US Dollar sees upbeat Services ISM report come a little too late

- The US Dollar enters third day of losses across the board.

- Services upbeat, though ADP numbers are coming in substantially softer than expected.

- The US Dollar Index DXY faces over 2.5% devaluation so far this week.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is unable to recover this Wednesday with again deepened out losses in already turbulent week for the DXY. The downward move comes as traders further unwind their overall Dollar exposure now that several analysts are calling the end of the United States (US) exceptionalism amid concerns that US President Donald Trump’s tariffs could damage economic growth. The move comes ahead of the European Central Bank (ECB) rate decision on Thursday and the US Nonfarm Payrolls report for February on Friday.

On the economic data front, the Institute for Supply Management (ISM) was a small positive point for markets. After the big miss in the ADP private payrolls number, the ISM Services report came in stronger on all fronts. Though, these positive numbers could create an issue again, with this time the Prices Paid component possibly feeding some inflation.

Daily digest market movers: ISM outlier or too early?

- At 13:15 GMT, the usual appetizer ahead of the Nonfarm Payrolls came in with the ADP Employment Change number for February. The number came in at 77,000, far below the xpectations for 140,000 new employees in the private sector, below the 183,000 in January.

- At 14:45 GMT, S&P Global has released its final reading for the Purchasing Managers Index (PMI) on the Services sector. The number came in at 51, beating the expectations for a steady 49.7.

- At 15:00 GMT, the ISM released its PMI report on the Services sector for February:

- Services PMI came in at 53.5, beating the 52.6 estimate and a touch stronger than the previous 52.8.

- The Employment component, came in at 53.9, beating the 52.3 in January.

- The New Orders component reached 52.5, an uptick from the 51.3 previously.

- At 18:00 GMT, Federal Reserve Bank of Richmond President Thomas Barkin delivers a speech titled "Inflation Then and Now" at the Fredericksburg Regional Alliance in Fredericksburg, United States.

- At 19:00 GMT, the Federal Reserve will release the Beige Book, which reports on the current US economic situation.

- Equities are surging after the upbeat ISM numbers, providing a sigh of relief.

- The CME Fedwatch Tool projects a 21.0% chance that interest rates will remain at the current range of 4.25%-4.50% in June, with the rest showing a possible rate cut.

- The US 10-year yield trades around 4.24%, off its near five-month low of 4.10% printed on Tuesday.

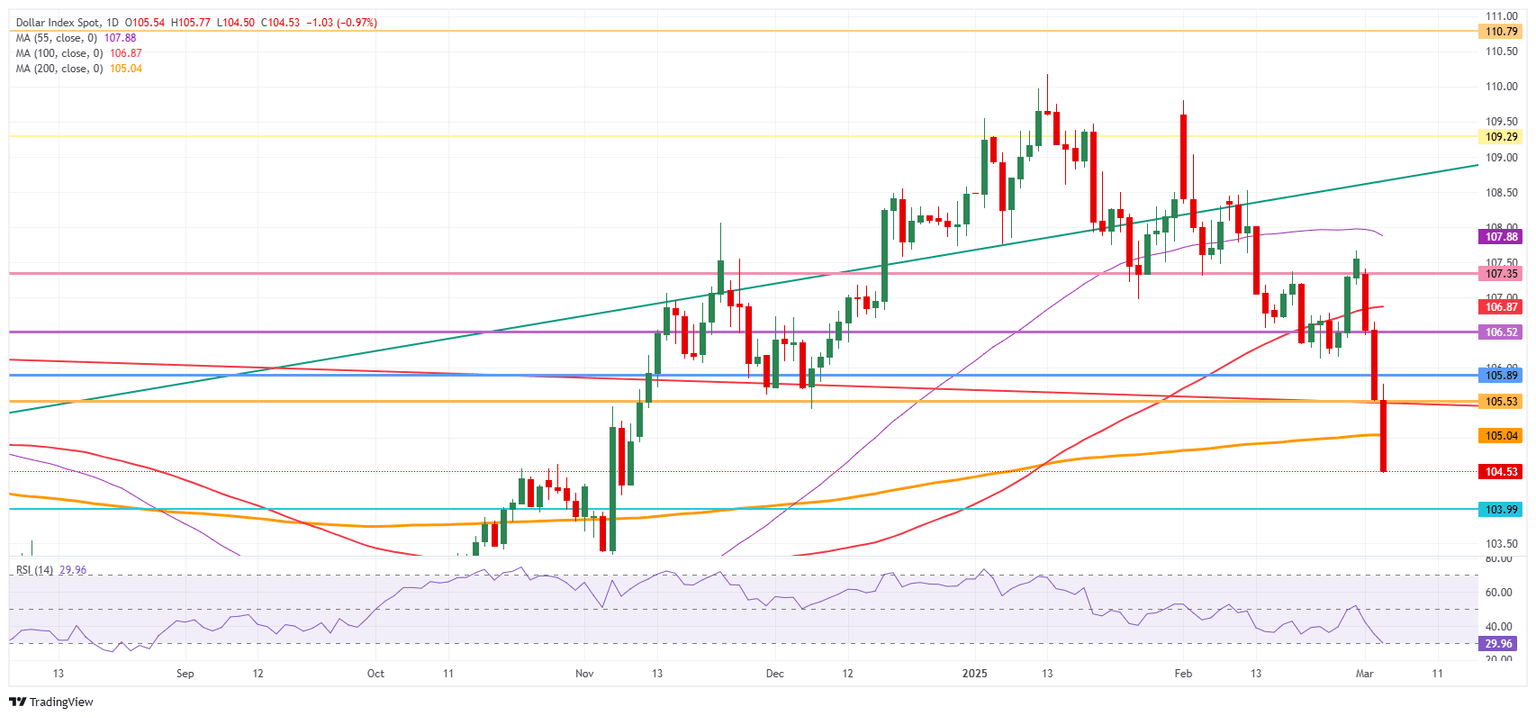

US Dollar Index Technical Analysis: Troubled to say the least

The US Dollar Index (DXY) is not enjoying this week, that is for sure. The DXY sees bulls exiting the premises, which gives the US Dollar bears good cards to run the Greenback into the ground. With more and more calls for lower US rates while US economic data further deteriorates, it looks like the DXY might be on its way even to 103.00 in the near term if this selling pressure keeps persisting.

On the upside, the first upside target to recover is the pivotal level at 105.53. Once through there, a heavy job awaits with pivotal levels at 105.89 and 106.52 before bulls start to consider a visit to the 100-day Simple Moving Average (SMA) at 106.87.

On the downside, the 200-day SMA at 105.03 is identified as the first support level, which is being tested at the time of writing. Should that level snap, a long stretch opens up towards 104.00. Even 103.00 could come under consideration in case US yields roll off further.

US Dollar Index: Daily Chart

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.