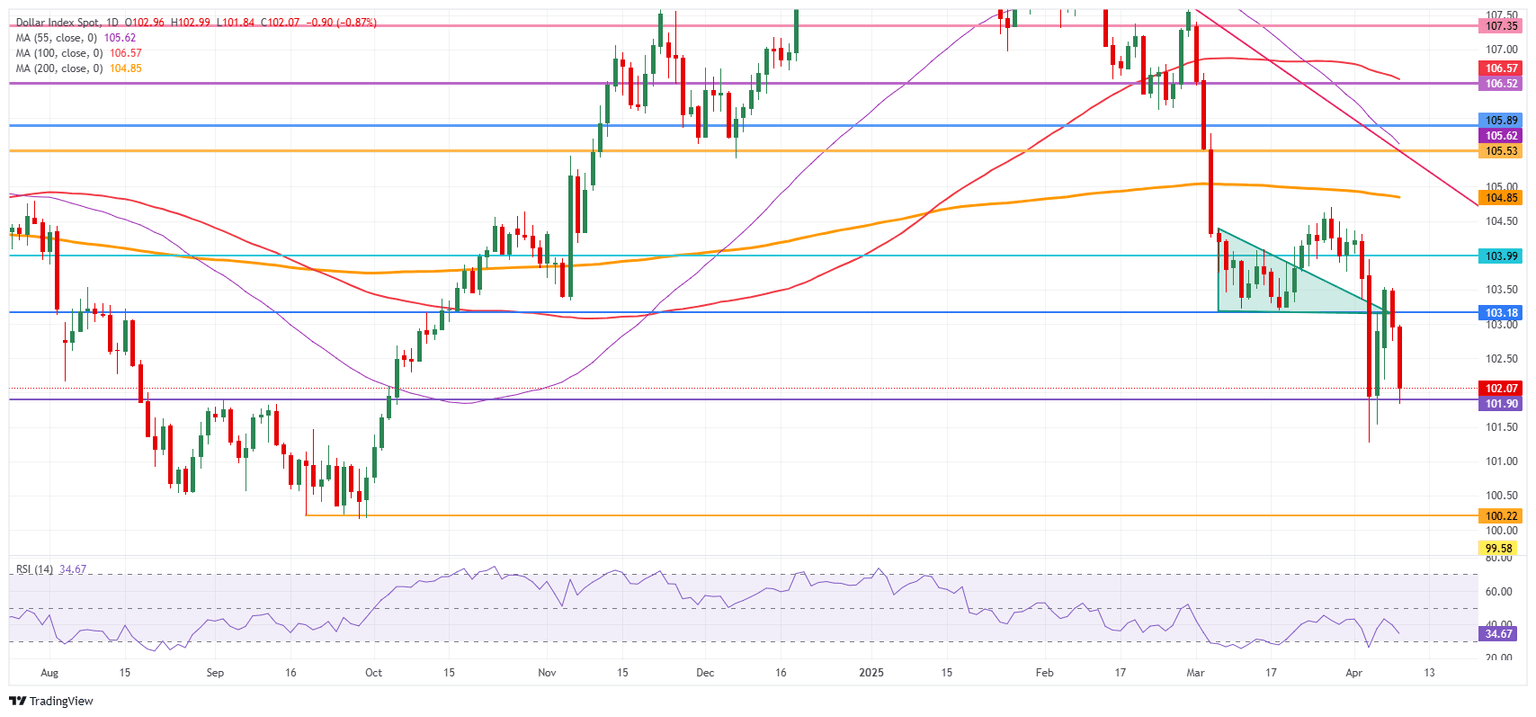

US Dollar Index Technical Analysis: Shall we start talking about a dip below 100.00?

The US Dollar Index (DXY) dipped lower earlier this Wednesday and looks to be bouncing off a pivotal support at 101.90 for now. The question remains, though, that with these tariffs and once US economic data start to turn, the DXY might see more selling pressure come in. That could mean a further weakening of the Greenback in the coming weeks or months, even as the impact of these tariffs will only start to be priced in now.

Looking up, the first level to watch out for is 103.18, which supported the DXY in March and has now become a strong resistance. Above there, the 104.00 round level and the 200-day Simple Moving Average (SMA) at 104.85 come into play.

On the downside, 101.90 is the first line of defense, and it should be able to trigger a bounce as it has been able to hold the recent bearish momentum last week and did its duty again earlier this Wednesday. Maybe not on Wednesday, but in the coming days, a break below 101.90 could see a leg lower towards 100.00.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.